Source: PaxForex Premium Analytics Portal, Fundamental Insight

Investors often admire the advantages of Chinese companies operating in the world's most populous country and second wealthiest economy. Alibaba dominates China, claiming 15% of the world's population as customers. But China's political risks can affect companies, making Alibaba a minefield for investors to navigate.

Over the past year, the company's share price has fallen by almost 40%. Is Alibaba worth buying on the decline? Here are three key things to consider before making a decision.

First, Alibaba stock has been expensive for years.

Past share price movements can make investors think the stock is expensive or cheap. In other words, "the stock is down 30% this year, so now must be a good time to buy." It can easily be false because there are many reasons why the stock price can fluctuate.

Let's compare Alibaba to Amazon. Amazon stock has been trading at a price to sales (P/S) ratio in the low to mid numbers since the dot-com bubble burst almost 20 years ago.

Alibaba began trading on U.S. exchanges in late 2014, and in early 2015 the P/S ratio was over 24. Can you make an argument that Alibaba deserves a premium over Amazon? Sure, over the past five years, its revenues have grown at an average annual rate of 48% compared to Amazon's 29%.

But one can hardly justify a valuation that is many times higher than Amazon's. If you track Alibaba's P/S ratio since 2015, you'll see that it's steadily declining. The fall in Alibaba stock is not just a fluke that should cause investors to rush to buy; stock valuations have had a multi-year downward trend because the stock has been overvalued.

Second, political pressure makes valuation difficult.

Alibaba has been embroiled in political turmoil over the past year. Alibaba founder Jack Ma has criticized China's banking laws; he has made controversial comments about China's largely state-controlled financial system, saying it lacks innovation and has an outdated risk mentality. These comments came shortly before Ant Group, another Ma-founded company that owns China's largest digital payment platform (Alipay), was due to go public. Alibaba owns one-third of that company.

Chinese regulators blocked Ant Group's planned initial public offering, citing potential risks to China's financial system, and the company may now be forced to abandon its Alipay platform and transfer user data to an entity partly owned by the Chinese state. Curiously, Ma hasn't been in the public spotlight for months after blocking Ant Group's IPO.

Investors should understand that the Chinese government is actively involved in business and has the right to interfere in companies.

In addition, China is putting pressure on China's big tech companies with its "shared prosperity" program, which aims to address economic inequality by redistributing wealth across the country. Chinese President Xi Jinping has emphasized the need to raise incomes for the poor and middle class while "regulating" excessive wealth.

China's largest companies, including Alibaba, have pledged to support this effort. In Alibaba's case, the company will commit 100 billion yuan by 2025, the equivalent of $15.5 billion. Alibaba's profits for the entire fiscal year 2021 were $21.8 billion, so such an amount might make investors think this move is too significant to be purely voluntary.

Such politically sensitive events create problems for investors. It is difficult to predict when and to what extent a Chinese company might run afoul of the ruling state. Events that have already occurred also make it difficult to trust what will be said in the future.

Third, one has to figure out what the potential for growth is.

Finally, investors need to consider the potential upside if things work out well in the long run. Alibaba already has a market value of $435 billion. Amazon has a market capitalization of $1.7 trillion, but its revenues are about four times that. Judging by their current P/S ratio, they are fairly equal in valuation.

Alibaba will need organic growth to raise its share price, as it is difficult to justify a positive valuation compared to Amazon in light of all the political noise. Analysts expect Alibaba's revenues to grow 20% in 2022, so it could take years for the stock price to rise significantly if political issues persist.

Meanwhile, the stock market is a vast ocean of strong and emerging companies. Perhaps Alibaba will be able to remove political issues. Perhaps, the stock can regain its premium valuation after a multi-year downtrend. Perhaps Alibaba will continue to grow fast enough to deliver high returns to investors.

But it's far from certain that a company with a $435 billion capitalization has enough growth potential to justify all these "options." Investors are better off looking at smaller, faster-growing companies that don't carry Alibaba's political baggage.

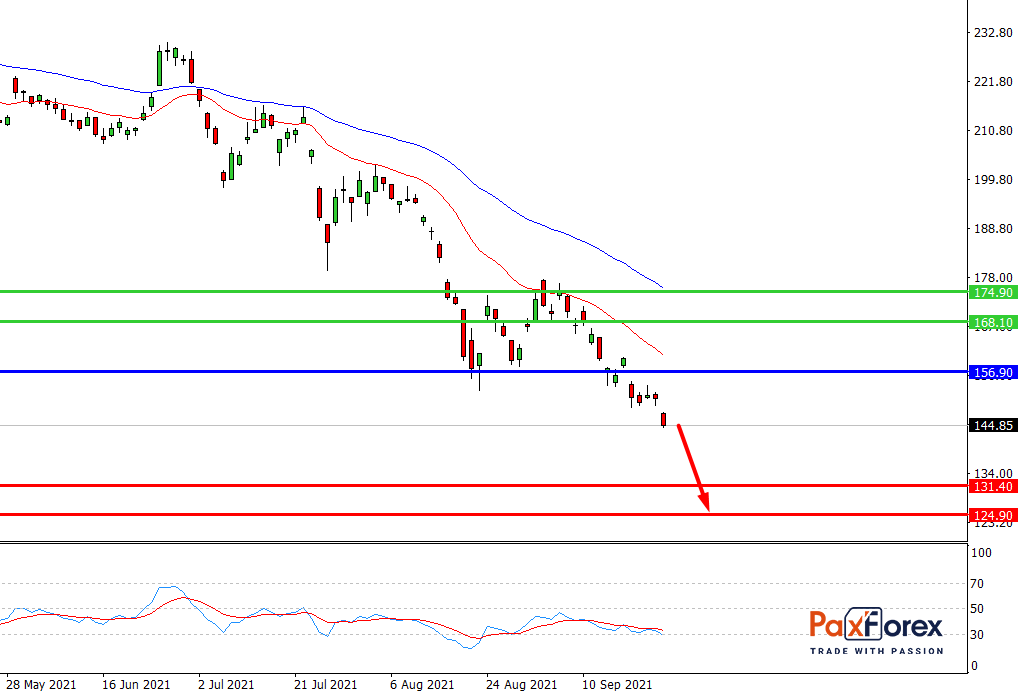

As long as the price is below 156.90, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 144.85

- Take Profit 1: 131.40

- Take Profit 2: 124.90

Alternative scenario:

If the level of 156.90 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 156.90

- Take Profit 1: 168.10

- Take Profit 2: 174.90