British Prime Minister Theresa May has survived several leadership challenges over the past year, but so far was always able to avoid a critical issue. Many have compared the post-crisis announcements as muddy waters as it was ultimately unclear what was agreed on between Brexit hardliners and Tory rebels. Each side always claimed victory without any real progress made. The European Union has repeatedly claimed that negotiations can’t advance until clarity on the post-Brexit trade deal exists. Will Friday’s meeting at the PM’s ‘Chequers’ country house finally give clarity on the post-Brexit trade deal?

May will try to unite her cabinet behind her new approach, a two-tier deal where goods will be treated differently than services. When it comes to the trading of goods between the EU and the UK, May wants the UK to remain close to EU trading rules with little to no change. This would certainly please the EU and the UK goods exporting sector and pro-Brexit ministers will demand a clear explanation on how this would work. The vote for Brexit was for a clean break from the EU. On the other side, the EU already stated that splitting goods from services will not be acceptable as it will threaten the integrity of the EU single market.

When it comes to services, which account for the majority of the UK’s GDP, May favors mutual recognition of regulation rather than following EU regulations. The previous two post-Brexit trade deals have split her cabinet and were rejected. The third plan is rumored to continue the plan that the UK will collect tariffs at the border on behalf of the EU. This option was previously rejected by key pro-Brexit ministers such as Foreign Secretary Boris Johnson and Brexit Secretary David Davis as it was labeled ‘crazy’ and ‘unworkable’.

With less than nine months until Brexit, time is running out for both sides to reach a deal. The British Pound has been under selling pressure over the past two months, but the downtrend shows signs of weakness. Will the bulls be able to launch a reversal? A short-covering rally may be on the horizon which could carry enough momentum for a sustained rally. Open your PaxForex Trading Account now and position your portfolio for growth amid ongoing Brexit negotiations.

The biggest fear of Euroskeptic Tories is that PM May will water down her red lines and keep the UK too close to the EU trading rules and regulations. This would be a betrayal of the Brexit vote which gave a mandate for a clear break with the EU. The UK wants to strike trade deals of its own and remaining too close to the EU would render that essentially impossible. There are some private discussions amid pro-Brexit Tories in regards to potentially oust PM May if she wants to push ahead with a plan which would not constitute a clean break from the EU. Free movement of individuals will not be discussed on Friday, but a deal to mutual respect professional qualifications has been rumored. Will the EU accept a two-tier post-Brexit trade deal? We will find out together, but here are three forex trades which should be part of every profitable forex portfolio this summer.

