Oil is the most traded commodity in the world and for speculative traders oil trading represents a potentially attractive combination of a large market and an actively changing price. At the same time, traders can be assured that they will find both buyers and sellers for the different types of crude oil on the market, and that there will typically be enough activity for them to develop profitable trading opportunities. The fact that oil is a vital component of all developed economies, make the market similar to that of the foreign exchange where different currencies are a vital part of international trade.

According to the oil producer and the composition of the crude oil, it may be suitable for different purposes and therefore attract different prices on the market. “East Sour Crude” from Middle East countries, “WTI Crude” from Texas and “Brent” from the oilfield of the same name in the North Sea are all examples of different types of oil, serving different markets. Oil trading contracts are typically quoted against the US dollar. They can be analyzed and traded in similar ways to trading currencies. The same technical indicators and techniques of leverage also apply.

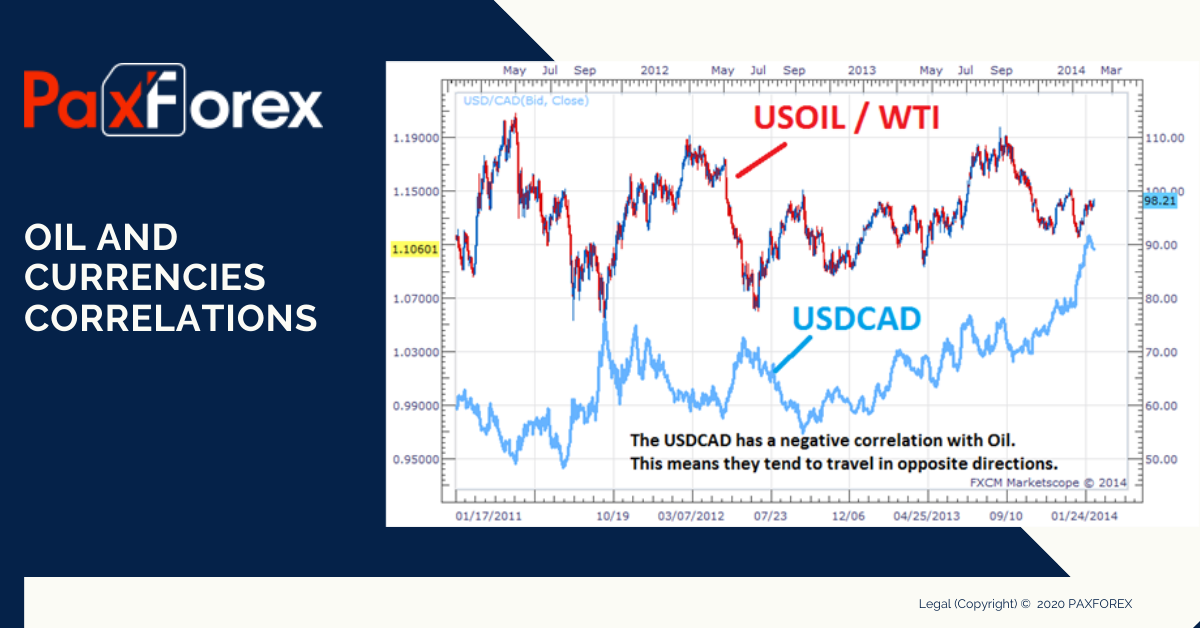

When trading Oil, currency traders should immediately think of the USDCAD as a correlating currency pair. These assets are negatively correlated meaning they generally can be seen moving in opposing directions. This occurs because the USDCAD quotes the price of Canadian Dollars in terms of US Dollars. US Oil represents Oil per barrel priced in terms of US Dollars. With the USD being on opposing sides of each equation this means that the two assets will move in opposing directions when the USD strengthens or weakens. Secondly, the CAD has a high correlation to Oil due to Canada’s extensive oil deposits.

Canada is a major exporter of oil, and thus its economy is affected by the price of oil and the amount it can export. Japan is a major importer of oil, and thus the price of oil and the amount it must import affects the Japanese economy. Because of the major effect oil has on Canada and Japan, the CAD/JPY positively correlates with oil prices. This pair can be monitored as well as the USD/CAD. The downside is that the CAD/JPY generally has a higher spread and is less liquid than the USD/CAD.

It is also crucial to point out that just because a relationships exists "on average" over time, does not mean that strong correlations exists at all times. While these currency pairs are worth watching for their high correlation tendencies towards a commodity, there will be times when the strong correlation does not exist and may even reverse for some time. The key to trading positively or negatively correlated assets is finding a direction or having a fundamental opinion from one of the underlying assets before making a trading decision.