When Brexit negotiations started, everyone expected to face some tough discussions which would range from the divorce bill to citizens right and from a trade deal to security. The easiest to agree on issue was supposed to be the right of citizens, but even that has not been resolved yet. The UK’s commitment to European security appears to be the only positive agreement so far, while the size of the divorce bill has held trade talks hostage. The EU wants to settle the bill first before advancing to complicated trade talks as the deadline is approaching faster than negotiators can agree on.

With time running out, negotiators on both sides could not afford another big problem. After Prime Minister’s May snap election results which forced her into a coalition with the DUP from Northern Ireland, the current Irish political crisis could derail Brexit talks further. Post Brexit, the Irish border will be the only land border between the EU and the UK and Ireland doesn’t want to proceed to trade talks until written guarantees are issued in regards to how the border issue will be resolved. Nobody wants long check-points, border towers and guards.

The issue of the Irish border is complicated enough, but today at 8.p.m the Irish Deputy Prime Minister Frances Fitzgerald will face a no-confidence vote due to the handling of a whistle blower case. In case she will not pass the vote, it would bring down her Irish minority government and Prime Minister Leo Varadkar stated that it will result in elections next month. This would put intense pressures on Brexit negotiations and could derail much needed trade talks which some have hoped could be started next month.

In times of global uncertainty it is important to operate a forex account at a trusted broker which provides stability. PaxForex traders enjoy a professional trading environment with great trading conditions which allows them to increase their portfolio regardless of geopolitical events or economic performances. Download your MT4 trading platform now and join tens of thousands of successful forex traders at PaxForex!

Monday’s hopes that new elections could be avoided were squashed with the release of an e-mail cache by the Justice Ministry which pointed towards more knowledge from Deputy Prime Minister Fitzgerald about the police whistle blower and a potential legal strategy in order to discredit the police officer. Fitzgerald denies any part in the issue, but faces growing internal pressures to resign. Many fear that Prime Minister Varadkar will be less willing to hand out concessions on the border while in the midst of an election campaign. Bond traders are not pushing the panic button, and here are three ways forex traders can profit from any potential outcome.

