Source: PaxForex Premium Analytics Portal, Fundamental Insight

With markets demonstrating strong growth since April 2020, it is pretty tempting to assume that the economic recovery has already been turned around in stock prices. Following this argument means that with any disappointment in the economy, there is a risk of declining stock prices. It may well be the case for most of the market, but not all companies have been created equal. In the case of 3M, the stock still looks like a fairly attractive asset, and there is potential for improved sales and earnings in 2021. And here's why.

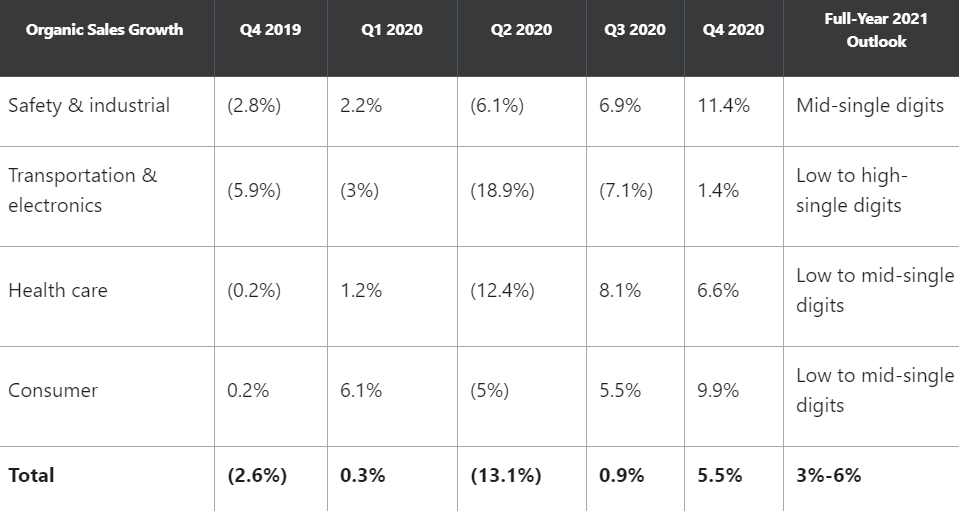

As you might guess, 3M's sales growth is driven by demand for respirator masks (safety and industrial segment) and respirators (healthcare segment), but other, more economically aligned businesses in those segments have yet to recover.

Also, the consumer segment is benefiting from measures to increase demand for grooming and home improvement products, but sales of office supplies and office products remain weak.

Finally, the transportation and electronics segment returned to growth in the fourth quarter, but there is great uncertainty about the outlook for the auto and electronics industry in 2021. It is largely reflected in the broad range of forecasts for 2021 in the table below:

Clearly, 3M's goal over the next few years is to make a subtle transition from COVID-19-related revenues to more profitable ones. As the pandemic slowly subsides, growth in sales of masks, respirators, and home products should slow, but 3M should see improvement in its more cyclically oriented sales. These include industrial abrasives, electrical materials, automotive parts, advanced materials, and non-COVID-19 medical products.

The potential for growth for the company is great, as 3M's cyclical sales have not yet fully recovered. In other words, there should be room for growth as automotive production improves, manufacturing plants open, and non-COVID procedures take place. The table below helps outline the main points:

The company's investment rationale is based on three ideas:

First, 3M is a clear winner if the pandemic continues, as masks, respirators, and sales related to quarantine restrictions will remain strong. Besides, the company has the potential to succeed if the economy begins to recover due to pandemic subsidies. The latter point is underlined by the fact that there is still a lot of uncertainty in management's outlook.

Second, 3M management has been actively restructuring for growth, and these internal initiatives are expected to improve future performance.

Third, the decline in stock price is limited due to its attractive valuation. At an adjusted free cash flow (FCF) of $6.7 billion, the stock trades at an attractive valuation. In 2020, the stock trades at only 15 times the current FCF. In other words, the company generates 6.7% of its market capitalization in FCF. In theory, it could pay a dividend yield of 6.7% of its annual FCF and still be able to grow the business.

Overall, the stock trades at a favorable valuation, the dividend yield is 3.3%, and production-related sales have growth potential if the economy improves.

That being said, we can say that 3M is not one of those stocks that are highly valued in the hope of an economic recovery in 2021. Therefore, they still represent an attractive and excellent value opportunity for investors.

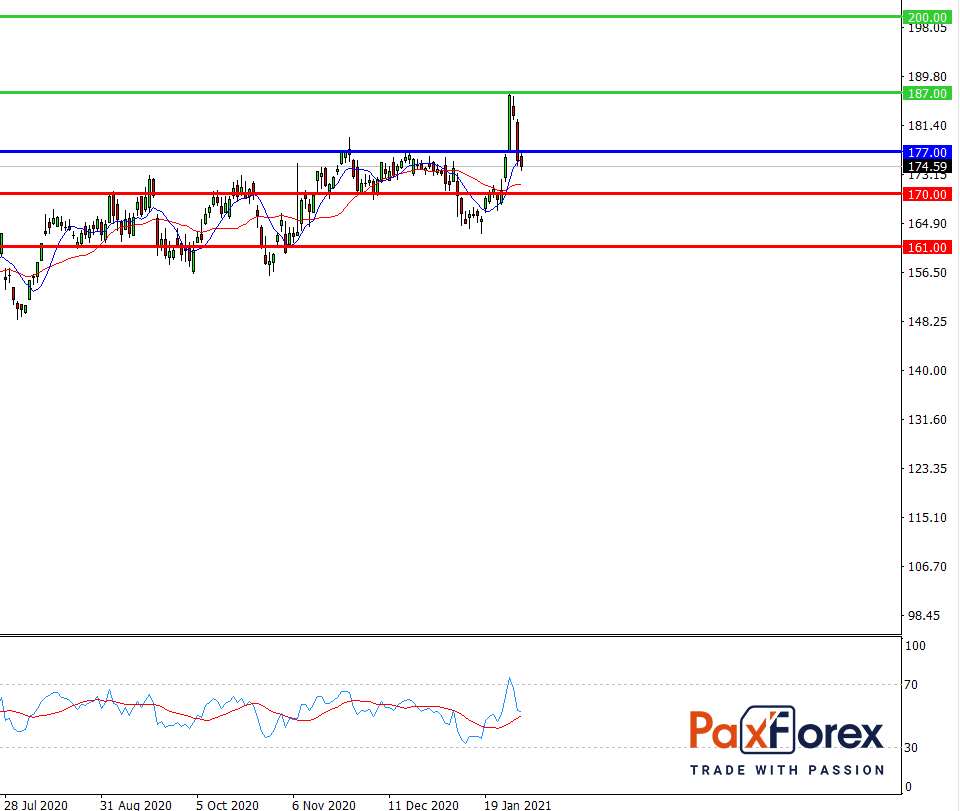

Provided that the price is below 177.00, follow these recommendations:

- Time frame: D1

- Recommendation: short position

- Entry point: 174.00

- Take Profit 1: 170.00

- Take Profit 2: 161.00

Alternative scenario:

In case of breakout of the level 177.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 177.00

- Take Profit 1: 187.00

- Take Profit 2: 200.00