The trade war between the US and China is in its early stages and many compare it more than a conflict for the time being. The risks that it will turn into a longer lasting, full blown trade war are increasing daily as rhetoric is on the rise. US President Donald Trump now asked the United States Trade Representatives Office, tasked with identifying another $200 billion worth of Chinese imports for tariffs, to increase the proposed tariffs from 10% to 25%. In response, a Chinese newspaper close to the leadership stated that Chinese people are ready for a long trade war and can endure hardship. No country is ready to dial back the tensions while negotiations are ongoing to find a solution which works for both countries.

While a lot of media attention is focused on the tariffs which are in place already, are ready to be implemented and are being readied for implementation, a potentially bigger economic problem has managed to fly under the radar in stealth mode. The risk of a currency war is much bigger with the US potentially entering the battlefield in order to manipulate its currency, the US Dollar. President Trump has accused the European Union and China of currency manipulation in the Euro and Yuan in order to gain a trade advantage. He has also attacked the US Federal Reserve for its interest rate increases and openly admitted that he supports a weak US Dollar.

While many analysts currently see a low risk for US interventions in the forex market, it can’t be ruled out. Michael Feroli, Chief US Economists at JPM, summed it up by stating that 'While not our base case scenario, we cannot rule out a turn toward a more interventionist currency policy, particularly since the current administration has, at times, hinted at a preference for dollar weakness or objected to perceived Chinese currency manipulation.' The last time the US intervened in the forex market and sold US Dollars was in 2000 together with other G-7 members in order to stem the steep slide in the Euro. In 2011 it bought US Dollars in order to halt the rally in the Japanese Yen in the aftermath of the Japanese tsunami.

Will Trump use US Dollars as a weapon? What will the impact on the forex market be? Time will tell if the US will sell US Dollars in the market for the first time in almost two decades, but even the threat of interventions could have an impact. An increase in volatility is likely to accompany the interventions which will also create plenty of great trading opportunities. Open your PaxForex Trading Account now and access countless ways to boost your monthly income.

Should Trump use US Dollars as a weapon, it would violate the G-20 pact that 'members will refrain from competitive devaluations, and will not target our exchange rates for competitive purposes.' The People’s Bank of China, which Trump accused of championing a low Yuan in order to boost trade, stepped in this week in order to stabilize the Yuan’s contraction. The PBOC has long stated that it will tolerate moves in the Yuan in both directions, that it has plenty of tools to stabilize the market if needed and that currency stability is favored. Will Trump use US Dollars as a weapon? We will find out soon, but here are three forex trades to consider now in order to position your forex portfolio for growth.

