One of the most basic ways in which traders can determine the trends in forex market is through the use of fractals. Many people believe that the markets are random. However, many others argue that although prices may appear to be random, they do in fact follow a pattern in the form of trends. Fractals essentially break down larger trends into extremely simple and predictable reversal patterns.

One of the most basic ways in which traders can determine the trends in forex market is through the use of fractals. Many people believe that the markets are random. However, many others argue that although prices may appear to be random, they do in fact follow a pattern in the form of trends. Fractals essentially break down larger trends into extremely simple and predictable reversal patterns.

When many people think of fractals in the mathematical sense, they think of chaos theory and abstract mathematics. While these concepts do apply to the market (it being a nonlinear, dynamic system), most traders refer to fractals in a more literal sense. That is, as recurring patterns that can predict reversals among larger, more chaotic price movements.

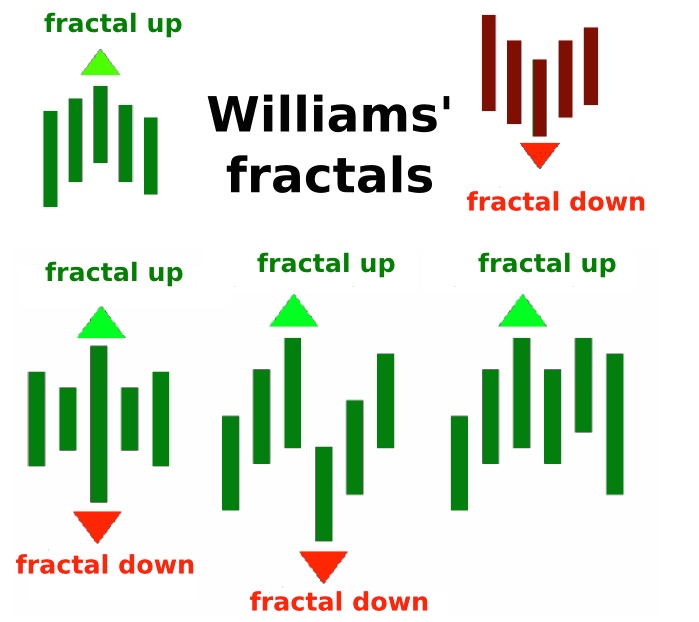

Fractals are tools of technical analysis developed by successful trader B.Williams. Unlike other forex indicators, they are drawn as simple arrows in currency chart, pointing at the top/bottom of five candles formation. Fundamentally, however, they break down very complex and chaotic structure of price movement into smaller waves. As such, they can help us to find some order and structure in forex market.

The word “fractal” was introduced by Benoit Mandelbrot in 1975. This word came from the word “fractus” which means broken or un-patterned. Fractal is top or bottom pint where the price is about to turn back. It is a simple and usable indicator. In forex trading fractal indicator helps traders to identify highest the price points and the lowest price points by drawing a trend line.

In order for a fractal to form, there should be a series of five consecutive bars where the middle bar will be the highest preceded and followed by two lower neighboring bars on each side. A Buy fractal forms at the top of the price wave with the Highest High in the middle and two Lower highs on each side. A Sell fractal forms at the bottom of the price wave with the Lowest Low in the middle and two Higher Lows on each side.

Since fractals highlight points at which price failed to hold and therefore reversed, it is logical that once price beats its old fractal, there is a new strength coming. Setting a trade at the breakout point is an obvious and simplest application of the fractals indicator. Another way to describe it: fractals help to see the levels of Support and Resistance.

How do fractals help with forex trading?

Fractals predict reversals in current trends. When viewed as a set of price bars on a chart, the most basic fractal pattern contains five bars or candlesticks with these characteristics:

1. When the lowest bar is positioned at the middle of a pattern, and two bars that have successively higher lows are located on each side of it, this signals the change from a downward trend to an upward trend;

2. When the highest bar is positioned at the middle of a pattern, and two bars that have successively lower highs are located on each side of it, this signals the change from an upward trend to a downward trend;

Stated differently, when the forex fractal pattern shows the highest high at the center, and there are 2 lower highs positioned at each side, it signals a bearish turning point. And, when the pattern has the lowest low at the center, and there are 2 higher lows positioned at each side, it signals a bullish turning point.

Things to Consider:

- They are lagging indicators. They are best used as confirmation indicators to help confirm that a reversal did take place.

- The longer the time period (i.e. the number of bars required for a fractal), the more reliable the reversal.

- It is best to plot fractals in multiple time frames and use them in conjunction with one another.

- Along these same lines, long-term fractals are more reliable than short-term fractals.

- Always use fractals in conjunction with other indicators or systems. They work best as decision support tools, not as indicators on their own.

Fractal Alligator indicators

The “Alligator indicator” is a moving average tool that relies on fractal geometry and SMMAs. This indicator with a fancy name was introduced by senior trader Bill Williams around 1995, and it’s commonly available in MetaTrader software. If you’re using MetaTrader, you should be able to easily add this fractal indicator by clicking on the menu tabs “Insert,” then “Indicators,” “Bill Williams,” and “Fractals.” Alligator indicator lines confirm the direction and presence of a trend. Specifically, the Alligator indicator consists of three smoothed moving averages.

The Alligator fractal indicator shows trends in the following way: When the price is trading above the mouth of the Alligator, i.e. the green balance line is over the red line which is over the blue line, and all three are aligned and pointing upward, yet still below the price line, this indicator signals a clear uptrend. Conversely, when the price moves below the Alligator’s mouth, and the blue line is over the red line which is over the green one, and all three of the balance lines are above the price line, then the indicator signals a downtrend.

In order to double-check the signals generated from fractal indicators, you can use other indicators such as the CCI oscillator to confirm fractal signals before trading. And, as with any type of trading method, use appropriate risk management measures to ensure that draw-downs are reasonable. Fractals can be plotted in multiple time frames and used to confirm each other. One simple rule is to only trade short-term fractal signals in the direction of long-term fractal signals, since long-term fractals are the most reliable. Use another indicator for safety such as the CCI oscillator to confirm the signal.

As you can see, fractals can be extremely powerful tools when used in conjunction with other indicators and techniques, especially when used to confirm reversals. The most common usage is with the "Alligator indicator"; however, there are other uses too, as we've seen here. Overall, fractals make excellent decision support tools for any trading method.