Despite the fact that trading the forex market is not an easy task, there is a number of traders who are still able to consistently make profitable returns. Part of the reason for this fact is that they successfully use forex trading indicators. The existence of proven best forex indicators implies that the forex market is not a random walk, as some economic theories contend. The flaws of the human psyche mean that markets do not always behave rationally. The forex markets have a tendency to behave in certain ways under certain conditions. This behavior repeats itself, meaning that certain price patterns will occur time and again.

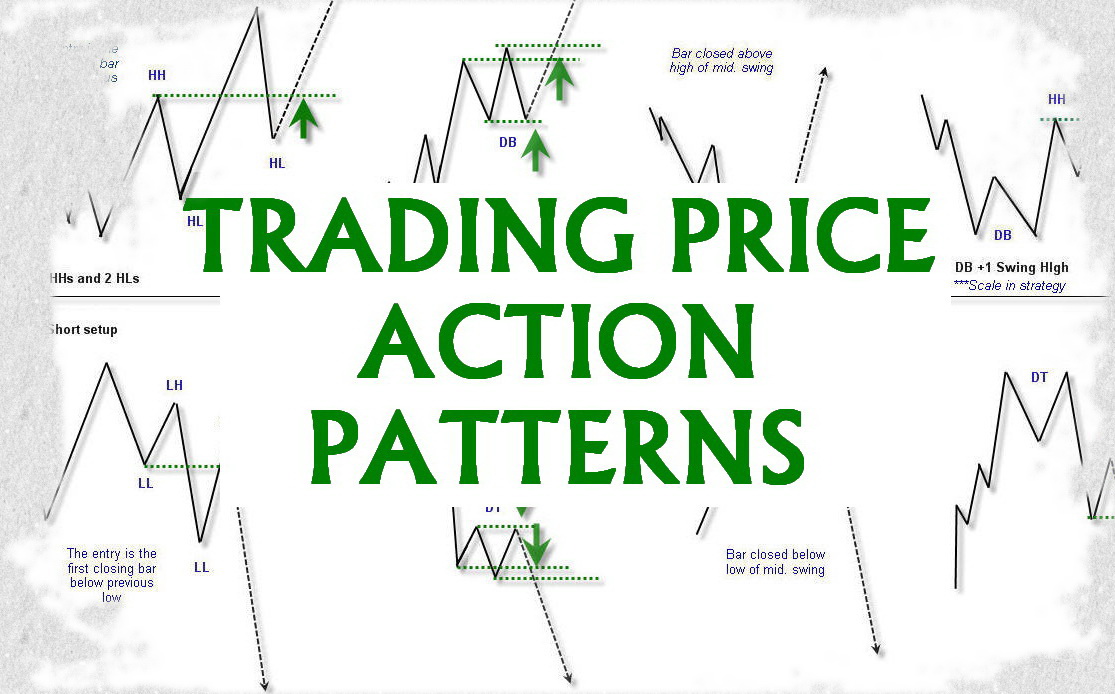

The best forex indicators attempt to recognize such patterns as they form and to gain an edge by exploiting that knowledge. Chart patterns are one of the most effective trading tools for a trader. They are pure price-action and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

Price pattern recognition comes from looking for patterns that appear in the prices of traded instruments. You should be looking for shapes such as triangles, rectangles, and diamonds. While this may not inspire confidence at the outset, these are formations that arise and track the changes in support and resistance. Once you have learned these skills, you will be able to apply them in any financial market that you choose, from shares to indices and forex. Pattern recognition can form the basis of trading strategies for day traders, swing traders and longer-term position traders alike and can be applied to anything from five-minute to weekly charts.

Since price patterns are identified using a series of lines and/or curves, it is helpful to understand trend-lines and know how to draw them. Trend-lines help technical analysts spot areas of support and resistance on a price chart. Trend-lines are straight lines drawn on a chart by connecting a series of descending peaks (highs) or ascending troughs (lows). A trend-line that is angled up, an uptrend-line, occurs where prices are experiencing higher highs and higher lows. The uptrend-line is drawn by connecting the ascending lows. Conversely, a trend-line that is angled down, called a down trend-line, occurs where prices are experiencing lower highs and lower lows.

In trading the forex market, we can trade price action patterns by themselves, but we can easily see how dis-empowering this is. Patterns by themselves are meaningless unless we can read the price action and order flow behind it. When we can read the order flow, we can determine where the institutional players are buying and selling, the speed of buying and selling, where are key support and resistance areas, when the market will continue the trend when it will reverse and when key breakouts are happening.

To receive new articles instantly Subscribe to updates.