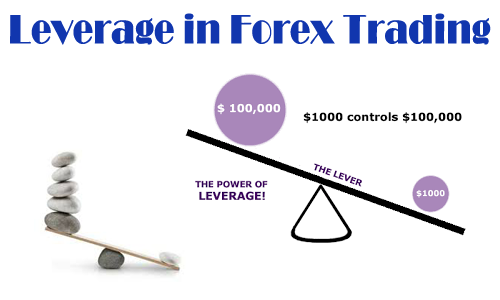

Financial leverage attracts a lot of traders to the forex market. Financial leverage allows traders to place orders that are significantly higher than their actual deposit - it can be viewed as credit provided by a broker. This tool allows forex traders to trade much more than they actually have and potentially achieve higher profits in the market. Of course the same applies for losses - a trader risks losing his deposit much faster when using leverage. The biggest advantage of forex trading using financial leverage is the ability to...

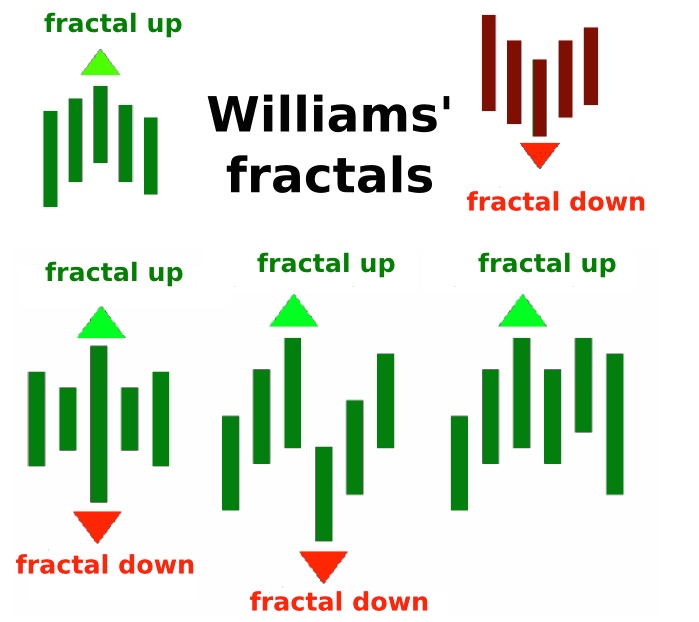

One of the most basic ways in which traders can determine the trends in forex market is through the use of fractals. Many people believe that the markets are random. However, many others argue that although prices may appear to be random, they do in fact follow a pattern in the form of trends. Fractals essentially break down larger trends into extremely simple and predictable reversal patterns. When many people think of fractals in the mathematical sense, they think of chaos theory and abstract mathematics....

Uses of Equity Equity and free Margin Margin to Equity Ratio In forex trading the concept of equity refers to the total value of a trader’s account when any open positions have been factored into the equation. When the trader has active positions in the market (i.e. when the trader has open trades), the equity on the forex account is simply the sum of the margin put up for the trade from the forex account plus the free or usable margin , which is called equity. When there are no active trade positions, the equity is the same as...

The foreign exchange market is a leading international market with a daily execution turnover of more than $5.3 trillion. If you are interested in participating in the world on online trading but aren’t sure where to start, this huge, decentralized market is the ideal investment to start with. The forex market possesses endless benefits over other markets such as the stocks, futures or commodities. Online forex trading offers many unique advantages compared to trading other financial instruments. Over the course of many years, a large...

Those who are new to trading may not be familiar with the term drawdown which is most commonly used to refer to the high-to-low decline experienced by a trader or fund over a specified time period. Drawdown is the difference between the balance of your account, and net balance of your account. The net balance takes into account open trades that are currency in profit, or currently in loss. If you account net balance is lower than your account balance, this is called drawdown. Drawdown in forex is the difference between the account...