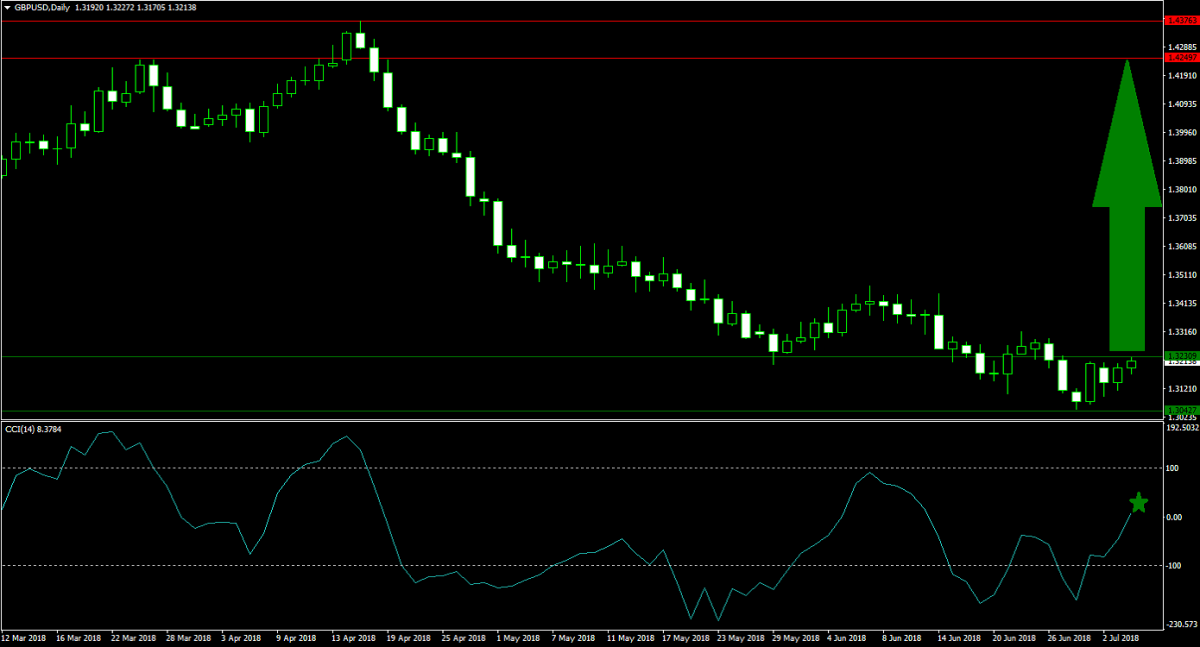

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

Following a multi-week correction cycle which took the GBPUSD into a very strong support level, a momentum change from bearish to bullish is materializing. Price action briefly touched the lower band of its horizontal support area from where it started to reverse. A positive economic surprise in regards to the UK service sector is adding to bullish pressures, and a breakout above the upper band of its horizontal support area will ignite a short-covering rally in this currency pair. Forex traders are advised to place their buy orders just below and above the upper band.

The CCI already completed a breakout from extreme oversold conditions and has already eclipsed the 0 mark. This resulted in a bullish sentiment change. Subscribe to the PaxForex Daily Forex Technical Analysis section and never miss any of our technical trading set-ups. Profit from the hard work of our expert analysts by simply following their recommendations.

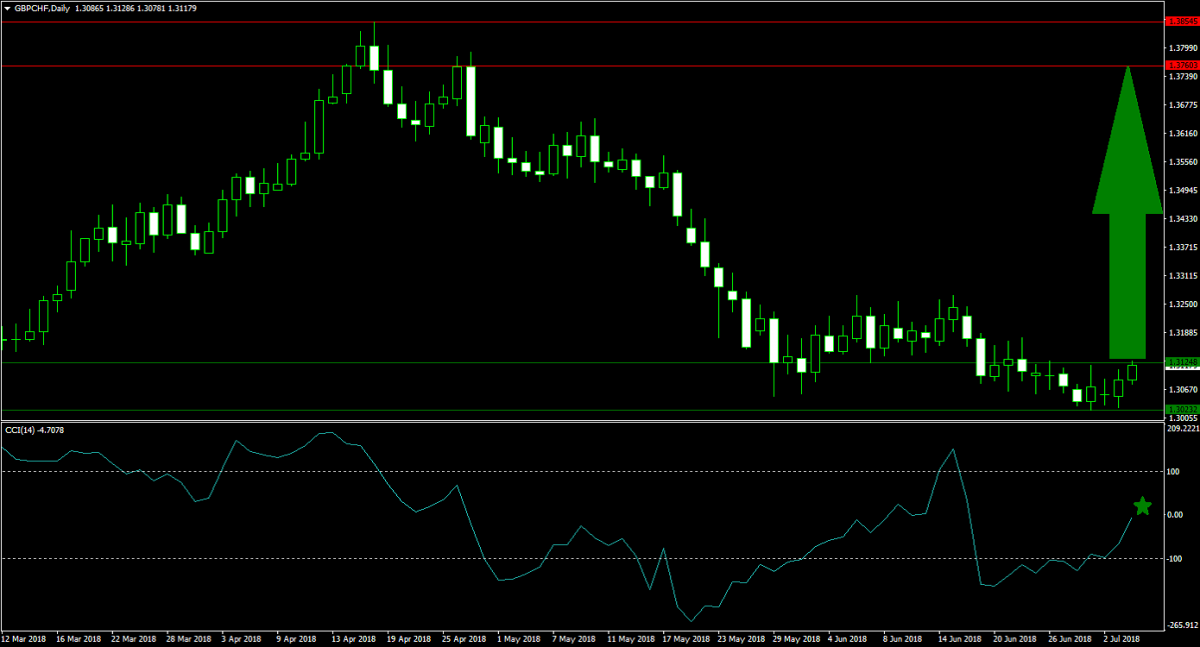

Forex Profit Set-Up #2; Buy GBPCHF - D1 Time-Frame

Similar to the GBPUSD, the GBPCHF has also descended from its horizontal resistance area into its horizontal support area. While the Swiss Franc usually attracts bids as uncertainty is on the rise, the Swiss currency is impacted by the commodity market as well. Price action is now on the verge of a breakout, it already recorded an intra-day high above the upper band of its horizontal support area. A sustained advance in the GBPCHF is anticipated and forex traders should spread their buy orders inside its horizontal support area.

