Source: PaxForex Premium Analytics Portal, Fundamental Insight

The decline in performance has been a label for AT&T for far too long. Over the past 25 years, the telecom company's stock price has risen only 25%. Over the same period, the S&P 500 has risen in value by nearly 540%. While the popularity of 5G networks offers the potential for AT&T stock to rebound, the stagnation in its stock price is likely to continue for the foreseeable future for the following reasons.

AT&T has invested heavily in non-wireless assets. In 2015, for example, it spent $67 billion on cable TV alternative DirecTV. In 2016, it spent $85 billion on what is now WarnerMedia.

Among other things, the WarnerMedia purchase led to the creation of HBO Max, which grew its subscriber base by 2.7 million in the last quarter alone. Nevertheless, the $14.99 a month fee the company receives from HBO Max subscribers does not make up for the $64.99 a month minimum cost paid by an increasingly smaller number of DirecTV subscribers.

But declining revenue from DirecTV subscribers is the least of the company's problems. DirecTV has plagued AT&T since it bought it in 2015. The growth of streaming has led to massive subscriber attrition and a significant devaluation of the asset. Despite this problem, AT&T has refused to get rid of this unprofitable holding company entirely. Although it technically separated DirecTV, it decided to retain a 70 percent stake in this new company. AT&T now values the DirecTV separation at just over $16 billion and is rumored to be trying to sell the remaining stake.

When you compare problematic telecom expansion attempts not focused on 5G, the roughly $9 billion that Verizon has spent on AOL and Yahoo! represents a relatively small problematic investment. Moreover, T-Mobile has focused solely on wireless expansion and 5G. Buying Sprint in 2020 significantly increased its debt, but at least it was focused on telecom expansion.

Dividend spending is also hampering AT&T. Last quarter, its quarterly free cash flow of nearly $5.9 billion sufficiently covered its dividend expense of just over $3.7 billion. It represents 63% of free cash flow. However, Verizon pays only about 50% of its free cash flow in dividends, and T-Mobile offers no dividend payments. This growing liability puts AT&T at a competitive disadvantage.

In addition, its payout has been growing for 35 consecutive years, making AT&T a Dividend Aristocrat. Its shareholders now receive $2.08 per share, a yield of about 6.6 percent. That's nearly five times higher than the S&P 500's average yield of 1.4 percent.

However, the dividend creates a Catch-22 dilemma for AT&T. Dividend aristocrat status helps stabilize the stock price because it attracts funds and investors accustomed to annual pay increases. But at current yields, a payout increase does not seem necessary to attract investors, except to maintain the aristocrat status. Moreover, companies that have lost that status often suffer for years amid a collapse in stock prices.

AT&T hasn't raised its payout so far this year, and it will lose its aristocrat status if the payout doesn't rise in 2021. Although AT&T is likely to raise its dividend before the end of the year, the delay has created even more uncertainty for AT&T's stock price.

Dividend spending also leaves AT&T with less available capital to upgrade its network. In 2020, AT&T will spend just under $15.7 billion on capital spending, most of which will go toward building its 5G network. That's down from just over $19.6 billion in 2019. By comparison, Verizon spent $18.2 billion in 2020, and T-Mobile allocated $11 billion for real estate and equipment during that period.

For now, investors don't have to worry about network speeds. Ookla Speedtest recently ranked AT&T's network as the fastest for both 4G and 5G. However, both of its competitors have expressed their intention to improve speed and quality.

Verizon spent $45 billion to buy spectrum in a state C-band auction earlier this year, nearly double the $23 billion allocated to AT&T. The spectrum purchase increased AT&T's total debt to $180.2 billion, and total liabilities could limit AT&T's ability to buy more much-needed spectrum. In presenting its first-quarter 2021 earnings report, CFO Pascal Desroches said the company would focus on reducing its debt. Nevertheless, that burden could hinder future investments.

In addition, AT&T has not developed a clearer strategy for developing the network as a service. That would help to further monetize the network and thus stabilize the balance sheet. On the other hand, Verizon has partnered with Amazon's AWS, Honda's autonomous driving, and others. AT&T will probably have to follow suit to stay competitive and better monetize its network.

For now, AT&T remains competitive in the telecom space. As long as the company can produce sufficient cash flow, it should maintain its status as a dividend aristocrat and avoid excessive debt growth.

However, its current strategy leaves the company with a strained balance sheet and little growth. Until AT&T figures out how to boost earnings, it may continue to struggle to make its stock more attractive to some risk-averse dividend investors.

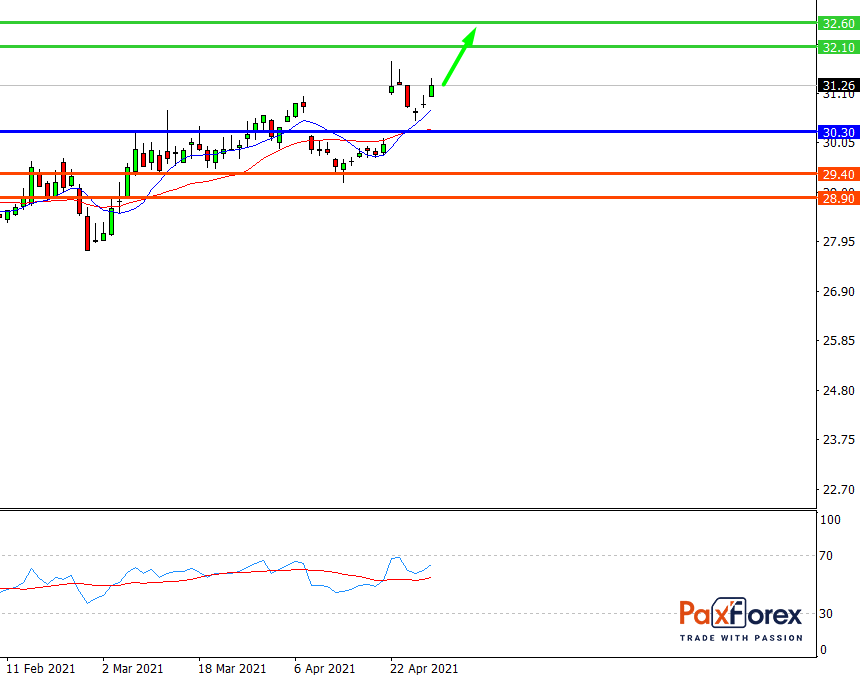

While the price is above 30.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 31.00

- Take Profit 1: 32.10

- Take Profit 2: 32.60

Alternative scenario:

If the level 30.30 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 30.30

- Take Profit 1: 29.40

- Take Profit 2: 28.90