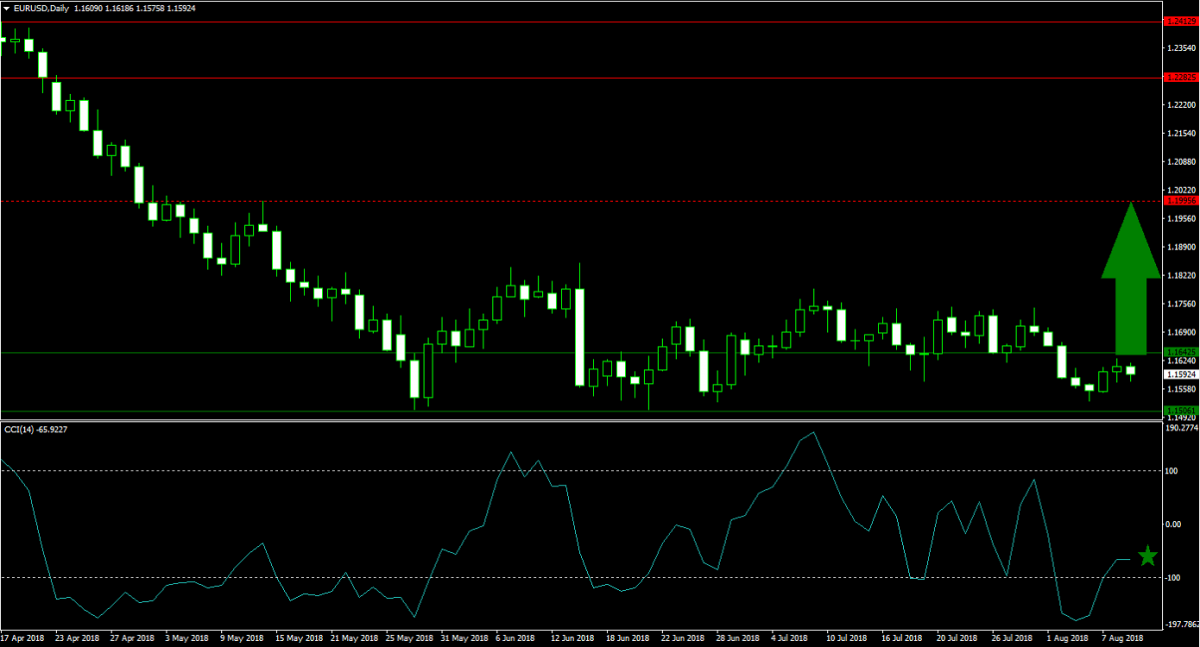

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

Following s steep sell-off, the EURUSD has entered a sideways trend and price action is currently located inside of its horizontal support area. Since the last trading week in May, this currency pair has traded in and out of this support area without having the catalyst to sustain a move in either direction. Given the strength of its current horizontal support area, the next move is expected to the upside on the back of US Dollar weakness from the fallout of a prolonged trade war with China. Forex traders are recommended to spread their buy orders between the upper and lower band of its horizontal support area.

The CCI has just moved out of extreme oversold conditions which increased bullish pressures in the EURUSD. Momentum could extend this advance above the 0 mark which would complete a momentum shift from bearish to bullish. Diversify your forex income with PaxForex and enter into a Partnership with us; earn the best commissions in the forex affiliate space. Join us today and see how it can increase your revenues.

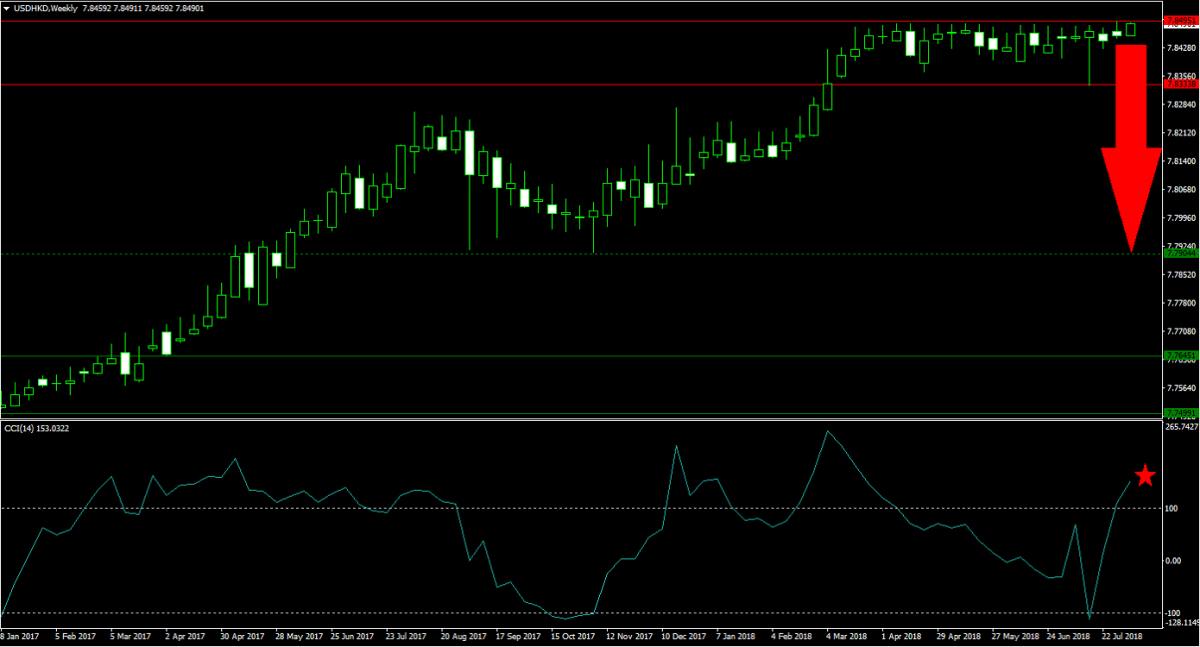

Forex Profit Set-Up #2; Sell USDHKD - W1 Time-Frame

The USDHKD has spend the last few months in a narrow trading range inside of its horizontal resistance area. As the PBOC is stepping up moves to shore up the Yuan, the Hong Kong Dollar could be exposed to secondary effects. Bullish sentiment is slowly eroding as this currency pair remains stuck in its range. The risk now is to the downside and forex traders should watch for a move below the lower band of its horizontal resistance area which could ignite a bigger sell-off on the back of profit taking. Short positions inside the horizontal resistance area are favored.

