Forex trading by retail investors has grown by leaps and bounds in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit. Leverage is the ability to use something small to control something big. Specific to forex trading, it means you can have a small amount of capital in your account controlling a larger amount in the market. Leverage in general terms simply means borrowed funds.

Forex trading by retail investors has grown by leaps and bounds in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit. Leverage is the ability to use something small to control something big. Specific to forex trading, it means you can have a small amount of capital in your account controlling a larger amount in the market. Leverage in general terms simply means borrowed funds.

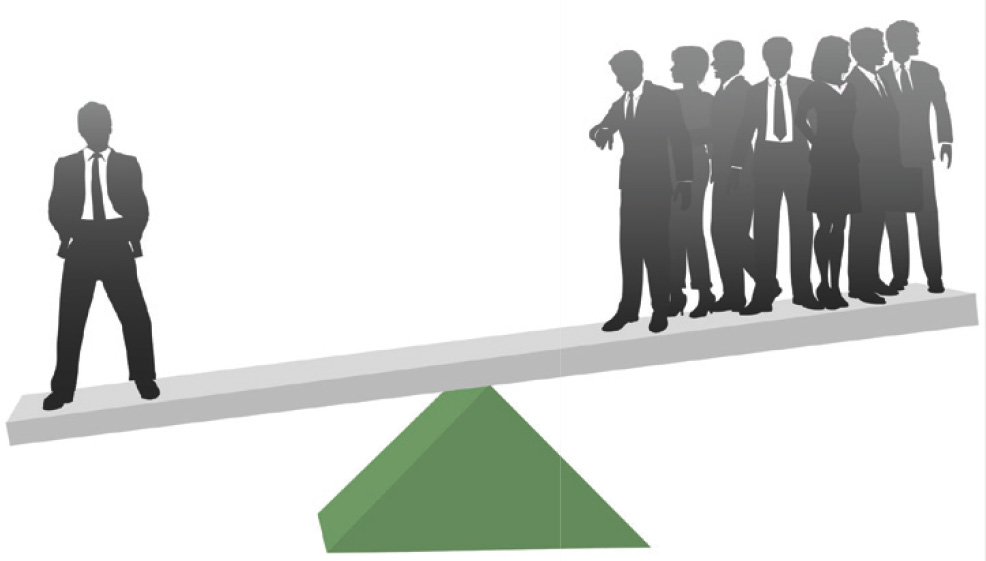

In the forex market leveraged trading exists to create the possibility of making a bigger profit. Leverage is necessary because forex traders involve very small differences in price. The difference can be a very small part of one cent. With such small amounts it can take a long time to make a meaningful profit, as well as bigger initial investments. Using leverage you can get a return on your investment faster and using smaller initial deposits.

For example, if you have 1:100 leverage in the forex market you can control $100,000 with as little as $1,000 of your own money. That means you only have to pay for 1 percent of the position with your own money. You can borrow the remaining 99 percent of the purchase price from your forex broker. However, this doesn’t mean that your profits are going to get increased just because of the leverage offer. It can go both ways depending on your trading strategy.

The leverage you enjoy in the forex market is determined by what your broker is able to offer you and your own preference. When you trade with leverage you need to always be aware of margin requirements. Margin is the money you set aside with your forex broker for safe keeping to prove that you are able to cover your losses. Different currency pairs have different margin requirements.

Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. For example, if the currency underlying one of your trades move in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid such a catastrophe, forex traders usually implement a strict trading style that includes the use of stop loss and limit orders.