Source: PaxForex Premium Analytics Portal, Fundamental Insight

There is no denying the fact that 3M stock has been under significant pressure lately. Yes, the stock still looks undervalued over the long term, but that depends on management meeting its turnover goals.

The good news is that the company has a strong enough financial foundation to do so and is actively pursuing change. The bad news is the following: There isn't enough serious indication that the restructuring is having a meaningful influence, and the forthcoming first-quarter earnings report, due out April 27, may be even more confusing than clarifying the situation.

The investment argument for the stock is based not on the company that 3M is now, but on what it might become. Simply put, CEO Mike Roman's challenge is to use the company's substantial earnings and free cash flow (FCF) to turn around 3M's results.

The company generates a large amount of earnings before interest, depreciation, amortization (EBITDA), and FCF. Its price-to-FCF ratio looks low, particularly if opposed to a multi-industry company like Illinois Tool Works, which trades at nearly 28 times its FCF.

The reason 3M is underperforming Illinois Tool Works comes down to a combination of its potential legal liability for PFAS chemicals and its poor earnings performance compared to management expectations.

3M operates in four segments. The safety and industrial segment, as well as the transportation and electronics segment, are heavily influenced by the industrial economy and the auto industry. And given the weak end-market environment of recent years, it is understandable that they have not performed well. What is not forgivable, however, is that the less cyclical segments, namely the health care and consumer sectors, disappointed the most.

For instance, back in late 2018, then-CFO Nick Gangestad outlined expectations for 2019-2023 that overall organic revenue growth for the company would be 3% to 5% per year, 4% to 6% in the healthcare segment, and 2% to 4% in the consumer segment.

While the 2020 results are understandable in the context of a pandemic, the 2018-2019 results are disappointing. In case you were wondering, the consumer segment got a big boost in 2020 from measures to boost home improvement sales.

However, there are bright spots as well: Roman is taking action, particularly in the health care segment. The non-core drug delivery business was sold for $650 million in 2020. As for acquisitions, in early 2019. 3M acquired the M*Modal health information systems business for $1 billion. In late 2019, management bought Acelity (specializing in advanced and surgical wound care) for $6.7 billion. Also, the food safety business is rumored to be another business that management is willing to sell.

In addition to acquisition and divestiture activity, Roman has restructured the company from five business segments into four and streamlined operations by downsizing positions. He also changed the company's business model, allowing 3M's business groups to operate globally rather than on a country basis.

In case there was any doubt that changes in the healthcare segment were not the main focus, it is no coincidence that former GE Healthcare CFO Monish Patolawala was named CFO of 3M in July 2020.

With all this action, investors have a right to expect improvements that will begin to show in 2021, starting with the company's upcoming first-quarter earnings report on April 27.

Unluckily, the business encountered problems in the first quarter, and they are likely to make the earnings report rather mixed. For example, automotive manufacturing (the main end market for 3M in its industrial segments) suffered from semiconductor shortages, and rising raw material costs are leading to lower profits, according to Patolawala. Meanwhile, the medical sector is likely to suffer a pandemic in the first quarter.

On the other hand, the U.S. industrial economy is recovering, and many of 3M's end markets will strengthen. Also, since management has said that its customers are not building up their inventories, it could happen at some point in 2021 as the economy recovers.

It is still unclear exactly what 3M will report, and the market may be disappointed if the company doesn't raise the bar at a time when many competitors may pull ahead. Nevertheless, 3M's earnings report will not be clear, and if you are looking for convincing evidence of a turnaround in the numbers, you are unlikely to find it in the upcoming results.

There are good reasons to buy the stock, but management needs to start delivering in 2021, especially in the medical segment.

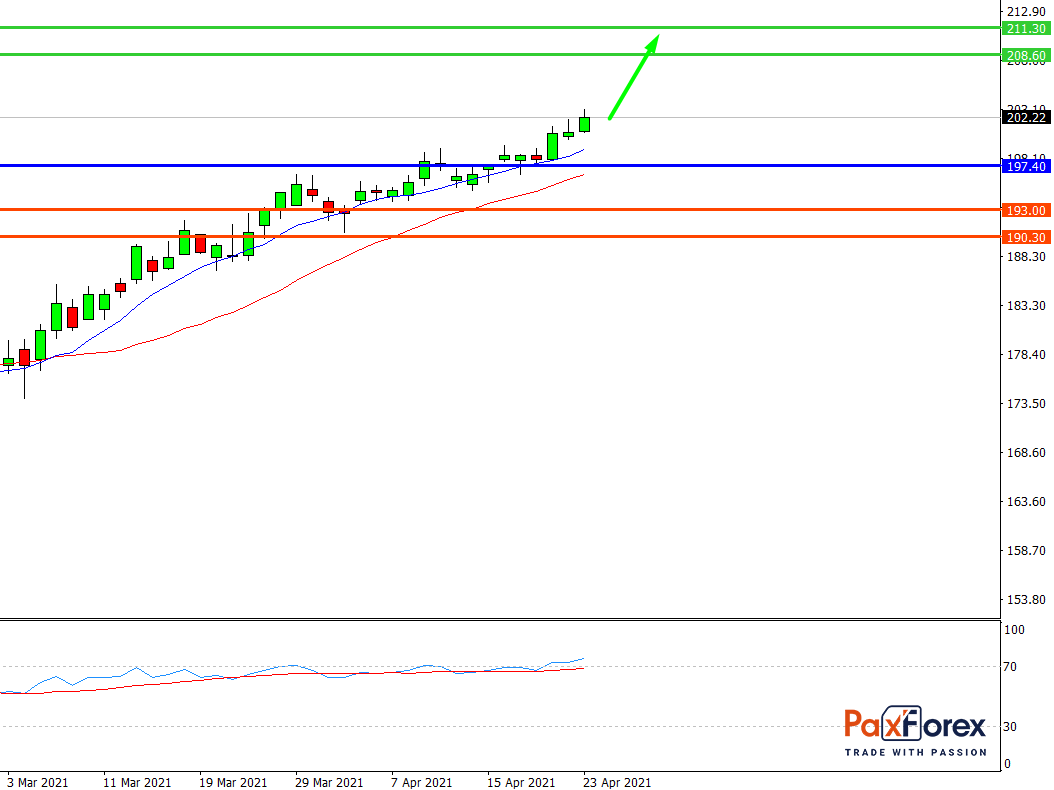

While the price is above 197.40, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 202.20

- Take Profit 1: 208.60

- Take Profit 2: 211.30

Alternative scenario:

If the level 197.40 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 197.40

- Take Profit 1: 193.00

- Take Profit 2: 190.30