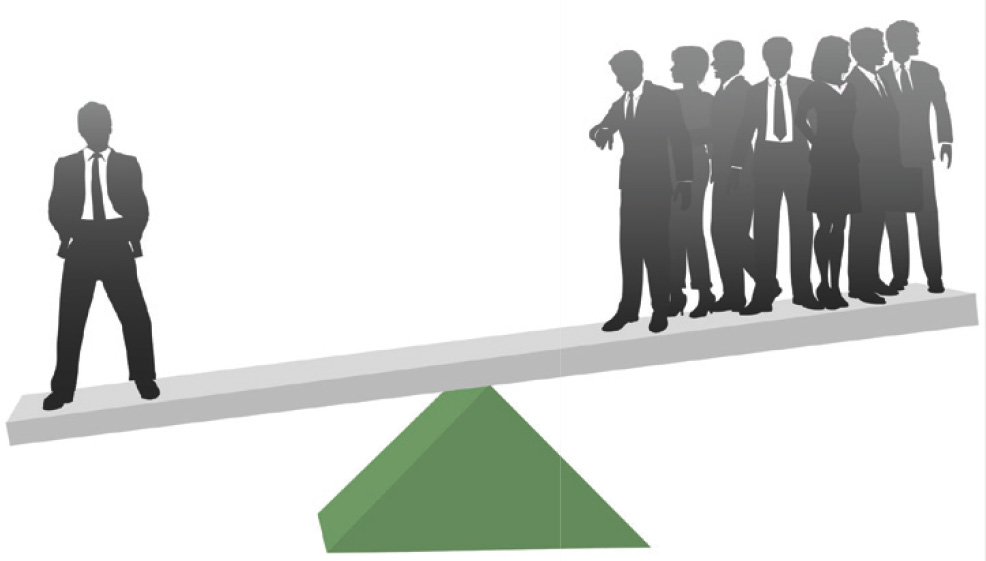

Forex trading by retail investors has grown by leaps and bounds in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit. Leverage is the ability to use something small to control something big. Specific to forex trading, it means you can have a small amount of capital in your account controlling a larger amount in the market. Leverage in general terms simply means borrowed funds. In the forex market leveraged trading exists to create the possibility of making a bigger profit. Leverage is...

The concept of overtrading indicates the situation in which you open too many positions with respect to the investment capital available, because you feel the need to always be in the market. It is a compulsive behavior that goes against every type of strategy. The overconfidence is certainly a big danger for a trader and it is an emotional state difficult to manage. Therefore, the consequences of a series of winnings can be more severe than those resulting from a series of losses. Forex traders have to not only compete with other traders in...

Please note that on Sunday, 25th of October 2015, Daylight Saving Time will end in Europe, with the opening and closing times of specific markets being affected until the ending of Daylight Saving Time in US on Sunday, 1st of November 2015. Please note the below trading times of the affected financial instruments between 26/10/2015 – 30/10/2015: FOREX: Normal Market Opening at 00:00 (25/10/2015 and 1/11/2015) Early Closing at 23:00 (30/10/2015) CFDs on Precious Metals: GOLD, SILVER, Opening time will be 00:00 and closing time 23:00

Oil is the most traded commodity in the world and for speculative traders oil trading represents a potentially attractive combination of a large market and an actively changing price. At the same time, traders can be assured that they will find both buyers and sellers for the different types of crude oil on the market, and that there will typically be enough activity for them to develop profitable trading opportunities. The fact that oil is a vital component of all developed economies, make the market similar to that of the foreign exchange...

Trading the forex market is inherently risky and brings with it the possibility of losing money anytime you enter a trade. Despite the fact that most traders are fully aware of, it’s a curious notion that many traders seem to ignore money management all together, or pay very little attention to it. Anyone serious about trading would do well to incorporate money management techniques to their trading to protect their portfolio. It’s often said that what sets successful traders apart from those who fail over the long term is their money...