A common dilemma for forex traders is whether to adopt a manual or algorithmic trading strategy that produces profitable outcomes over the long-term. But this question requires an individual to really understand their own capabilities when it comes to making decisions in high-pressure trades; and to recognize how technology can help overcome limiting psychological habits. All forex traders are susceptible to human tendencies that can affect judgment. But those who have the ability to monitor the patterns of their own mindset stand a far...

With at least eight major currencies available for trading at most currency brokers and more than seventeen derivatives of them, there is always some piece of economic data slated for release that traders can use to inform the positions they take. Generally, no less than seven pieces of data are released daily from the eight major currencies or countries that are most closely followed. So for those who choose to trade news, there are plenty of opportunities. Trading news is harder than it may sound. Not only is the...

It is very rare that traders start their career as traders. Usually people become interested in trading when they are stuck in a regular 9 to 5 job and start looking for ways to live independently and financially free. But becoming a successful forex trader when you spend 40 hours at your job every week, taking care of a family, paying off a mortgage and enjoying your hobbies is often an impossible task. It is only when you can use the time you can sacrifice for your trading most effectively that you stand a chance to make it in this...

Forex Grid Trading Strategies Grid Trading Advantages Grid Trading Disadvantages Forex trading that attempts to take advantage of the natural back and fourth motion of the market by placing orders both above and below the current market price and catching profits as the market moves is called a grid trading. The appeal of this type of trading is that the model requires almost no forecasting of the market direction. This benefit of removing the variable of price forecasting. However, it comes at a cost of complicated money...

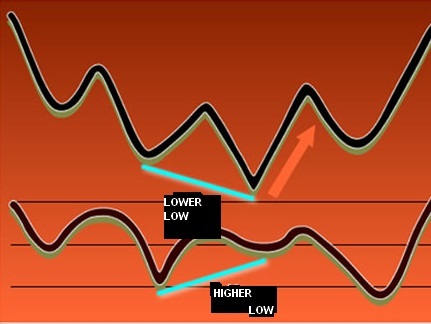

Visual disagreement between the actual price on a chart and a technical indicator in forex trading is called divergence. This disagreement can be seen on any time frame and often happens numerous times per day, providing opportunities for successful trading. The concept is simple, although many will also argue that the effectiveness of divergence is down to the thousands of traders who act on this signal. It can be learned by any trader, but the ability to spot genuine divergence is a skill which is acquired through practice and close...