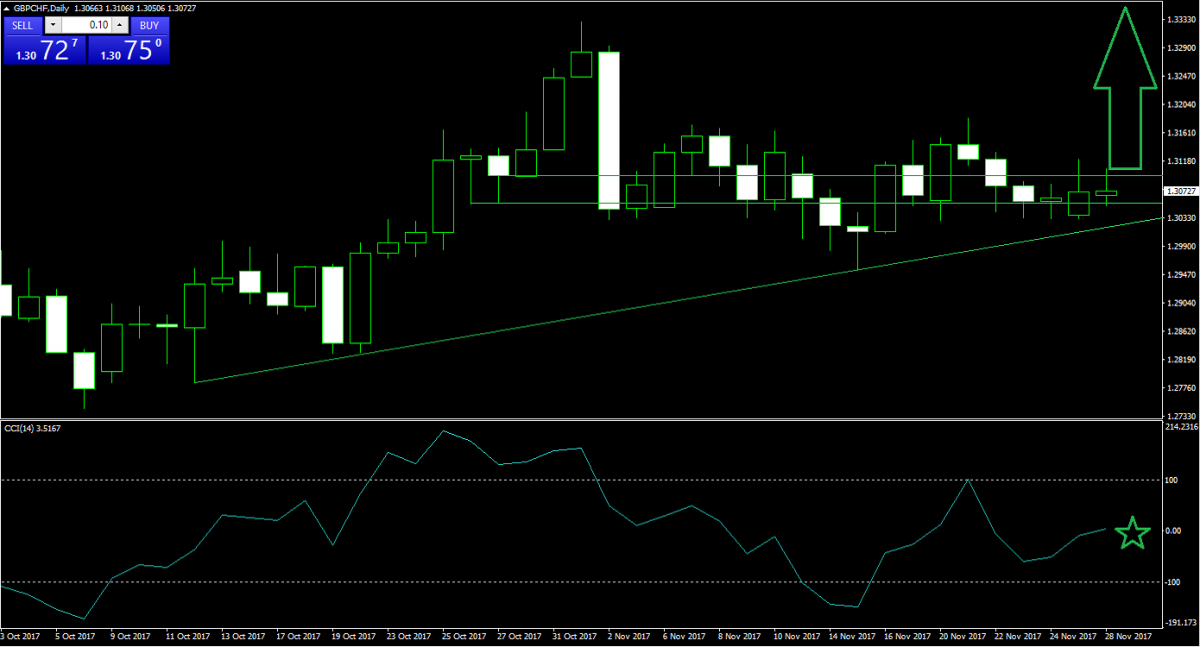

Forex Profit Set-Up #1; Buy GBPCHF - D1 Time-Frame

The GBPCHF enjoys a double dose of bullish pressures which bodes well for our buy recommendation. A sideways trend has confirmed a solid horizontal support area from where an advance is predicted. This currency pair is currently trading inside of its support area and is further pressured to the upside by a confirmed ascending support level. This is on track to force a breakout which will open the way back up to its most recent high of 1.3329 from where price action should be monitored for more potential upside.

The CCI completed a breakout above the 0 mark which resulted in a momentum shift to bullish and adds further conviction to a long position in the GBPCHF. Add this currency pair to your PaxForex trading account and utilize leverage in order to increase your profit potential. Trade like a pro and enjoy the benefits of a smart forex portfolio.

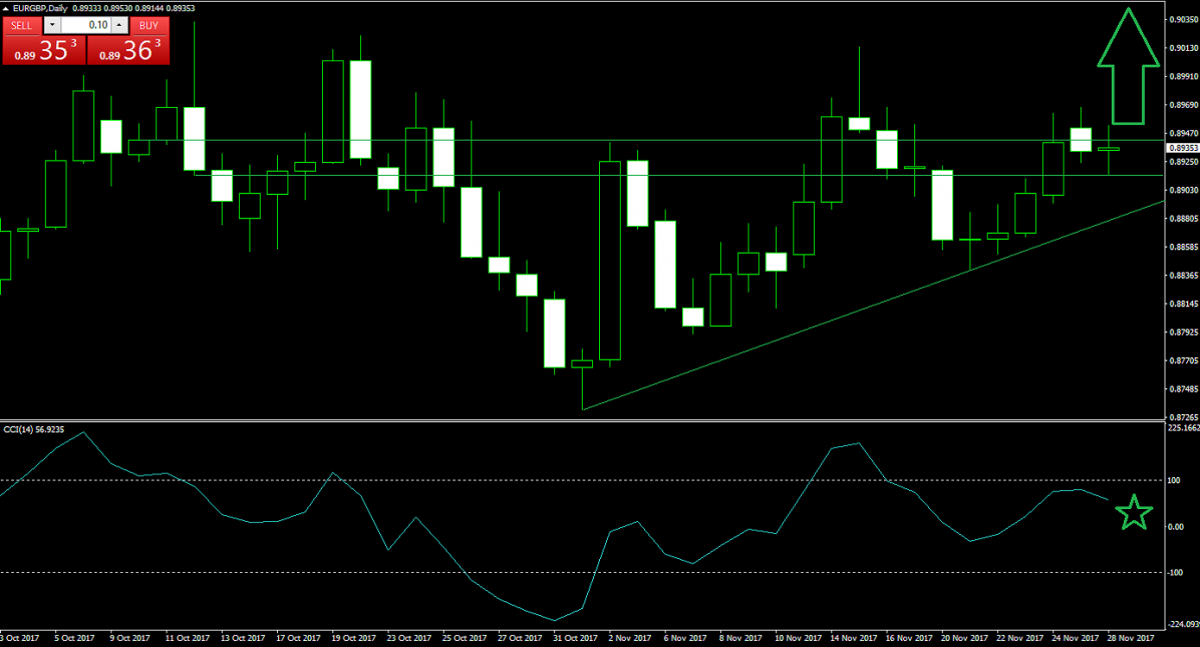

Forex Profit Set-Up #2; Buy EURGBP - D1 Time-Frame

The EURGBP offers forex traders a perfect hedge to their long positions in the British Pound. In the above trade, the GBP is the base currency and we have a strong bullish set-up. In this long EURGBP trade, the GBP is the quote currency and we have a similar double bullish set-up. This currency pair is trading inside a resistance-turned-support area and face an increase in bullish pressures from its ascending support level. A great way to reduce your risk in the GBP and profit from any outcome of this evenings no-confidence vote.

