The World Economic Forum, which is held every year in the Alpine resort town of Davos, Switzerland, has commenced and the global elite from the private sector and governments are gathering this week to discuss everything from the economy to innovation and from security to immigration. Many deals get either announced or signed and there are plenty of forums hosted to give leaders a platform to share ideas and discuss problems which the economy is likely to face in the near future. Forex traders should pay attention to developments in Davos, as short-to-medium term trading ideas can be found or existing trades adjusted in order to increase profitability.

The global economy has expanded at its healthiest rate in seven years which has impacted currencies in a positive manners in countries who saw the biggest impact from it. On the other side of the equation, countries which lagged behind also saw their currencies lag behind positive momentum. Adding to the overall positive tone is the bullishness among CEO’s, which according a the latest survey by PricewaterhouseCoopers is at record levels. While many cheer the overall positive mood across the globe, this is where the next collapse is usually born.

Complacency is the biggest risk to the economy right now and the IMF used the first day of Davos to issues a warning that a recession could be much closer than many account for. The President of the Institute of International Finance, Tim Adams, noted that ‘The bull market seems to be steamrollering over everyone who has a bearish view.But there’s a lot of complacency. There are termites in the foundation and a number of those are gnawing away at night.’ This years Davos gathering also marks the ten year anniversary of the worst global financial crisis since the Great Depression.

PaxForex offers traders the best environment to grow their trading portfolio, regardless of economic conditions. Open your forex trading account today and join the growing number of forex traders who earn more pips every day at PaxForex. Take full advantage of market opportunities and find out why tens of thousands successful traders call PaxForex their home.

The next recession will be much harder to handle for central banks and governments as there is essentially no ammunition left to fight a crisis. This is due to the prolonged period of quantitative easing as well as negative interest rates. Maurice Obstfeld, IMF Economic Counselor stated that ‘The next recession may be closer than we think, and the ammunition with which to combat it is much more limited than a decade ago.’ 2018 is ripe to be a very interesting trading year and here are three ways to profit from the IMF warning on the global economy from Davos.