The CCI has formed a positive divergence prior to its breakout from extreme oversold territory and this technical indicator is now approaching the 0 level. A push above it is set to further attract buy orders. Download the PaxForex MT4 Trading Platform today in order to enter this trade to your forex portfolio before price action will accelerate to the upside.

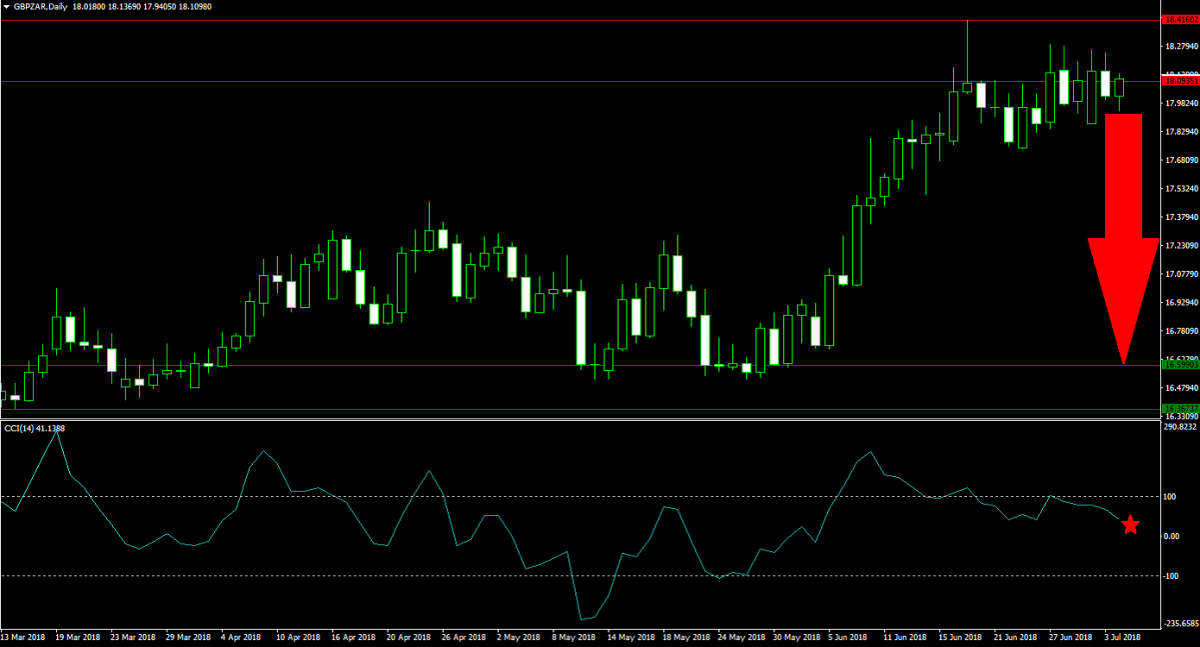

Forex Profit Set-Up #3; Sell GBPZAR - D1 Time-Frame

A good way to hedge the above to bullish British Pound recommendations is a short position in the GBPZAR. This currency pair advanced into its horizontal resistance area from where a sideways trend emerged. The failed breakout attempt resulted in a sentiment change to bearish. A sustained trade below the lower band of its horizontal resistance area may result in profit taking which will push the GBPZAR to the downside. Forex traders are recommended to place their sell orders above and below the lower band of its current horizontal resistance area.

The CCI, a momentum indicator, formed a negative divergence which is a strong bearish trading signal. This led to the descend from extreme overbought conditions and momentum is strong enough to push the CCI below the 0 level which would complete a bearish momentum change. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide your forex portfolio to a profitable outcome. Earn over 500 pips per month.

To receive new articles instantly Subscribe to updates.