Source: PaxForex Premium Analytics Portal, Fundamental Insight

Will Google stock finally beat other FANG stocks? To date, Alphabet stock has looked better than Facebook, Amazon.com, and Netflix.

Shares of the largest Internet companies may be facing some unfavorable headwinds. In an unexpected move, President Biden appointed Lina Khan as chairman of the Federal Trade Commission on June 15. Khan, for her part, has been critical of the big tech companies.

GOOGL stock is on the leader's list of many investors who are relying on a variety of technical and fundamental indicators.

Bulls backing Google stock tirelessly talk about the rise of digital advertising as the coronavirus vaccine gains momentum, boosting the global economy as the industry normalizes.

Additionally, Google's cloud computing revenue grew 46% in the March quarter, and Apple became the largest customer of Google's cloud computing division, according to the report.

Google's first-quarter revenue far exceeded analysts' forecasts, including a $4.8 billion gain on investments.

Revenue from Internet search advertising and YouTube ads beat expectations in the March quarter, sending Google stock higher. Alphabet also declared a new $50 billion buyback of GOOGL stock.

Under Alphabet's new CEO Sundar Pichai, Google has increased its transparency. In its fiscal fourth-quarter earnings report, Google said its fast-growing cloud computing business was at a loss amid high investment. However, cloud computing's operating margins are expected to improve significantly.

Meanwhile, the ongoing share buyback program has boosted GOOGL's stock earnings. Google bought $7.9 billion worth of its own stock in the fourth quarter. The company also bought $7.9 billion worth of stock in the September quarter and $6.9 billion in the June quarter.

Google has about $15.4 billion left in its stock buyback authorization.

Although Google has been active in cloud computing and consumer hardware, digital advertising still accounts for the lion's share of the revenue. On June 24, Google said it would postpone plans to stop supporting third-party cookies with the Chrome Web browser by the end of 2023, two years later than the original deadline.

Amazon is slowly taking market share away from Google in Internet search advertising, according to a report by market research firm eMarketer. As Amazon gains ground in digital advertising, Google made big changes in how it handles e-commerce ads in 2020. The company has also strengthened its ties with Shopify, an e-commerce software provider.

In December 2019, Google co-founder Larry Page withdrew as CEO of Alphabet. He was succeeded by Pichai, who led the Google division. Google co-founder Sergey Brin stepped down as president of Alphabet.

It should be noted that Google's earnings performance remains a challenge amid high investments in data centers for cloud computing, artificial intelligence, YouTube, and consumer products. In early 2018, Google changed its accounting methods. It switched to reporting under GAAP, or generally accepted accounting principles. GAAP earnings include stock-based compensation.

Meanwhile, Google is struggling to gain share in cloud computing services over Amazon and Microsoft

Bank of America predicts that YouTube subscription revenue will reach $18 billion by 2025, up from $5 billion in 2020. YouTube also benefits from big brands shifting ad budgets from linear TV to digital channels. Late last year, Google reported that YouTube already has more than 30 million subscribers to its paid music and premium channels, and YouTube TV has more than 3 million subscribers.

Meantime, Google's cloud computing business lags behind competitors Amazon and Microsoft. Google has brought in Thomas Kurian, a former Oracle executive, to improve its performance in the enterprise market. According to Bulls, Google Cloud Platform is starting to win back share as it focuses on security, open-source software, and data analytics.

In June 2019, Google acquired data analytics company, Looker, for $2.6 billion in cash. Looker, an analytics platform based in Santa Cruz, California, uses business intelligence and data visualization tools. According to analysts, more acquisitions could be made shortly to grow Google's cloud business.

As of July 6, GOOGL stock is trading in the buy zone.

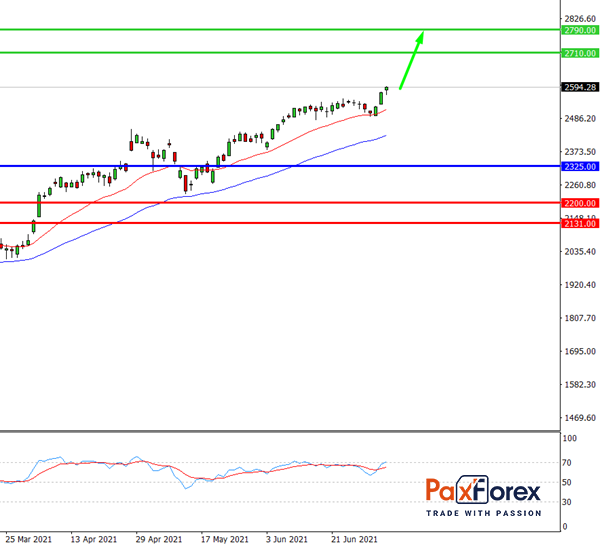

Provided that the company is traded above 2325.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 2479.00

- Take Profit 1: 2710.00

- Take Profit 2: 2790.00

Alternative scenario:

In case of breakdown of the level 2325.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 2325.00

- Take Profit 1: 2200.00

- Take Profit 2: 2131.00