Source: PaxForex Premium Analytics Portal, Fundamental Insight

Apple's stock price has risen about 460% over the past few years, defying anyone who stated its momentum was gone. The company's annual earnings increased from $215.6 billion to $274.5 within the last 4 years.

But can Apple support this dynamic over the next several years? Let's look at its long-term prospects to find out.

Analysts anticipate Apple's revenue to grow 21% in fiscal 2021 and then grow another 4% in 2022. Much of that increase will come from new hardware devices and an expanding ecosystem of services.

The iPhone 12, Apple's first 5G device, is predicted to trigger a new wave of upgrades this year. According to the latest vendor estimates, the company could deliver 230 million iPhones in 2021, a 14 percent growth rate from 2020 and the best rate for flagship devices since 2016.

Strong iPhone shipments, which accounted for half of Apple's revenue in 2020, should limit user growth from its growing ecosystem of services, which includes the App Store, Apple Music, Apple TV+, Apple Arcade, Apple Pay, and other services. Last year, 20% of Apple's revenue came from these services, and it lately exceeded 600 million paid customers within the ecosystem.

Apple will keep taking advantage of its hardware business and locked ecosystem to retain its customers, which could bring more disagreements with such businesses as Spotify, Netflix, and Amazon. These controversies can get expensive, but Apple still had nearly $196 billion in cash and marketable securities last quarter, so it can comfortably manage to confront these longtime rivals.

As for the rest of the hardware, investors should expect Apple to release new versions of Macs, iPads, Watches, and AirPods every year. The new Macs will run on Apple's own ARM-based processors rather than Intel's x86 processors. So, the company can put even more chips in other devices to strengthen the supply chain, modify its products and increase its profits.

Apple is reportedly developing an augmented reality (AR) headset, according to The Information, with a target launch date of 2022. It could follow that device with a lighter pair of AR glasses in 2023.

Details about these long-established devices are scarce, but they could help Apple keep up with Microsoft and Facebook in the nascent virtual and augmented reality markets. Microsoft's HoloLens is still an expensive developer-focused device, while Facebook intends to extend its Oculus VR business into the AR market with lightweight glasses between 2023 and 2025.

Apple often destabilizes markets it didn't create by allowing early owners of the glasses to identify flaws first. It used to do this with MP3 players, smartphones, tablets, and smartphones -- and could take a similar approach with AR glasses, which still haven't achieved traction in the past few years.

A victorious launch of Apple Glasses would help the iPhone, Apple Watch, AirPods, and other devices to tie users into an ever-expanding ecosystem. It would also further reduce dependence on Apple, the iPhone, and possibly pave the way for the launch of its Apple Car in a few years.

Apple is reportedly developing an electric driverless car, and talks have been held with several automakers to release the car. Analysts expect it to be launched sometime between 2024 and 2027, and people think it will likely have a full suite of Apple software and AR services. Together, Apple's AR devices and in-car efforts could finally help the company move beyond the iPhone and into a diversified tech giant.

No doubt Apple's core business still has room to develop, and it will likely proceed to compensate loyal investors with higher dividends and bigger buybacks.

Apple pays a 0.6% dividend today, but its low payout ratio of 22% suggests that it has plenty of room for future hikes. Apple has already decreased its publicly traded stock by more than 20% over the past five years, and that cut should continue for the foreseeable future.

It's impossible to say exactly at what level Apple stock will be trading at by the end of 2025, but it will likely outperform the S&P 500 by a significant margin.

The company's core business is still strong, it has plenty of bullets in its gun, and its stock still trades at less than 30 times forward earnings. The stock could still go through some sharp swings, but investors who simply hold Apple stock -- instead of trading it -- could be well compensated over the next several years.

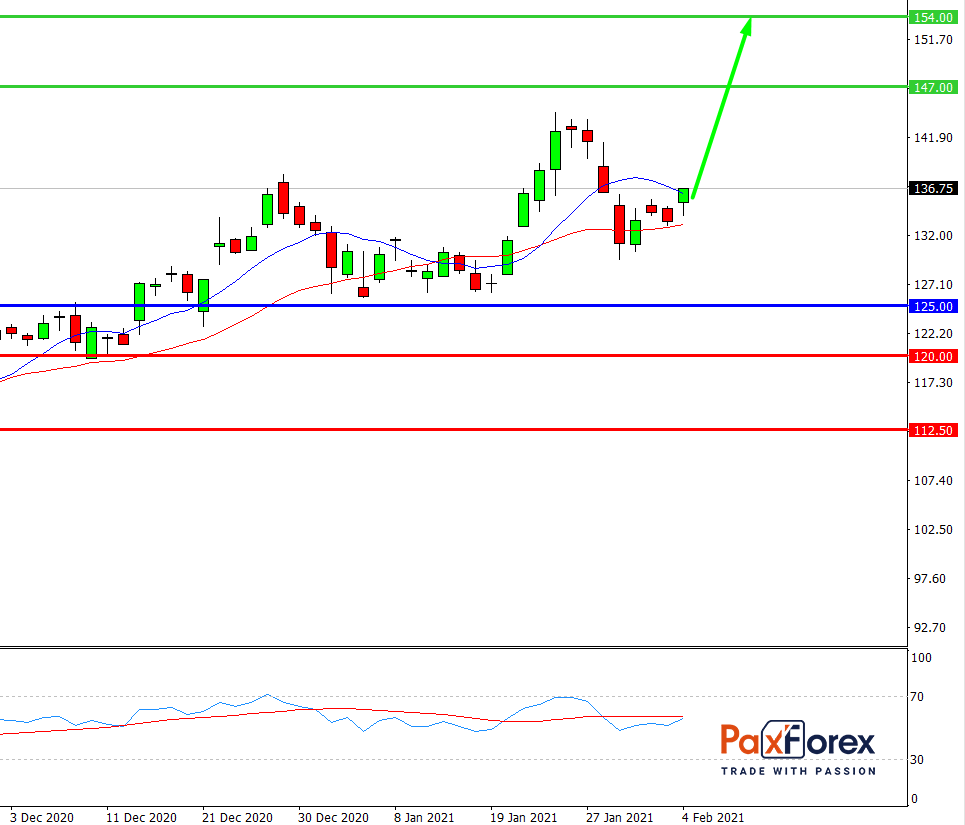

While the price is above 125.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 137.00

- Take Profit 1: 147.00

- Take Profit 2: 154.00

Alternative scenario:

If the level 125.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 125.00

- Take Profit 1: 120.00

- Take Profit 2: 112.50