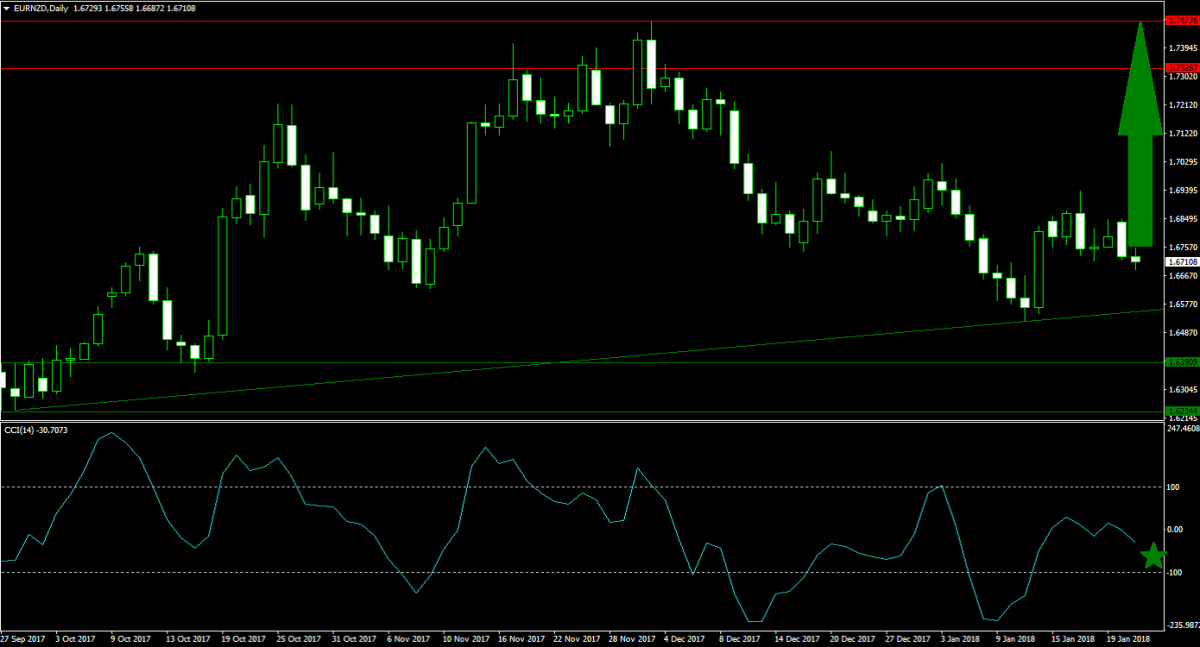

Forex Profit Set-Up #1; Buy EURNZD - D1 Time-Frame

The EURNZD offers a solid buying opportunity for all forex traders who missed the previous Euro advance. The New Zealand Dollar is set to suffer the most from the next global recession as compared to other developed markets. This currency pair is ready for a bounce after contracting from its horizontal resistance area down into its ascending support level. This trade offers good upside potential and very little downside risk as the next horizontal support area is located just below the ascending support level. Any level below 1.6670 represents a good entry opportunity.

The CCI has drifted below the 0 mark, but is expected to make a higher low which would be a bullish trading signal. A breakout above the 0 level is predicted to invite a short-covering rally which would further boost the EURNZD. Download your MT4 Trading Platform now and enter this trade to your forex portfolio.

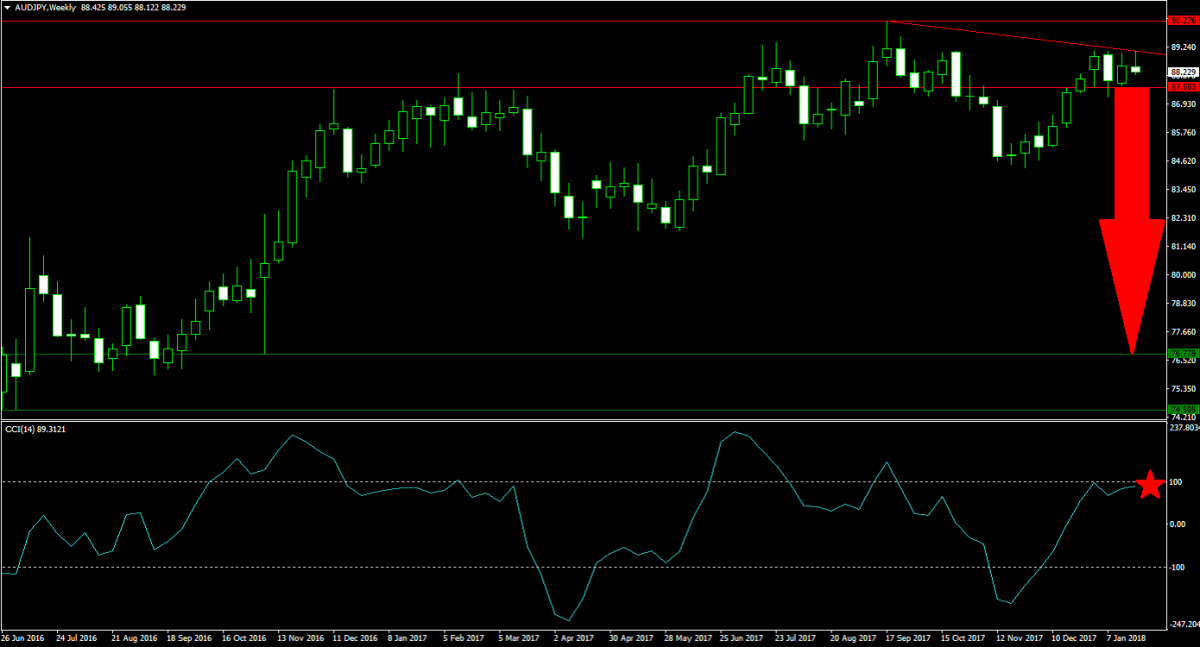

Forex Profit Set-Up #2; Sell AUDJPY - W1 Time-Frame

As global economic uncertainty increases, safe haven assets tend to increase. When it comes to the forex market, the Japanese Yen is the number one safe haven currency which never fails to attract traders seeking to protect their portfolios. With the AUDJPY, forex traders not only have the safe haven trade, but also a commodity trade in the Australian Dollar. Price action is currently trading inside a solid horizontal resistance area which is being intersected by a descending resistance level for even greater bearishness. Forex traders are advised to spread their short entries between 87.600 and 89.200.

