Source: PaxForex Premium Analytics Portal, Fundamental Insight

The T company surprised shareholders last month with two statements. First, the company is going to get rid of WarnerMedia and merge it with Discovery, ending its pricey attempt to become a media giant after acquiring Time Warner three years ago.

Second, the company announced a dividend cut after the spin-off, stopping its 36-year streak of annual dividend increases and leaving the prestigious group of Dividend Aristocrats. AT&T says the dividend cut reflects the sale of WarnerMedia, and it will be balanced by newly issued shares of the spun-off company.

But there has also been no clarity about AT&T's plans to expand as an independent company, particularly after T-Mobile merged with Sprint in 2020 and outdid AT&T as the second-largest wireless carrier in America. AT&T's 5G network also still provides less coverage than T-Mobile's.

AT&T CFO Pascal Desroches lately decided to clarify the situation at a Credit Suisse communications conference. Now we'll analyze the main points he wanted to deliver to investors.

- The company's wireless business is still strong

Desroches argues that AT&T's mobile division has successfully made up for its past failures by concentrating on "higher value" customers. In other words, Desroches anticipates the number of postpaid subscribers generating more revenue than prepaid subscribers will continue to grow after slowing growth in 2019.

- The company is expanding its 5G network

T-Mobile's 5G network provides about 33% more geographic coverage than AT&T and Verizon Communications' combined 5G networks in the United States. That's because T-Mobile's 5G network primarily uses a 2.5 GHz mid-band spectrum, which spreads farther and penetrates buildings more easily than the C-band spectrum used by AT&T and Verizon.

Desroches insists that AT&T will expedite the deployment of its C-band spectrum and reach "200 million people by the end of 2023." Nevertheless, T-Mobile's expanded 5G spectrum already covers about 295 million people today -- so AT&T won't overtake T-Mobile anytime soon.

- AT&T is doubling its fiber coverage area

Desroches said AT&T will "double the size" of its "fiber coverage to 30 million customer seats by the end of 2025."

This expansion could strengthen AT&T's broadband and wireline business, which generated 22 percent of the company's revenue last year. That percentage should grow after AT&T separates WarnerMedia.

- Capital expenditures are on the rise

Desroches expects AT&T to increase its capital spending to about $24 billion a year as a stand-alone company, with most of that spending going to 5G and fiber-optic network expansion.

- WarnerMedia is improving

Desroches thinks that WarnerMedia's Q2 results will be positive thanks to an easier comparison to the aftermath of the pandemic a year ago.

In the second half of the year, he believes WarnerMedia will benefit from rising ad sales, the resumption of movie theater operations, and the continued growth of HBO Max, which could serve 67 to 70 million subscribers by the end of the year. That still leaves HBO Max far behind Netflix and Walt Disney in the streaming race, but a merger with Discovery could bring more content and subscribers to the company's streaming services.

- Confirmation of long-term guidance.

Desroches reemphasized AT&T's previous 2022 to 2024 forecast, which reflects WarnerMedia's spin-off and higher capital spending targets. The company expects to generate more than $20 billion in annual free cash flow after the deal closes and maintain a cash dividend payout ratio of 40-43%.

In other words, the revamped AT&T will pay about $8 billion in annual dividends, compared to nearly $15 billion in dividend payments in 2020, so investors should expect its current dividend to be nearly cut in half.

- The company won't cut its dividend until after the deal closes

AT&T, on the other hand, has no plans to " reset" its current dividend until after the spin-off and merger deal closes. AT&T expects to close the deal in mid-2022, but the actual deadline is July 15, 2023. Thus, investors will be able to earn a 7% yield for at least one more year.

- The company's returns are still very attractive

Desroches says the amended dividend will continue to deliver "a very attractive yield in the 95th percentile" among all dividend stocks. It's not surprising, since AT&T's current yield could be cut in half and still remain higher than many other mature blue-chip stocks.

- The company will have less debt

According to Desroches, AT&T's ratio of net debt to adjusted EBITDA will drop from 3.1 times last quarter to 2.6 times after the deal closes. He believes that the ratio will drop below 2.5 times by the end of 2023.

- The company may resume buybacks

If AT&T's net debt to adjusted EBITDA ratio falls below 2.5 times, the company will have an opportunity to resume share repurchases, which have been on hold since last year.

- Not much has changed

While all of the above may sound optimistic, Desroches still offered no compelling reasons to buy AT&T -- he basically repeated the same points he made last month. The stock certainly looks cheap, but it will probably trade at a discount until new, more compelling catalysts emerge.

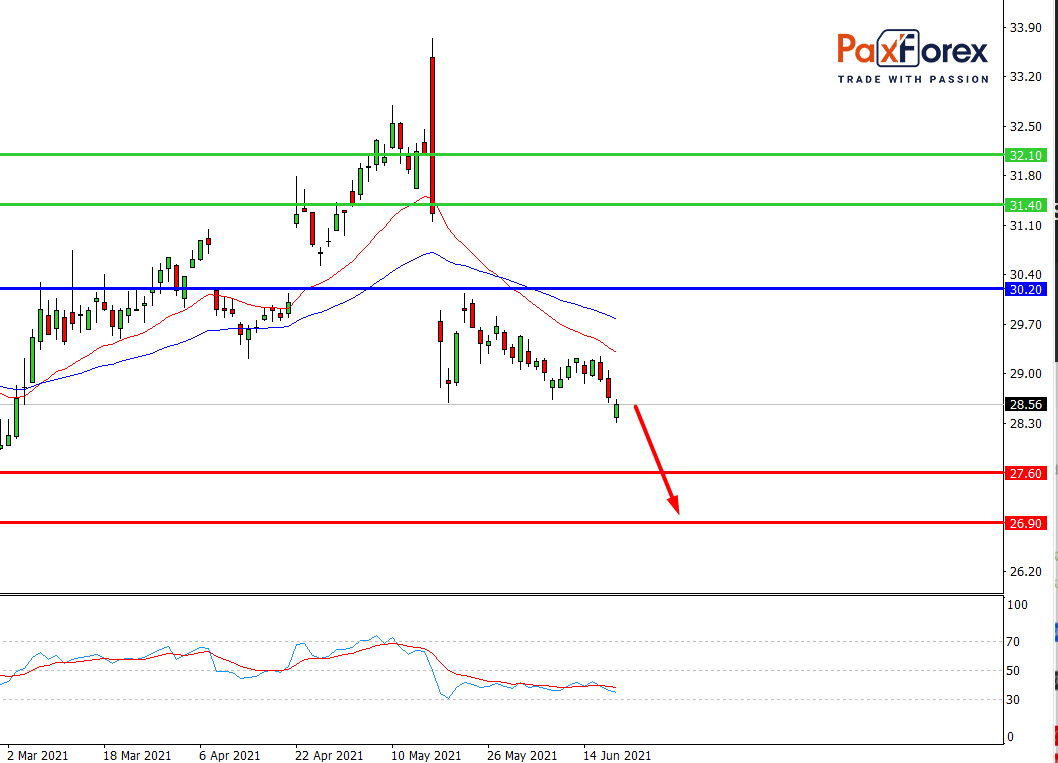

While the price is below 30.20, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 28.99

- Take Profit 1: 27.60

- Take Profit 2: 26.90

Alternative scenario:

If the level 30.20 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 30.20

- Take Profit 1: 31.40

- Take Profit 2: 32.10