Source: PaxForex Premium Analytics Portal, Fundamental Insight

AT&T stock lost more than a quarter of its price in 2020 Weak growth in the wireless segment couldn't make up for the loss of pay-TV subscribers and WarnerMedia's pandemic-related issues, and the company continued to spend money on its streaming services to compete with Netflix, Disney, and other platforms.

AT&T's debt levels remain high, and some investors question the durability of its dividend. T-Mobile has also exceeded AT&T as the second-largest wireless carrier in the U.S. since its merger with Sprint last April. All of these unfavorable factors were already scaring investors away from AT&T last year, and it didn't ease that the market also supported faster-growing tech stocks that were better protected from the pandemic.

Over the past few months, however, that market sentiment has changed. Rising bond yields have caused a rotation from growth stocks to value stocks, and investors have switched from pandemic to renewed activity. It caused some investors to return to AT&T.

AT&T also decided earlier this year to sell a 30% stake in DIRECTV, the troubled core of its pay-TV business, to streamline its operations and reduce debt. In April, the company posted better-than-expected first-quarter earnings that beat analysts' estimates for revenue, profits, and wireless subscribers, and HBO Max continues to expand with 44.2 million subscribers in the United States.

AT&T announced this week that it has reached an agreement to spin-off WarnerMedia and merge that division with Discovery Communications to create a new company, allowing it to focus on growing its core wireless business. AT&T's current shareholders will get a 71% stake in this newly emerged firm.

As a result, AT&T stock is up more than 15% this year, while many other technology companies are down. The stock still looks cheap at 10 times forward earnings and a high dividend yield of 6.5%, but is it ultimately worth buying it again as a long-term investment?

In fiscal 2020, AT&T's revenues and adjusted earnings were down 5% and 11%, respectively. Its wireless business stabilized in the second half of the year, and the company continued to gain streaming subscribers.

But the loss of traditional pay-TV subscribers deferred WarnerMedia movies and declining advertising revenue offset those gains. Free cash flow (FCF) for the full year also fell 5% to $27.5 billion.

For the first quarter of 2021, AT&T's revenues and adjusted earnings were up 3% and 2% year-over-year, respectively. Mobile revenues were up 9% as the company acquired 595,000 wireless subscribers, and WarnerMedia revenues were up 10% as HBO and HBO Max added 2.7 million subscribers.

Growth in these two core businesses offset slower growth in the wireline, pay-TV, and AT&T segments in Latin America. The company also benefited from a slight comparison to the initial impact of the pandemic a year earlier.

AT&T expects full-year revenue to grow only 1%, adjusted earnings to remain flat, and FCF to fall another 5% to about $26 billion. Those estimations should remain stable because AT&T doesn't plan to complete the WarnerMedia spin-off until mid-2022.

The spin-off will likely free up some cash and allow AT&T to finally raise its dividend. The company anticipates its dividend to remain steady this year and its payout ratio to be in the 50s, but its quarterly payout has been flat for the past six quarters. The delay indicates that the company could break its 36-year streak of annual dividend increases this year and lose its status as an S&P 500 Dividend Aristocrat.

Losing that elite title may seem like bad news, but AT&T's overall return -- which takes into account reinvested dividends -- has lagged far behind the S&P 500 over the past decade. Its competitor Verizon also had a much higher total return with a lower dividend yield.

AT&T paid out almost $15 billion in dividends last year, but that money might be better spent elsewhere. After the WarnerMedia merger with Discovery, it won't need to invest in new streaming content, but it could still improve its 5G networks to catch up with T-Mobile.

AT&T could also put more cash toward paying down long-term debt, which has grown over the past decade after acquiring DIRECTV, AWS-3 spectrum licenses, and Time Warner. The spin-off would take some of the debt off the company's balance sheet, but its debt-to-equity ratio would remain high.

Last year, AT&T paid nearly $8 billion in interest expense on that debt. So AT&T investors may agree to suspend the annual dividend increase (or even reduce it) if the company wisely uses that cash to pay down debt or improve its business.

AT&T is slowly evolving, but it is still a long and complicated process. Its previous purchases of DirecTV and Time Warner were unfortunate, and its wireless business is losing its edge over T-Mobile.

Many investors have owned AT&T stock for years, but no one has high hopes for it this year. Its low valuation and high yield may limit the downside potential, but investors looking for simpler companies with better growth rates should consider buying Verizon or T-Mobile stock.

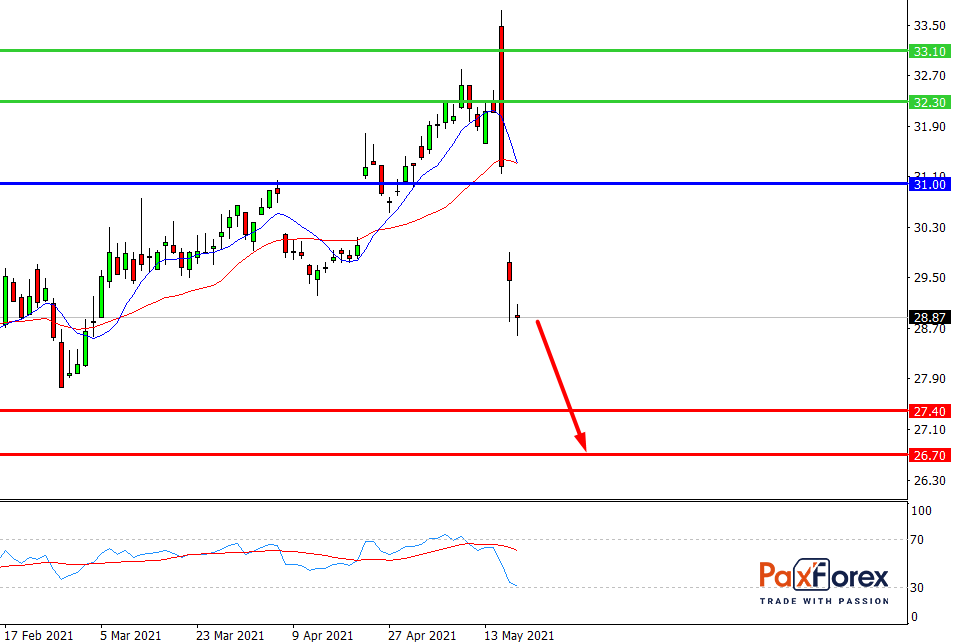

Provided that company is traded below 31.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 29.55

- Take Profit 1: 27.40

- Take Profit 2: 26.70

Alternative scenario:

In case of breakout of the level 31.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 31.00

- Take Profit 1: 32.30

- Take Profit 2: 33.10