Visual disagreement between the actual price on a chart and a technical indicator in forex trading is called divergence. This disagreement can be seen on any time frame and often happens numerous times per day, providing opportunities for successful trading. The concept is simple, although many will also argue that the effectiveness of divergence is down to the thousands of traders who act on this signal. It can be learned by any trader, but the ability to spot genuine divergence is a skill which is acquired through practice and close observation of the market.

Visual disagreement between the actual price on a chart and a technical indicator in forex trading is called divergence. This disagreement can be seen on any time frame and often happens numerous times per day, providing opportunities for successful trading. The concept is simple, although many will also argue that the effectiveness of divergence is down to the thousands of traders who act on this signal. It can be learned by any trader, but the ability to spot genuine divergence is a skill which is acquired through practice and close observation of the market.

Divergence basically means moving in different directions. In terms of trading, divergence occurs when the price goes in one direction while an indicator – appropriately enough, called a divergence indicator – turns in a different direction. Forex traders utilize divergence indicators such as the Relative Strength Index (RSI), the Stochastic Oscillator and the Moving Average Convergence Divergence indicator (MACD).

Divergence indicators are momentum – market strength – indicators. They signal possible market tops and bottoms. Divergence indicators are also used to indicate overbought or oversold conditions in a market. This can be particularly important in forex trading, since economic data surprises often result in an exaggerated market reaction that is retraced in subsequent price action. Divergence indicators help forex traders identify price levels that may represent such excessive reactions, price points from which they can then initiate trades to profit from the market sudden movement.

A divergence occurs when a new high in a price trend is not confirmed by a corresponding new high on the oscillator, but instead is contradicted as the oscillator registers a new low. Divergences can occur on all kinds of oscillators, and they signal that the trend is in peril of losing strength, possibly even reversing. As usual, the signals they emit can easily be contradicted by the eventual price action, and the trader should always be cautious when interpreting them. Nonetheless, such patterns can give an early warning of an eventual trend reversal especially when they’re backed by other kinds of data provided by other methods.

Types of Divergences

- Regular Bullish Divergence

- Regular Bearish Divergence

- Hidden Bullish Divergence

- Hidden Bearish Divergence

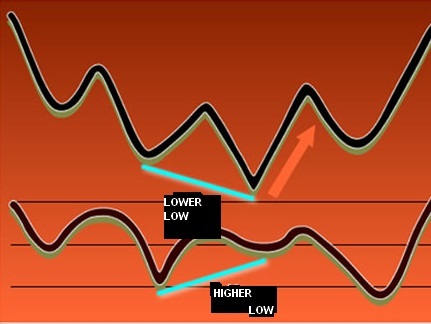

The oscillators signal to us that momentum is starting to shift and even though price has made a higher high (or lower low), chances are that it won’t be sustained. A regular divergence is used as a possible sign for a trend reversal. If price is making lower lows, but the oscillator is making higher lows, this is considered to be regular bullish divergence. This normally occurs at the end of a down trend. After establishing a second bottom, if the oscillator fails to make a new low, it is likely that the price will rise, as price and momentum are normally expected to move in line with each other.

Now, if the price is making a higher high, but the oscillator is lower high, then there is a regular bearish divergence. This type of divergence can be found in an uptrend. After price makes that second high, if the oscillator makes a lower high, then you can probably expect price to reverse and drop. Regular bearish divergence indicates a fall in the price to come. In this case, since we are in an uptrend we should expect a retrace. After entering at the top, we should look to get out of the trade at the uptrend line.

Hidden divergences occur when directional momentum signaled by an oscillator doesn’t confirm the price when we need the chart. Unlike normal divergences, hidden divergences are a signal of trend continuation and not reversal. A hidden bullish divergence occurs when price is making higher lows, but the oscillator makes lower lows. When this happens, you need to look for a spot to go long on an asset. When the security is making lower highs, but the oscillator is making higher highs, we are spotting for a hidden bearish divergence to go short on a continuation of the down move.

When a hidden divergence is spotted, you need to use your oscillator of choice’s entry rules and get confirmation from price actual like chart patterns and candlestick formations. If you are using trend lines, for example, you also need to look for maybe a candlestick formation that will show you that price has rejected the trend line and is in fact going to continue with the up move.

Most of the technical indicators used to observe divergence are momentum oscillators. These indicators that provide a sense as to the strength of a move seen in the market. Some momentum oscillators are used to determine whether a market is overbought or oversold and hence might be subject to a correction. Popular examples of banded oscillators that measure market momentum include the aforementioned Relative Strength Index (RSI) and the Stochastic Oscillator.

Now we know how to spot divergence and how to enter the market on a divergence. However, before you start trading divergence setups, there are a few more points which we need to discuss further. These things include an example money management approach when trading divergence setups. If you do not have a solid money management plan you are likely to lose money trading divergences or any other setups for that matter.

Regardless of the trading method you use, you should always use a Stop Loss order for each of your trades. It is no different when you trade divergences. And for most traders, it is best to place a hard stop in the market instead using a mental stop. As far as the divergence setup goes, one way to place your stop loss would be put it right above the last top on the chart, which confirms the bearish divergence. If the divergence is bullish, then we rely on bottoms and the stop should be placed below the last bottom on the chart.