Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian Building Approvals for January decreased by 19.4% monthly, and Private House Approvals decreased by 12.2% annualized. Forex traders can compare this to Australian Building Approvals for December, which increased by 12.0% monthly, and to Private House Approvals, which increased by 15.8% annualized. The Australian RBA left interest rates unchanged at 0.10%. Economists predicted no change in interest rates. Forex traders can compare this to the previous Australian RBA Interest Rate Decision, where interest rates were left unchanged at 0.10%.

The Australian Current Account Balance for the fourth quarter was reported at A$14.5B. Economists predicted a figure of A$13.1B. Forex traders can compare this to the Australian Current Account Balance for the third quarter, reported at A$10.0B. Australian Net Exports of GDP for the fourth quarter decreased by 0.1% quarterly. Economists predicted a decrease of 0.3% quarterly. Forex traders can compare this to Australian Net Exports of GDP for the third quarter, which decreased by 1.9% quarterly.

The Canadian GDP for December is predicted to increase by 0.3% monthly and for the fourth quarter by 7.5% annualized. Forex traders can compare this to the Canadian GDP for November, which increased by 0.7% monthly, and to third-quarter GDP, which increased by 40.5% annualized.

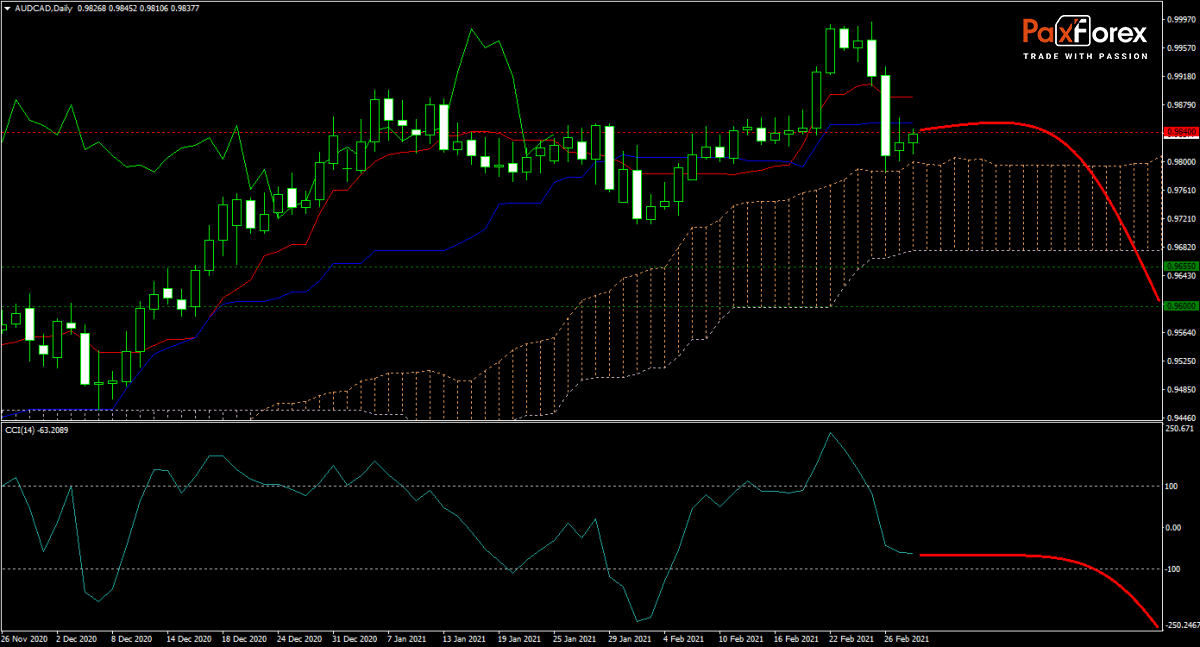

The forecast for the AUD/CAD remains bearish after price action failed to sustain its upward movement towards the psychological resistance level of 1.0000. While this currency pair paused its sell-off after reaching its Senkou Span A, the Kijun-sen, the Tenkan-sen, and the Ichimoku Kinko Hyo Cloud entered a sideways trend. It suggests a period of consolidation. The CCI dropped out of extreme overbought territory and has more downside potential. Will bears extend the sell-off in the AUD/CAD until it reaches its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/CAD remain inside the or breakdown below the 0.9810 to 0.9890 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9840

- Take Profit Zone: 0.9600 – 0.9655

- Stop Loss Level: 0.9930

Should price action for the AUD/CAD breakout above 0.9890 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9930

- Take Profit Zone: 1.0000 – 1.0030

- Stop Loss Level: 0.9890

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.