Source: PaxForex Premium Analytics Portal, Fundamental Insight

Everyone knows the name Google pretty well. And we all deal with its products and services on a daily basis. Established 23 years ago, Google (part of parent company Alphabet) has evolved into one of the largest companies in the world. And undoubtedly, it's also one of the most popular stocks.

Notwithstanding its reputation and huge size, there are still a few little-known details about Alphabet and Google that current and potential investors may find very important. Let's take a look at a few things you may not have known about Alphabet.

First, Alphabet is a major player in several global markets.

Google has made a name for itself as a search engine, but Alphabet has become a leader in various different business sectors. Google has 92% of the world's search engine market, handling more than 3.5 billion searches every day. This staggering traffic has been used by Alphabet to lead the digital advertising market, 30% of which Alphabet controls.

It may be a shock to some in the U.S., but Alphabet also controls mobile device operating systems on a global level. Seventy-three percent of mobile devices worldwide run the Android operating system. And while the company lags behind rivals Microsoft and Amazon when it comes to cloud services, Alphabet still holds a respectable 7 percent share in this emerging market.

Alphabet plays an important role in several key technology industries, allowing it to collect a huge amount of data from individuals and businesses. That's why the company will play an essential part in forming the global economy for years to come.

Second, Alphabet spends a huge amount of money on research and development.

The tech giant's research and development budget of $28 billion was one of the largest in the world last year. Among major U.S. tech companies, it was surpassed only by Amazon in dollar terms and by Facebook as a percentage of sales. Almost 20 percent of Alphabet's spending was on research and development. It shows a commitment to innovation, which should inspire investors. This company must continue to improve existing products and create new ones to drive future growth in competitive markets.

Third, Alphabet is one of the most active acquisition-minded companies.

It might surprise some to learn that Alphabet has acquired 161 companies over the past 10 years, averaging more than one per month. Annual acquisition spending has ranged from $738 million to $2.5 billion over the past three years, so these acquisitions are clearly an important aspect of the company's growth strategy. It's not a huge amount for a company whose free cash flow last year exceeded $40 billion, but it does indicate the company's desire to innovate and expand its product portfolio. Alphabet's acquisitions of Motorola Mobility, YouTube, and DoubleClick were key to its market dominance.

Fourth, advertising continues to be Alphabet's main source of revenue.

Although the giant's status is confirmed in several verticals, 82 percent of Alphabet's revenue still comes from advertising services. It is also the only segment of the business that is currently profitable. In many ways, the Alphabet universe functions to enable and optimize the company's core marketing operations, which benefit from data collection and user interaction.

However, the company is also betting on the future of artificial intelligence, data analytics, healthcare technology, and other driving forces that will shape daily life and corporate operations after the digital transformation. Along with other tech giants, Alphabet has positioned itself as a major partner for enterprises to modernize and grow their businesses. It is a strong argument for creating long-term shareholder returns.

Finally, the fifth, Alphabet is popular with ESG investors.

Environmental, social, and governance (ESG) investing has become a very popular topic. People embrace the idea that their financial returns should coincide with ethical standards, and many corporations explicitly incorporate these standards into their operating mission. Alphabet executives have said that the company is committed to being a leader in ESG, which stands in stark contrast to the concerns of some that the company has questionable practices in collecting user data and selectively presenting news or search results.

Alphabet focuses on the "E" in ESG investments as it works to minimize its impact on the environment. Management says the company has been carbon-neutral since 2007 and aims to become completely carbon-free by 2030. The company has also made efforts to increase the transparency of its user data, and it has previously been involved in social issues. These factors could be very important for ethical investors, which could even lead to higher demand for Alphabet stock in the long term.

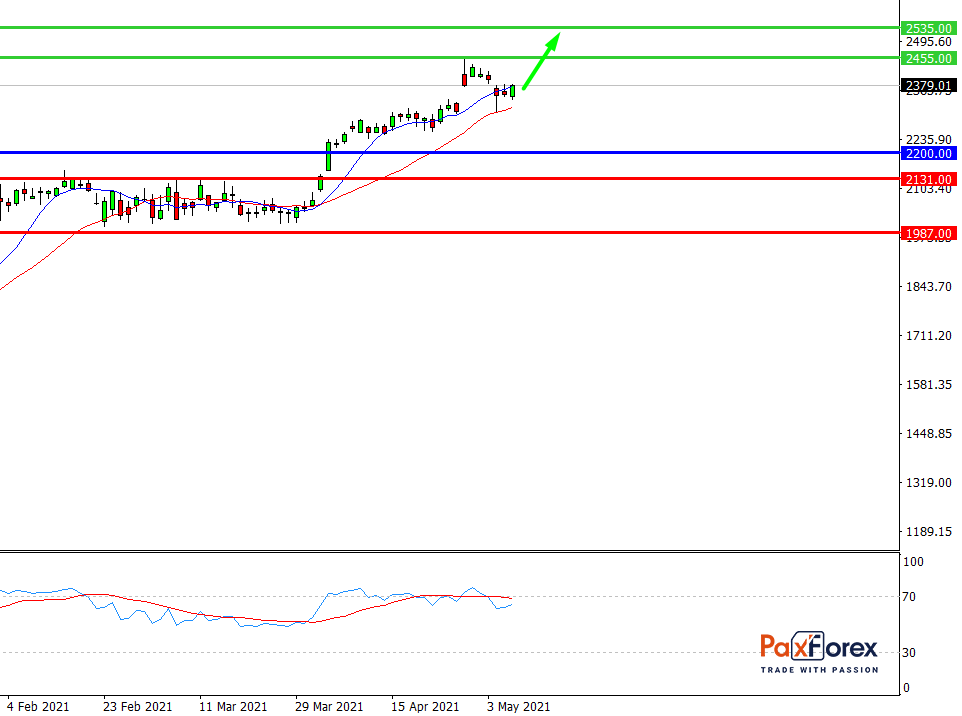

Provided that the company is traded above 2200.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 2357.00

- Take Profit 1: 2455.00

- Take Profit 2: 2535.00

Alternative scenario:

In case of breakdown of the level 2200.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 2200.00

- Take Profit 1: 2131.00

- Take Profit 2: 1987.00