The CCI has been exposed to volatile moves which bounced this indicator between extreme oversold and extreme overbought territory. The spikes to the upside have resulted in lower highs which points towards weakness in bullish momentum. Subscribe to the PaxForex Daily Forex Technical Analysis and never miss a profitable technical trading set-up again. Just copy the trading recommendations posted by our expert analysts.

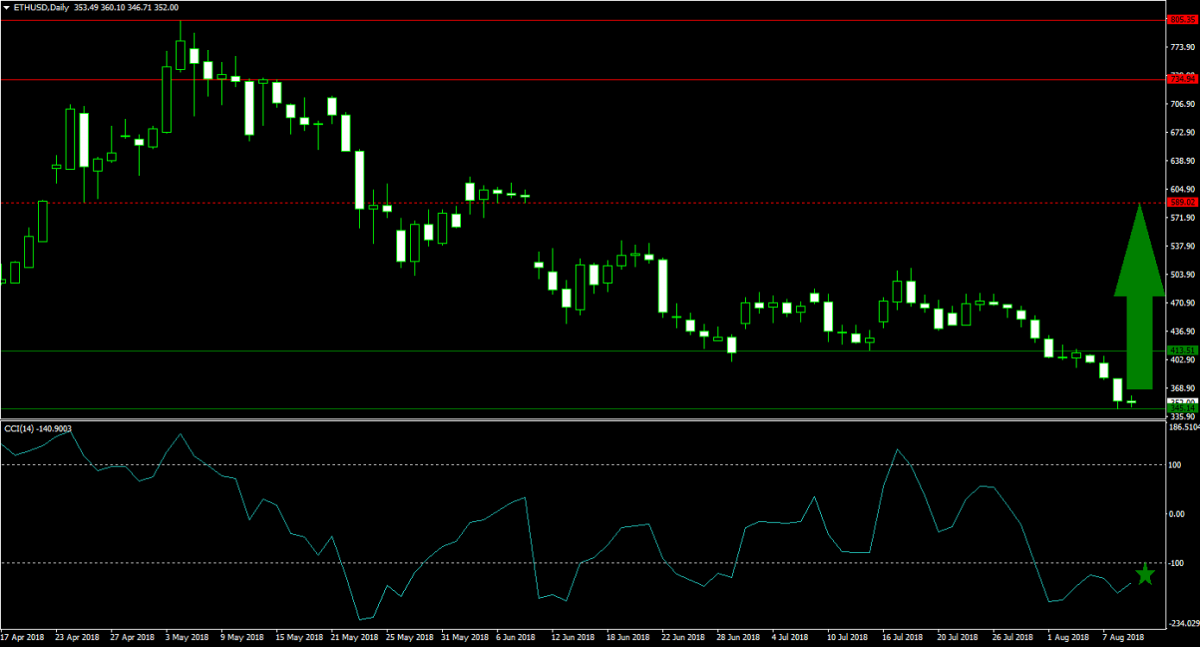

Forex Profit Set-Up #3; Buy ETHUSD - D1 Time-Frame

In the event that the US will sell US Dollars, a growing number of traders are expected to take advantage of the correction in Ethereum. It can offer forex traders a way to not only park their cash until more clarity returns to the USD trade, but also a chance to capitalize on a potential rally in this cryptocurrency back into its next horizontal resistance level. The sell-off in ETHUSD has been overextended and a short-covering rally is on the horizon. Forex traders are advised to spread their buy orders inside its horizontal support area in order to capitalize from the expected count-trend advance inside a larger bear market.

The CCI has dropped into extreme oversold conditions, but a narrow positive divergence emerged which represents a bullish trading signal. A push above -100 may trigger the expected short-covering rally in Ethereum. Follow the PaxForex Daily Fundamental Analysis and allow out expert analysts to guide you through the forex market. Learn how to earn over 500 pips per month, simply by following our fundamental trading set-ups.

To receive new articles instantly Subscribe to updates.