Source: PaxForex Premium Analytics Portal, Fundamental Insight

The annual shopping event of Singles Day from Alibaba had high expectations, and the company did not disappoint with its sales of about 74 billion U.S. dollars. It is almost twice as much as last year's 38.4 billion dollars. But the threat of increased regulatory control has burdened Alibaba shares, and this week's shares fell by 10%. The company is 15 percent off its recent high, and the stock looks like it's on sale, but does that make buying BABA shares right now profitable?

Investors began shorting Alibaba shares on November 3 after a $34.5 billion IPO of Ant Group in Shanghai, and Hong Kong was suspended. Ant Group is a high-tech division of Alibaba.

Another wave of short positions fell on November 5 after the company reported earnings and did not reach the analysts' estimates. But buyers were able to raise Alibaba shares from a minimum by closing.

But BABA stocks fell 8% on November 10 after Chinese regulators announced a new draft antitrust rules for Chinese online platforms such as Alibaba and JD.com in particular.

When it comes to liquid stocks of mega capital in China, it is difficult to find a more attractive asset than Alibaba. Since the IPO in September 2014, the company's shares have shown impressive results worthy of admiration.

In June, Alibaba reported record sales at the trade festival 618 in China. Sales on the trading platform of the e-commerce giant were 98.52 billion dollars. Being known as the 618 because it happens every year on June 18, Alibaba's strong sales showed that the Chinese consumer is active and healthy.

The company was able to remain in growth mode despite the slowdown in its core e-commerce business.

Alibaba`s business in China is very similar to the American Amazon. In the field of cloud computing, Alibaba shows strong growth, as well as a thriving business of Amazon web services.

Alibaba also profits from food delivery. In 2018, it combined its Ele.me food delivery service with its stylish Koubei app to better compete with Tencent owned Meituan.

Sales in Alibaba's digital media and entertainment division are also growing. This division includes the Alibaba Youku video streaming platform as well as the Xiami music streaming service.

Alibaba also has a licensing agreement with Walt Disney`s Buena Vista International, which gives it access to a large amount of Disney content.

And just like Amazon, Alibaba sees the potential in the sports streaming market. In 2018, the company collaborated with China Central Television and broadcast all matches of the 2018 FIFA World Cup. According to the company, the World Cup, as well as continued investment in original content, contributed to the average daily growth of Youku subscribers by 200%.

Alibaba's rating is underpinned by strong revenues and sales growth in recent quarters, as well as excellent 12-month prices.

Given the company's incredible market capital, Alibaba continues to show strong growth. But profit and sales growth slowed down sharply in May due to the coronavirus outbreak. Adjusted earnings increased 2% year on year to $1.30 per share. But this was well above the consensus estimate of 85 cents. Revenue rose 16% to just over $16.14 billion, also exceeding expectations of $15.1 billion.

The company reported a 15% increase in quarterly profits on August 20. Sales increased by 30% to $21.76 billion.

Alibaba distributes its revenues into four segments: core trading, cloud computing, digital media, and entertainment and innovation initiatives. Core commerce revenue jumped 34 percent to $18.9 billion. Cloud computing revenue increased 59 percent to $1.75 billion, the lion's share of total revenue.

Monthly active mobile device users totaled 874 million, 15.8 percent more than in the same period last year, and 3.3 percent more than in the previous quarter. An annual ROE of 21 percent and an ROE of 31.3 percent pre-tax help the company to top the SMR rankings (sales + margin + ROE).

For the current fiscal year 2021, earnings per share are expected to grow by 34 percent, with 22 percent growth also seen in fiscal 2022.

After strong volume growth for Alibaba shares at the end of November, the stock market crash as a result of coronavirus attracted even more adherents of selling these shares. But the leading Chinese company soared out of the 24-week consolidation in July and remains a strong player in the market.

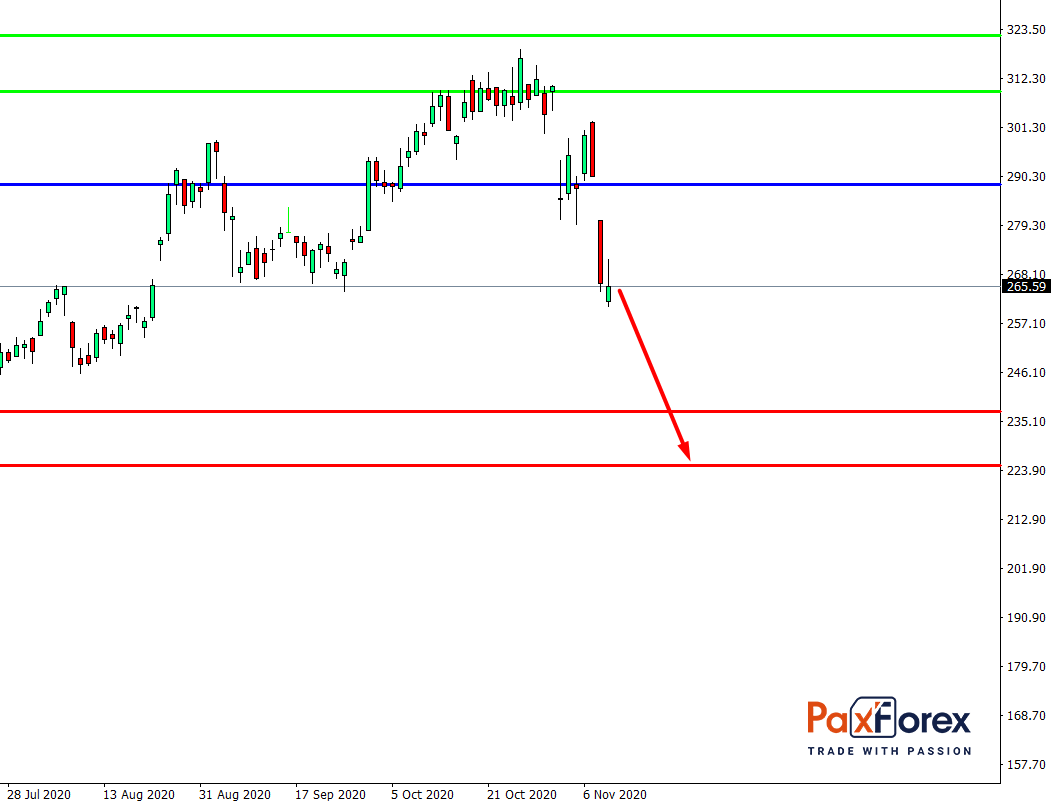

While the price is below 288.50, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 265.65

- Take Profit 1: 237.20

- Take Profit 2: 225.20

Alternative scenario:

If the level 288.50 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 288.50

- Take Profit 1: 309.40

- Take Profit 2: 322.20