Source: PaxForex Premium Analytics Portal, Fundamental Insight

India is the second-most populated country in the world, with almost 1.34 billion people, just behind China, which has a population of nearly 1.4 billion. Not surprisingly, global companies are struggling fiercely for a slice of India's impressive pie of personal consumption spending, which in March of this year was more than $460 billion, as per the database provider CEIC.

Apple is one of many companies that have long been trying to conquer the Indian market, though with mixed results. Despite having been in the country for years, the iPhone is still a small player in India's booming smartphone market. In the fourth quarter of 2020, Apple reportedly held just 4 percent of the Indian smartphone market.

But there are signs that Apple's fortunes in India are changing thanks to a series of thoughtful moves, as well as the enormous opportunities presented by the growing mobility of a population that is embracing new technologies. India's mass population represents a huge opportunity for Apple to generate revenue from various categories of devices, and the good news is that the company is well on its way to taking advantage of it.

DigiTimes reports that Mac sales in India more than tripled in the first quarter of 2021, making Apple the fifth-largest PC original equipment manufacturer (OEM) in the country. IDC estimates that Apple's PC shipments (excluding tablets) grew 335% year-over-year for the quarter, trailing Asus by 2,000 units.

Apple's extraordinary results in the Indian PC market are not unexpected, as the company has seen significant revenue and shipment growth since the coronavirus pandemic. What's more, iPad sales in that country are on the rise despite the broader tablet market experiencing a downturn. Third-party estimates show iPad shipments in India grew 144% year-over-year in the first quarter. The company is now the second-largest tablet brand in the country with a 29% market share.

At the same time, iPhone sales in India are also on the rise, with shipments up 207% in the first quarter, according to Counterpoint Research. By comparison, overall smartphone sales in India grew only 23% year-over-year in the quarter.

Canalys, a technology market analysis firm, notes that the launch of Apple's online store in India last September triggered an impressive sales increase. It's not unexpected at all, since Apple is offering exchanges, discounts, and free equal monthly installments (EMI) through its online store, which seems to be attracting more and more consumers. In addition, discounts offered by e-commerce platforms on popular Apple products are also helping to boost sales.

More importantly, Apple is taking steps to maintain its striking momentum in India.

Encouraged by the growth in sales through its online store, Apple is now working to open physical stores in India. CEO Tim Cook said in January of this year that the company is going to open physical stores in India, and it will continue to expand this network in the long term. Sources cited by India's Business Standard daily newspaper suggest that Apple may be planning to open physical stores in three major cities-Mumbai, Bengaluru and Delhi.

In addition, Apple resellers are looking to expand their physical presence to include smaller cities and towns. These efforts to expand Apple's presence in India will be complemented by improvements in the company's manufacturing operations in the country. Apple's manufacturing partners, Foxconn and Wistron, have been chosen as part of a $1 billion incentive plan to boost domestic production.

Apple is reportedly going to use these incentives to produce iPads domestically. It could lower the price of the popular tablet, as manufacturers under the plan will get cash for locally produced goods for four years.

When you consider that India's gross domestic product (GDP) per capita is expected to grow more than 58 percent by 2026 from 2020 levels, it becomes clear why the market Apple is targeting in this country will continue to grow. Apple products are in increased demand in the used market due to lower prices: The iPhone's share of the used smartphone market in India is 20%. Thus, higher disposable income and local production could lead to significant growth in sales of new Apple products in the long run, given the company's solid brand equity.

India is still a ludicrously small part of Apple's overall business. In the fiscal year 2020, the company generated just $1.85 billion in revenue there. But India's population of 1.34 billion people and their increased buying power could open up new growth horizons for Apple, which the company is taking some thoughtful steps to tap into that will help it remain a leading technology player in the future.

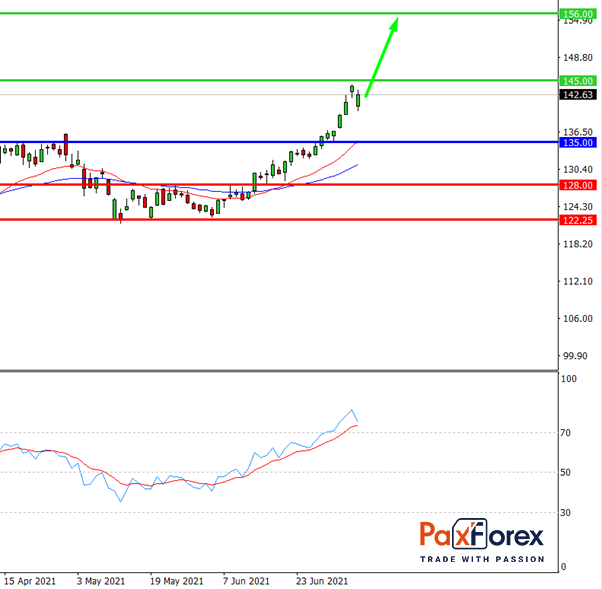

While the price is above 135.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 142.57

- Take Profit 1: 145.00

- Take Profit 2: 156.00

Alternative scenario:

If the level 135.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 135.00

- Take Profit 1: 128.00

- Take Profit 2: 122.25