Source: PaxForex Premium Analytics Portal, Fundamental Insight

American Express, the elite card company, has fallen on hard times after a coronavirus outbreak. Its stock fell on its Q1 earnings report after it missed the analysts` revenue forecast, but there were signs of a return to growth.

In a normal year, American Express posted strong sales growth. 2020 wasn't exactly a normal year, and the company is still trying to weather the effects of cost-cutting. Does it mean you should cross American Express off your list of possible investments, or is the price decline a great opportunity to buy the company's stock cheaper?

American Express is the third-largest credit card company, but it operates somewhat differently than Visa and Mastercard. Both of these companies are payment processors that work with banks, receiving transaction fees when a customer uses their branded cards but sparing them their own credit. American Express, on the other hand, operates as its own bank, and the pandemic has affected it as much as the banks, including having to transfer millions in reserves to cover credit losses, which has affected the final results.

Despite this, American Express managed to hold onto profits throughout the pandemic.

In addition, American Express's customer base tends to be higher-income, and the company focuses on travel and entertainment. With a more affluent customer base is usually an advantage, but while people have been sitting at home saving for the essentials, it has become something of a burden.

Visa and Mastercard are still reporting lower sales than last year. Visa's revenue was down 2 percent for the quarter ended March 31, after a 6 percent drop for the period ended Dec. 31. Mastercard will report first-quarter earnings today.

Despite declining sales, American Express still reported significant progress in the first quarter. Sales were down 12% (slightly more than analysts expected), but net of travel and entertainment spending, spending was up 11% from the corresponding quarter in 2019. Sales declines have improved in every consecutive quarter of the pandemic, and travel and entertainment spending has improved markedly in the past few weeks as the vaccine spread.

It is an essential improvement for American Express because until travel resumes, cardholder spending is likely to remain low. An internal report showed that 76% of respondents are planning a trip even if they can't travel yet, and 64% said they are so desperate for travel that they are willing to give up social media for a month for travel.

Earnings per share were $2.74, up from a projected $1.61. There were other positives, such as improved customer retention rates and a 35% increase in paid cards compared to the fourth quarter.

Over the past few years, American Express has invested in its digital capabilities, offering financial technology solutions to businesses and individuals. A record 88% of U.S. cardholders made digital payments in the first quarter. The company is also making strides with Kabbage, a fintech platform for small businesses that it acquired last year, which it makes available to its merchant base.

AXP offers "Pay It, Plan It" (BNPL) - Buy Now, Pay Later - to cardholders. BNPL has become a popular payment method since PayPal Holdings launched it and companies like Affirm Holdings have made it available to many merchants. American Express cardholders have made 6 million purchases with Pay It, Plan It and created more than $5 billion in receivables.

This option allows customers to make larger purchases than some of them would otherwise have made, and it can help boost spending.

Finally, the company is making strides in its China project, where last June it became the first foreign payment network to be authorized to conduct transactions. The company has already added 14 million merchants there and expects this market to become very substantial over time.

As for the rest of 2021, Chief Financial Officer Jeff Campbell confirmed that the company expects travel to increase to 70% of pre-pandemic levels by the fourth quarter and to fully recover by 2022.

Over the past year, American Express stock is up 75%, and notwithstanding the stock's decline after the earnings report, it is up 24% year-to-date after resuming its ascent to all-time highs. Investors are confident in the long term, and American Express is a great stock to consider for any portfolio.

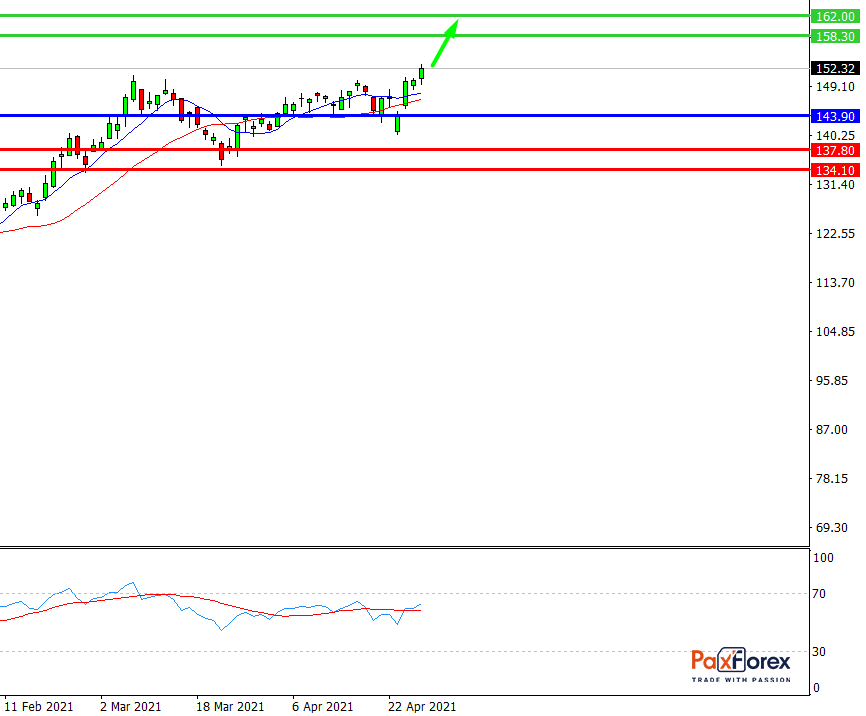

While the price is above 143.90, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 150.36

- Take Profit 1: 158.30

- Take Profit 2: 162.00

Alternative scenario:

If the level 143.90 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 143.90

- Take Profit 1: 137.80

- Take Profit 2: 134.10