The CCI broke down below the 100 mark which took the EURGBP out of extreme overbought conditions. This currency pair is now trading in neutral territory, but is predicted to advance back into overbought territory as a result of the pending advance. Follow PaxForex trading recommendations and stay up-to-date with the most profitable trades each day.

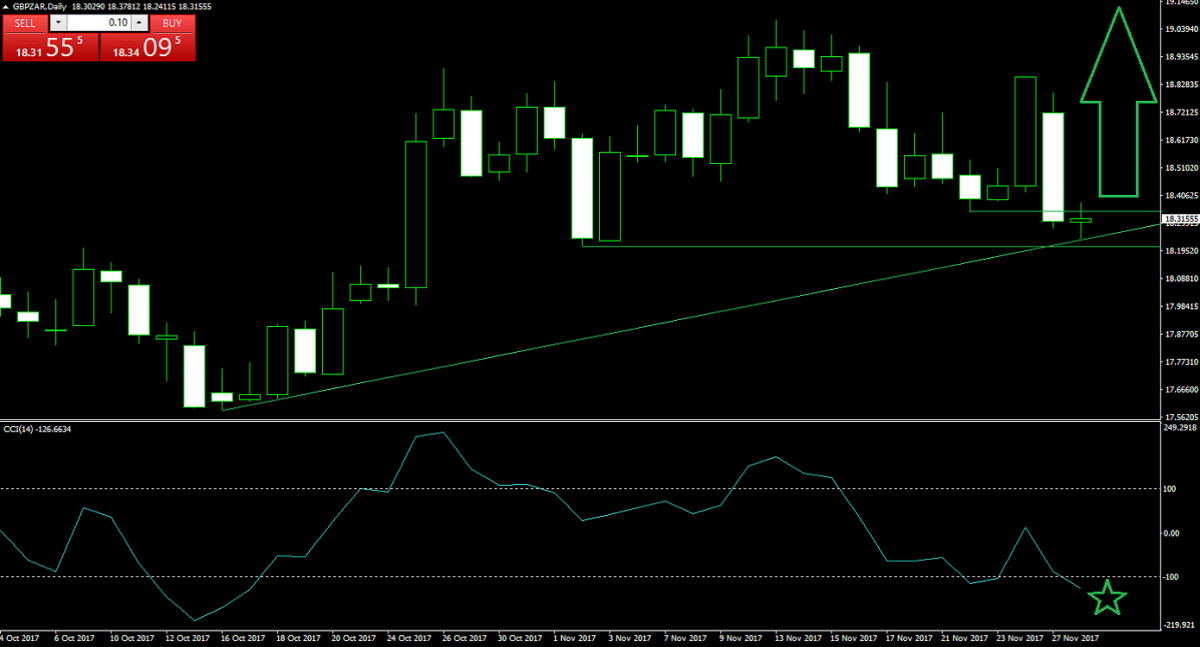

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

This exotic currency pair offers forex traders a bit more volatility as well as a lot more upside pips. The South African Rand has rallied over the past few trading sessions and pushed the GBPZAR down into its ascending support level which is merging with a new horizontal support area. As bearish pressures are on the retreat, bulls are set to take charge and reverse the most recent sell-off with a confirmation of its new support area and a subsequent breakout above it.

The CCI has reached extreme oversold territory with a reading below -100 and forex traders should monitor price action near current levels as well as the CCI for a move back towards the 0 mark. A breakout above 0 would result in new long positions as it will confirm a momentum change and potentially a big short-covering rally. Subscribe to the fundamental analysis section at PaxForex and turn every trade into a profitable one.

To receive new articles instantly Subscribe to updates.