Australian Home Loans for February decreased by 1.7% monthly. Economists predicted an increase of 2.0% monthly. Forex traders can compare this to Australian Home Loans for January, which increased by 4.6% monthly. Australian Investment Lending for February decreased by 1.9% monthly, and the Owner-Occupier Loan Value decreased by 1.7% monthly. Economists predicted an increase of 1.5% and 2.8%. Forex traders can compare this to Australian Investment Lending for January, which increased by 3.6% monthly and to Owner-Occupier Loan Value, which increased by 5.0% monthly.

Canadian Housing Starts for March are predicted at 170.0K. Forex traders can compare this to Canadian Housing Starts for February, which were reported at 210.1K. Canadian Building Permits for March are predicted to decrease by 3.5% monthly. Forex traders can compare this to Canadian Building Permits for February, which increased by 4.0% monthly.

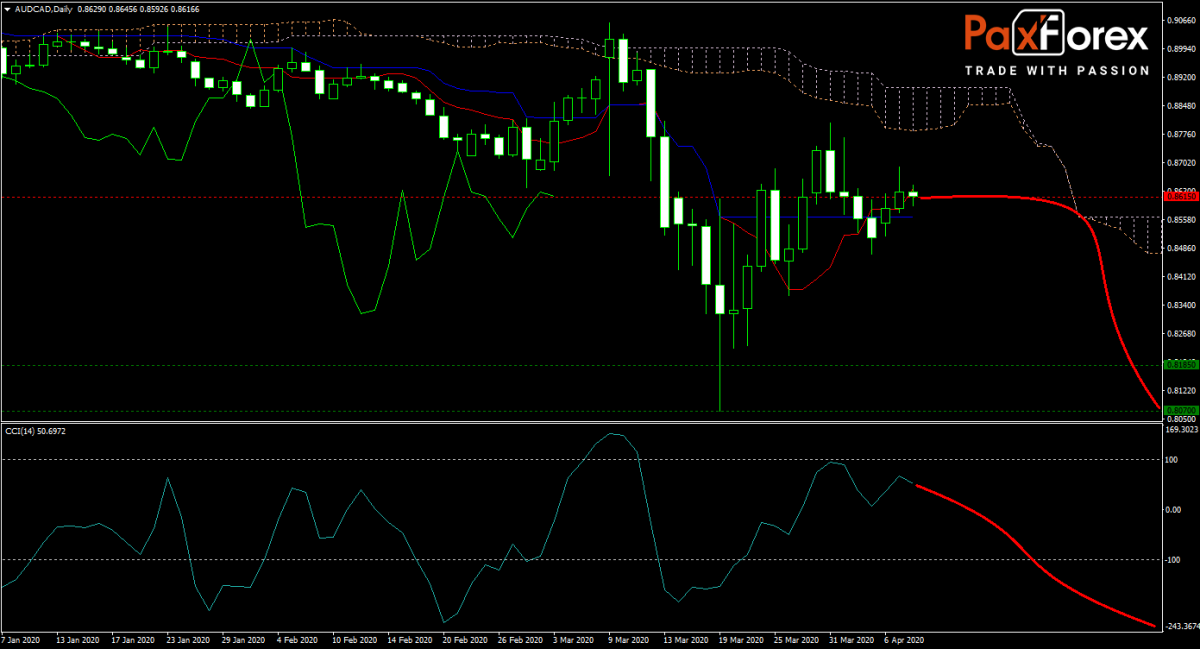

Following a price action reversal from extreme oversold conditions, the AUD/CAD is losing upside momentum. The Ichimoku cloud rejected an advance and forced a retreat. The forecast remains bearish. Will today’s Canadian data give bears a reason to accelerate the sell-off? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/CAD remain inside the or breakdown below the 0.8575 to 0.8690 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.8615

- Take Profit Zone: 0.8070 – 0.8185

- Stop Loss Level: 0.8735

Should price action for the AUD/CAD breakout above 0.8690 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.8735

- Take Profit Zone: 0.8885 – 0.8940

- Stop Loss Level: 0.8690

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.