Those who are new to trading may not be familiar with the term drawdown which is most commonly used to refer to the high-to-low decline experienced by a trader or fund over a specified time period. Drawdown is the difference between the balance of your account, and net balance of your account. The net balance takes into account open trades that are currency in profit, or currently in loss. If you account net balance is lower than your account balance, this is called drawdown.

Drawdown in forex is the difference between the account balance and the equity or is referred to as the peak to trough difference in equity. As one might know, the equity balance changes based on the open position’s profit/loss. When the equity balance drops below the account balance (i.e. when your equity is losing more than your balance) it is referred to as a drawdown. Drawdown measures the largest loss an account takes, therefore traders and investors should both pay attention to drawdown as it gives an overview on the loss taken by the account.

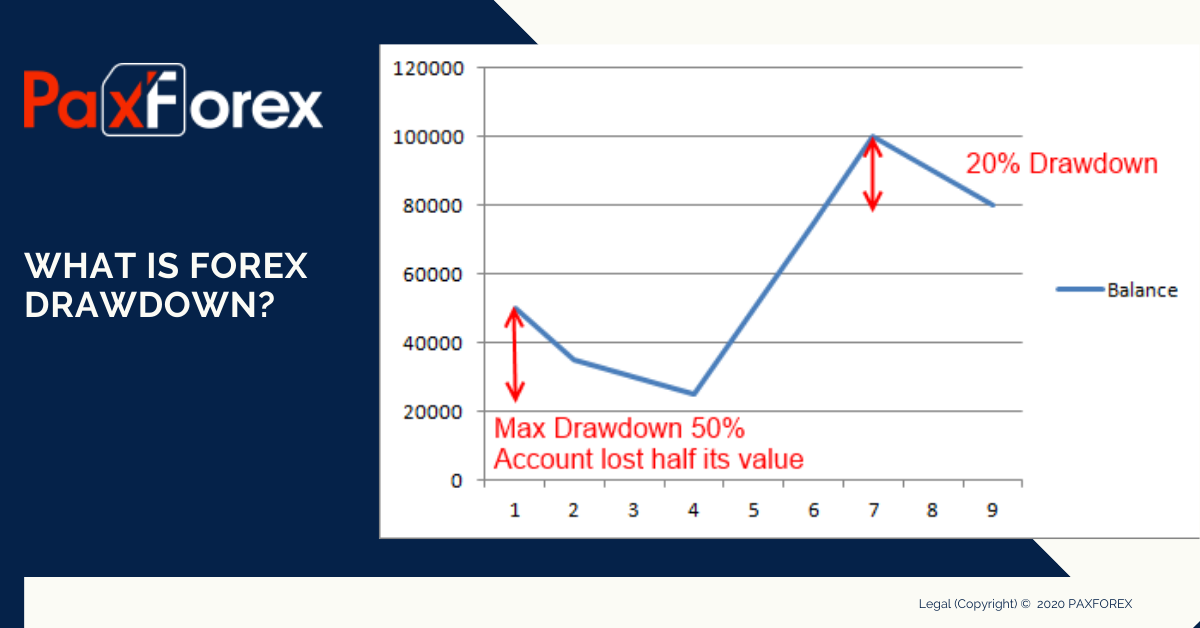

So to define it clearly, a drawdown is the depletion of a trader’s capital after a series of losing trades in the forex market. Usually, the drawdown is normally worked out by getting the value of the difference between a relative peak in equity capital minus a relative trough, or simply put, the value of the difference between the highest point the account has got to, and the lowest point the trading account has been depleted to. Traders normally express this figure as a percentage of their trading account.

This is something a new trader may not want to hear, but an important psychological part of forex trading is to understand that unless a trader has a big enough account to weather adverse market moves, the capital in one’s account should be considered risk capital. Forex is not the same as other investments since traders, depending on one’s leverage options, can and should be ready to lose all the capital in his or her account. Of course, in reality a trading plan is designed to do just the opposite, not to lose money. When beginning a trading plan, another step for a trader is to determine the psychological level of drawdown on the account that one is willing to tolerate.

Why is forex drawdown important?

Many people use historic drawdown to help determine an investments risk. Funds or traders which have gone through periods of significant drawdown are seen to be significantly more risky. It is very likely that funds or traders will go through periods of poor performance, even a system is which is profitable 80% of the time could feasibly experience an extended losing streak. Limited historic drawdown suggests that a trader has been effectively managing risk, risking only a limited amount of their total equity each time they open a position. When it comes to Forex, all social trading networks will quote a signal traders historic drawdown to help users determine the riskiness of a signal provider or trader.

As traders, we take risks each and every day through each of our trades. Whether you acknowledge the existence of those risks or not, they are there. Newer traders generally take the view of the market from the perspective of how much they have to gain in a particular trade or perhaps they expect to double their account in a month without an understanding of the risks it takes to perform at those levels. Experienced traders know that losses and drawdowns are a part of trading. Therefore, experienced traders will look for performance measures to gauge their strategy’s signal and exposure efficiency. Essentially, experienced traders want to know whether their strategy is efficiently entering and exiting out of the market.

Drawdown can help traders to identify if a trading system or method is profitable in relation to the risks associated with it. As a trader, drawdown therefore can tell you if you need to change the default contract sizes or if you have to completely overhaul your trading strategy. Drawdowns keep changing if a new peak or a trough is hit and therefore is not a constant but a variable that keeps changing throughout the lifespan of a trading system or a fund. It is for this reason; one commonly gets to hear the phrase that past performance is not indicative of future results. As a general thumb rule, the lower the risk per trade the lower the drawdown will be but at the cost that growth or profit increases at a very slow pace.

Drawdown risk considerations:

- maximum historical drawdown depth

- maximum historical drawdown depth

- maximum stop loss

- maximum take profit

- number of consecutive losses.

You can be sure that the maximum historical drawdown will occur on your account at some point. It may come sooner or later, but it will surely come. While drawdown can be useful in determining risk, it has some limitations. First off historic drawdown provides no indication of future risk and is simply a measure of past performance. While a trader may have a very low historic drawdown, there is no guarantee that they won’t blow their entire account the next day. Drawdown has a limited use when trying to evaluate the risk of a new fund or trader, as there may not be enough data to give an adequate picture of the riskiness of an investment proposition.

Drawdown is useful in helping an individual determine the risk involved with a particular investment proposition or as a performance indicator. Though individuals must realise that as a historic measure, there is no guarantee that past performance will continue into the future. Even so paying attention to drawdown can help you get a handle on the kind of risks a trader or fund has taken in the past.