Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Preliminary Australian Manufacturing PMI for December was reported at 56.0. Forex traders can compare this to the Australian Manufacturing PMI for November, reported at 55.8. The Preliminary Australian Services PMI for December was reported at 57.4. Forex traders can compare this to the Australian Services PMI for November, reported at 55.1. The Preliminary Australian Composite PMI for December was reported at 57.0. Forex traders can compare this to the Australian Composite PMI for November, reported at 54.9.

The Australian Westpac Leading Index for November increased by 0.5% monthly. Forex traders can compare this to the Australian Westpac Leading Index for October, which increased by 0.3%. Australian HIA New Home Sales for November increased by 15.2% monthly. Forex traders can compare this to Australian HIA New Home Sales for October, which decreased by 1.3% monthly.

The Japanese Trade Balance for November was reported at ¥366.8B. Economists predicted a figure of ¥529.8B. Forex traders can compare this to the Japanese Trade Balance for October, reported at ¥871.7B. The Japanese Adjusted Trade Balance for November was reported at ¥0.57T. Economists predicted a figure of ¥0.11T. Forex traders can compare this to the Japanese Adjusted Trade Balance for October, reported at ¥0.36T. Exports for November decreased by 4.2% annualized, and Imports decreased by 11.1% annualized. Economists predicted an increase of 0.5% and a decrease of 10.5%. Forex traders can compare this to Exports for October, which decreased by 0.2% annualized, and to Imports, which decreased by 13.3% annualized.

The Preliminary Japanese Jibun Bank Manufacturing PMI for December was reported at 49.7. Forex traders can compare this to the Japanese Jibun Bank Manufacturing PMI for November, reported at 49.0. The Preliminary Japanese Jibun Bank Services PMI for December was reported at 47.2. Forex traders can compare this to the Japanese Jibun Bank Services PMI for November, reported at 47.8. The Preliminary Japanese Jibun Bank Composite PMI for December was reported at 48.0. Forex traders can compare this to the Japanese Jibun Bank Composite PMI for November, reported at 48.1.

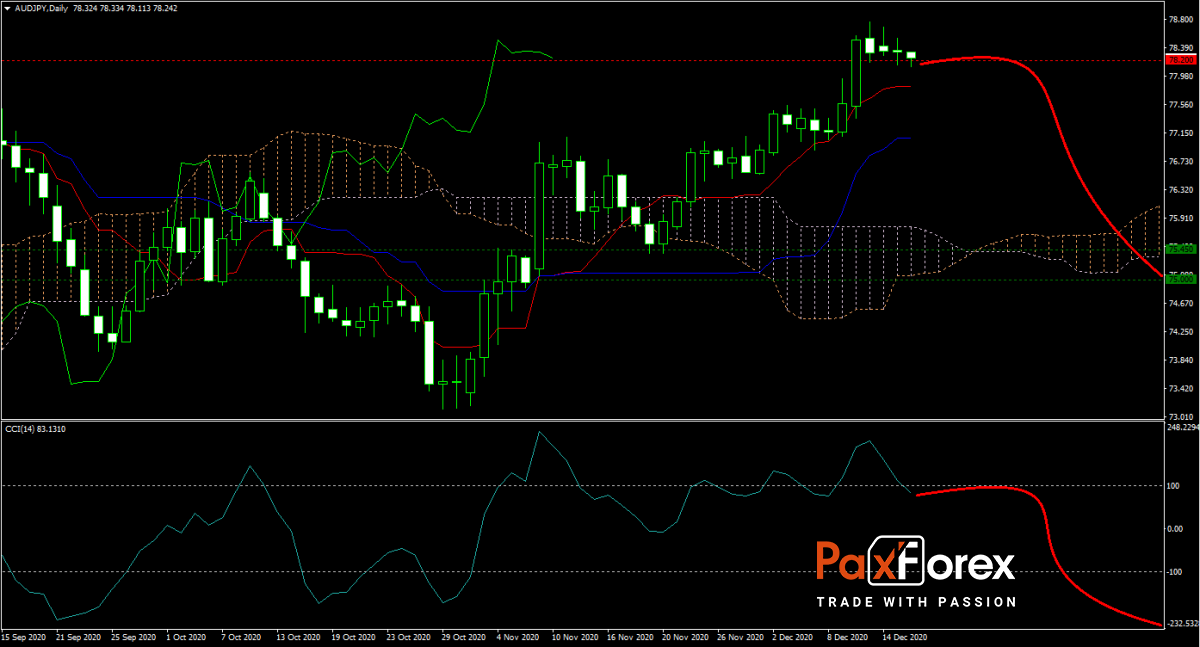

The forecast for the AUD/JPY turned bearish after its most recent move higher, with the Tenkan-sen and Kijun-sen entering a sideways trend. Global economic data points to ongoing weakness, creating conditions for a challenging start to 2021. The availability of any of the Covid-19 vaccines also clouds the medium-term outlook, favoring safe-haven assets like the Japanese Yen. Will bears force the AUD/JPY into its Ichimoku Kinko Hyo Cloud, which just moved out of a horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/JPY remain inside the or breakdown below the 77.850 to 78.500 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 78.200

- Take Profit Zone: 75.000 – 75.450

- Stop Loss Level: 79.000

Should price action for the AUD/JPY breakout above 78.500 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 79.000

- Take Profit Zone: 80.000 – 80.700

- Stop Loss Level: 78.500

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.