Source: PaxForex Premium Analytics Portal, Fundamental Insight

Amazon first revolutionized its industry when it went from a not-so-humble online bookseller to America's largest online marketplace for anything. Some of the company's expansions include the likes of Amazon Web Services and Amazon Prime.

But there doesn't seem to be an area that Amazon isn't interested in conquering. The company has launched its own Etsy product, it offers a service called Amazon Prime Wardrobe, which mimics many of Stitch Fix's efforts, it is expanding its presence in physical grocery stores, and most recently it has taken over pharmacies with Amazon Pharmacy. It's also changing the way we shop, testing drone delivery, and offering two-hour delivery for certain items.

After the market closed Tuesday, Amazon reported strong fourth-quarter results.

The stock was virtually unchanged in Tuesday's post-market. We can probably attribute the initial less than enthusiastic market reaction to two factors. The first is the news that founder Jeff Bezos will move to the role of executive chairman in the third quarter, and Andy Jassy, head of Amazon Web Services (AWS), will become CEO. Second, first-quarter 2021 operating profit guidance was lower than many investors probably expected, based on Wall Street's consensus earnings estimates.

However, fourth-quarter results were very commendable and exceeded analysts' expectations. Management also easily beat its earnings guidance for the first quarter of 2021.

Let's take a closer look at the tech giant's quarterly report as well as management's key estimates.

- Revenue growth totaled 44%

Amazon's quarterly net sales rose 44% year over year to $125.6 billion, beating Wall Street's expectations of $119.7 billion. The company also easily surpassed its projected range of $112 billion to $121 billion. Excluding growth from foreign exchange, revenue was up 42%.

The company's year-over-year revenue growth exaggerates the strength of its underlying performance. It is because its massive annual Prime Day event was held in the fourth quarter of this year, rather than its usual third quarter, due to the COVID-19 pandemic. Nevertheless, the revenue growth is still impressive.

In terms of context, the first, second, and third quarters of 2020 saw year-over-year revenue growth of 26%, 40%, and 37%, respectively.

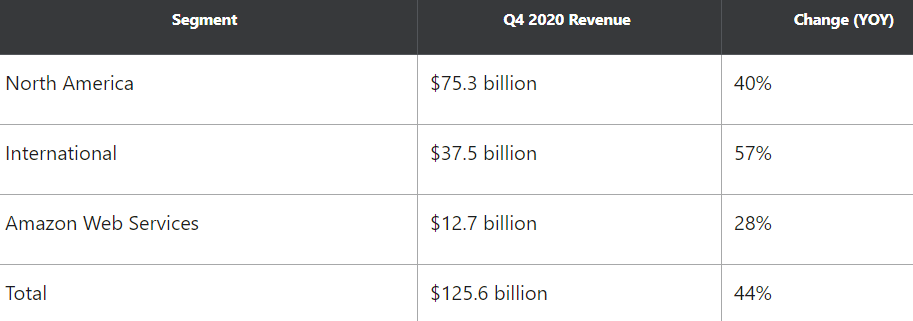

Here's how revenue broke down by segment:

As expected, Amazon's e-commerce units around the world continued to benefit from the pandemic. Consumers continued to largely avoid in-store shopping.

In the third quarter, revenue growth in North America, International, and AWS segments was 39%, 37%, and 29%, respectively, year over year.

- Operating income growth amounted to 77%

Operating income rose 77% year over year to $6.9 billion, lowering Amazon's $1 billion guidance to $4.5 billion.

- EPS more than doubled

Net income rose 118% year over year to $7.2 billion. In earnings per share (EPS) terms, it also rose 118% to $14.09. Wall Street projected EPS to be only $7.19.

- Operating cash flow jumped 72%

Operating cash flow surged 72% year-over-year to $66.1 billion in the last 12 months. Free cash flow increased 20% over the same period to $31 billion.

- Revenue for the first quarter of 2021 is expected to grow 33% to 40%

For the first quarter, Amazon was targeting net sales in the range of $100 billion to $106 billion, which would equate to a 33% to 40% year-over-year increase. The entire range exceeds Wall Street's consensus estimate of $95.5 billion.

The company also expects its operating income to be between $3.0 billion and $6.5 billion, compared with $4.0 billion for the year. This range means that management thinks operating profit could decline by as much as 25 percent or grow by as much as 63 percent. This projection includes about $2 billion in costs associated with covering costs caused by quarantine requirements.According to the report, Wall Street modeled Q1 earnings per share growth of 80% year-over-year. Thus, we can conclude that the company's operating profit forecast is lower

than analysts expected. Nevertheless, Amazon regularly adjusts its operating profit forecast, so we can probably assume that the current outlook for this metric is quite conservative.

Amazon's already high stock price has risen another 137% over the past three years, and investors can expect Amazon to continue to baffle analysts and reward shareholders.

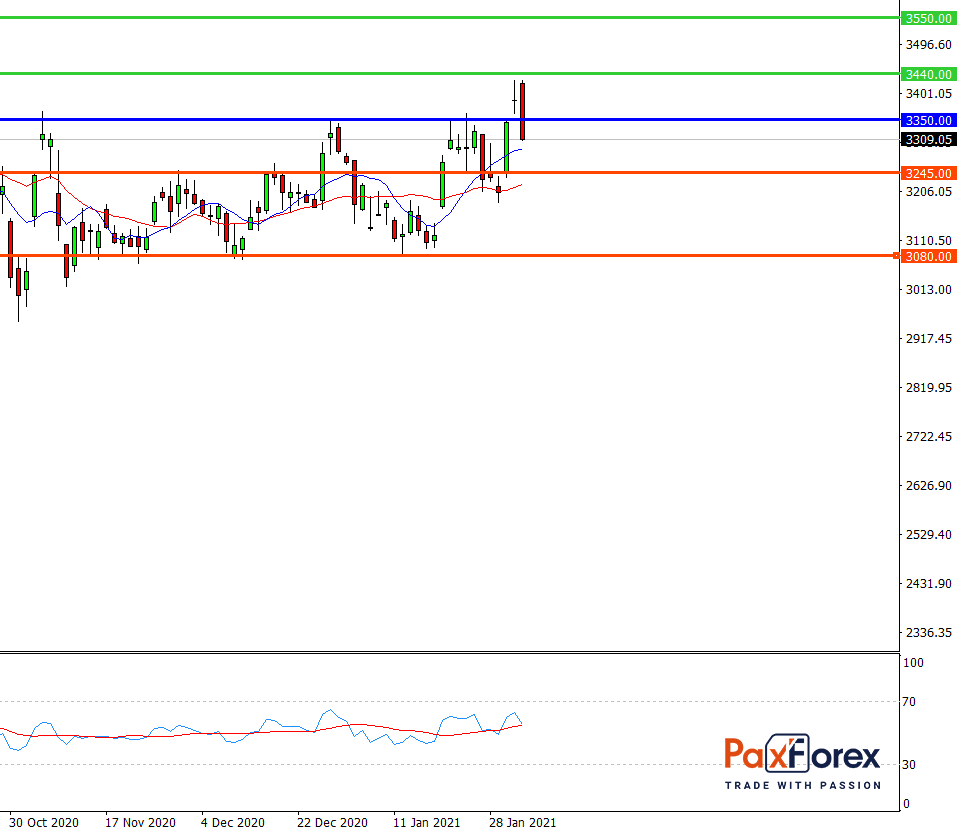

While the price is below 3350.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3308.00

- Take Profit 1: 3245.00

- Take Profit 2: 3080.00

Alternative scenario:

If the level 3350.00 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 3350.00

- Take Profit 1: 3440.00

- Take Profit 2: 3550.00