Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Australian AiG Performance of Manufacturing Index for May was reported at 61.8. Forex traders can compare this to the Australian AiG Performance of Manufacturing Index for April, reported at 61.7. The Final Australian Markit Manufacturing PMI for May was reported at 60.4. Forex traders can compare this to the Australian Markit Manufacturing PMI for April, reported at 59.7. Australian Building Approvals for April decreased by 8.6% monthly, and Private House Approvals increased by 4.6% annualized. Forex traders can compare this to Australian Building Approvals for March, which increased by 18.9% monthly, and to Private House Approvals, which increased by 0.1% annualized.

The Australian Current Account Balance for the first quarter was reported at A$18.3B. Economists predicted a figure of A$17.9B. Forex traders can compare this to the Australian Current Account Balance for the fourth quarter, reported at A$14.5B. Australian Net Exports of GDP for the first quarter decreased by 0.6% quarterly. Economists predicted a decrease of 1.1% quarterly. Forex traders can compare this to Australian Net Exports of GDP for the fourth quarter, which decreased by 0.1% quarterly.

Australian Business Inventories for the first quarter increased by 2.1% quarterly, and Australian Company Gross Operating Profits decreased by 0.3% quarterly. Economists predicted an increase of 0.2% and 3.0%. Forex traders can compare this to Australian Inventories for the fourth quarter, which decreased by 0.1% quarterly, and to Australian Company Operating Profits, which decreased by 4.8% quarterly. Company Pre-Tax Profits for the first quarter decreased by 6.0% quarterly. Forex traders can compare this to Company Pre-Tax Profits for the fourth quarter, which increased by 2.4% quarterly. The Australian RBA left interest rates unchanged at 0.10%. Economists predicted no change in interest rates. Forex traders can compare this to the previous Australian RBA Interest Rate Decision, where interest rates were left unchanged at 0.10%.

Swiss Retail Sales for April decreased by 4.4% monthly and increased by 35.7% annualized. Forex traders can compare this to Swiss Retail Sales for March, which increased by 22.3% monthly and 23.1% annualized. The Swiss GDP for the first quarter decreased by 0.5% quarterly and by 0.5% annualized. Economists predicted a decrease of 0.5% and 0.2%. Forex traders can compare this to the Swiss GDP for the fourth quarter, which increased by 0.1% quarterly and decreased by 1.6% annualized. The Swiss Manufacturing PMI for May is predicted at 70.0. Forex traders can compare this to the Swiss Manufacturing PMI for April, reported at 69.5.

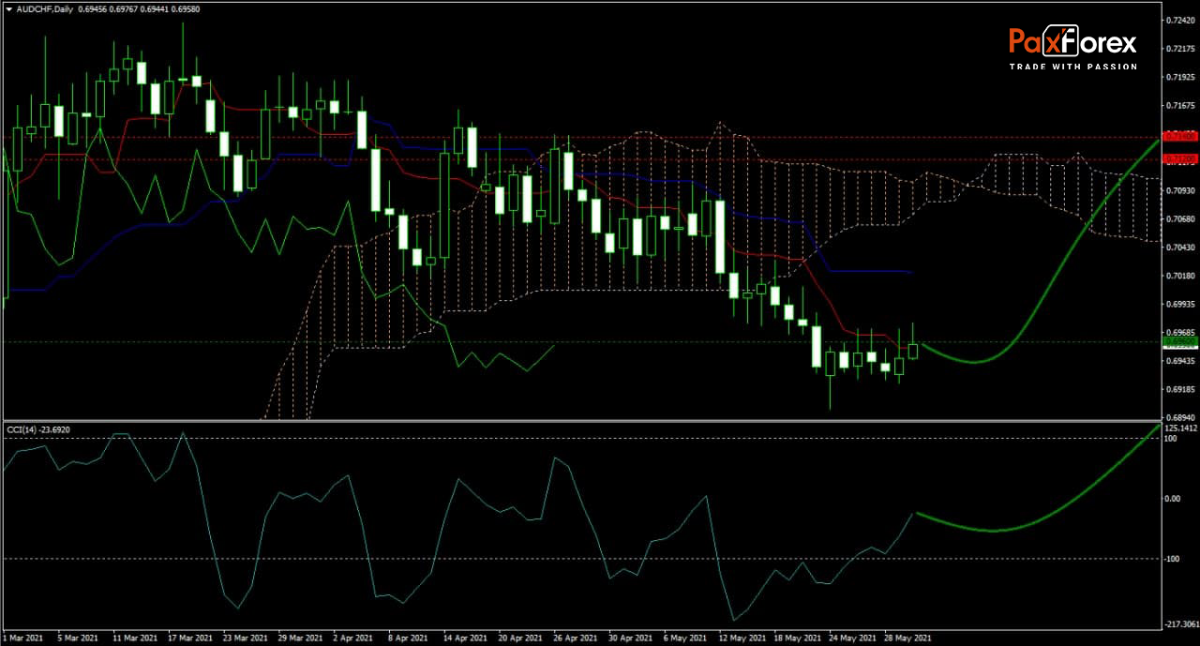

The forecast for the AUD/CHF remains cautiously bullish following its sell-off. Price action reversed off its current lows with an improving technical scenario over the short term. After the Kijun-sen and the Tenkan-sen flattened, bearish momentum is receding. The Ichimoku Kinko Hyo Cloud is also slowing its descend, while the CCI accelerated out of extreme oversold territory. Can bulls take advantage of the pause in the sell-off and force the AUD/CHF into a temporary rally into its horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/CHF remain inside the or breakout above the 0.6940 to 0.6980 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6960

- Take Profit Zone: 0.7120 – 0.7140

- Stop Loss Level: 0.6900

Should price action for the AUD/CHF breakdown below 0.6940, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6900

- Take Profit Zone: 0.6800– 0.6820

- Stop Loss Level: 0.6940

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.