The CCI confirms bearish momentum with a series of lower highs. In addition this momentum indicator already completed a breakdown below the 100 level and is set to resume its contraction until it will move below the 0 mark. The PaxForex Forex Fundamental Analysis section offers the fundamentally best trades every day; boost your earnings by over 500 pips every month.

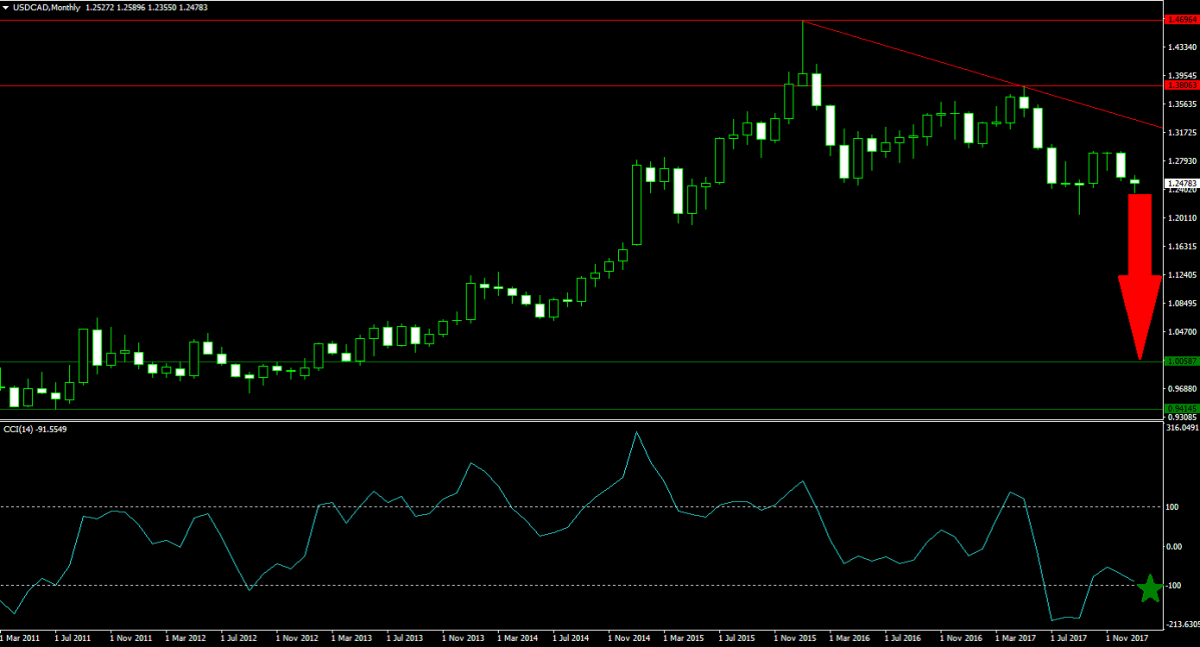

Forex Profit Set-Up #3; Sell USDCAD - MN Time-Frame

The USDCAD has been on a downward trajectory for several months and is set to resume it current path. After two failed breakout attempts above its horizontal resistance area, bearish pressures took over and price action stared to contract. A descending resistance level is additionally applying downside pressure on this currency pair. A set of lower highs and lower lows emerged as well which is another bearish trading indicator. Short entries should be place between 1.2475 and 1.2660.

The CCI is trading near oversold territory after pushing above extreme conditions, but is predicted to resume its contraction into extreme conditions and set a lower low. Forex traders are welcome to subscribe to the PaxForex Forex Recommendations where our expert analysts look at the most profitable trades from a technical perspective.

To receive new articles instantly Subscribe to updates.