As widely expected, the US Federal Reserve increased interest rates for the second time in 2018 by 25 basis points to Lower Bound Level of 1.75% and and Upper Bound Level of 2.00%. The US central bank also upgraded the amount of planned interest rate increases to four, which means that two more 25 basis point increases are on the table in the second-half of the year. The hike came on the back on a rise of inflation as well as a drop in the official unemployment rate. The US is currently experiencing the second-longest economic expansion in its history.

Some market participants worry that the Fed will increase interest rates too fast which will lead to a recession. US Fed Chief Jerome Powell tried to sooth those fears by stating that the Fed has 'been very, very careful not to tighten too quickly.' After announcing that he will address reporters after every meeting instead of every second meeting he also noted in regard to the interest rate increase that 'The decision you see today is another sign that the economy is in great. Frankly, I do think there is a lot to like about low unemployment.'

Forex traders have their attention now fully on the ECB press conference this afternoon. There are no expectations for a change from its current interest rate of 0.00%, its marginal lending facility rate of 0.25% and its deposit facility rate of -0.40%. Today’s press conference will receive an extra dose of attention as it will be the first time ECB President Mario Draghi and his colleagues will discuss the end of its three-year long quantitative easing program in the form of bond purchases. Expectations are that it will remain in place until the end of 2018. It is unclear if the ECB will commit to a time-line after today’s meeting or wait until the next one in order to communicate a phase out of bond purchases.

An interest rate increase by the ECB is not expected until the middle of 2019, but a decision on the end of QE and the start to a more normalized monetary policy would be very bullish development for the Euro. Open your PaxForex Trading Account today and join our growing community of profitable forex traders who changed their life through forex trading from the comfort of their homes.

The ECB has to deal with a few conflicting signs about the health of the economy which will play a large role in their decision to announce the end of QE following today’s meeting or six weeks down the road after the next meeting. Member of the ECB are confident in inflation on the back of an increase in wages across key Eurozone countries Germany, France, Italy and Spain. This is countered by a slowdown in economic activity amid a drop in output from the same quartet. A rise in global risks from pending trade wars may also influence today’s decision. After the US Fed hikes interest rates, all eyes are on the ECB press conference and here are three forex trades you need to take right now.

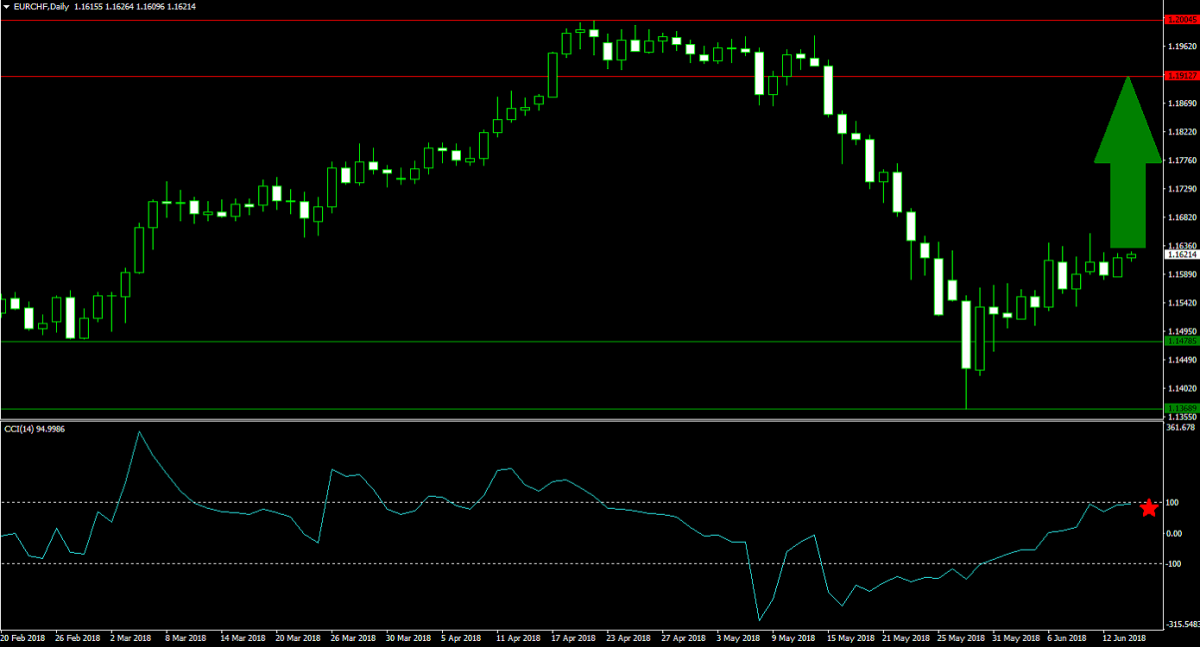

Forex Profit Set-Up #1; Buy EURCHF - D1 Time-Frame

Following the advance of the EURCHF to the 1.2000 mark, once one of the most defended levels in forex trading, price action entered a corrective phase which took this currency pair down into its horizontal support area. As bearish pressures faded, the EURCHF successfully completed a breakout above support which was accompanied by a bullish sentiment change. This currency pair has more upside potential and forex traders are advised to buy the dips.

The CCI is approaching extreme overbought conditions, but expected minor contractions in price action will take this indicator into neutral territory from where fresh highs should be expected. Download your PaxForex MT4 Trading Platform now and add this trade to your forex portfolio before it will accelerate to the upside.

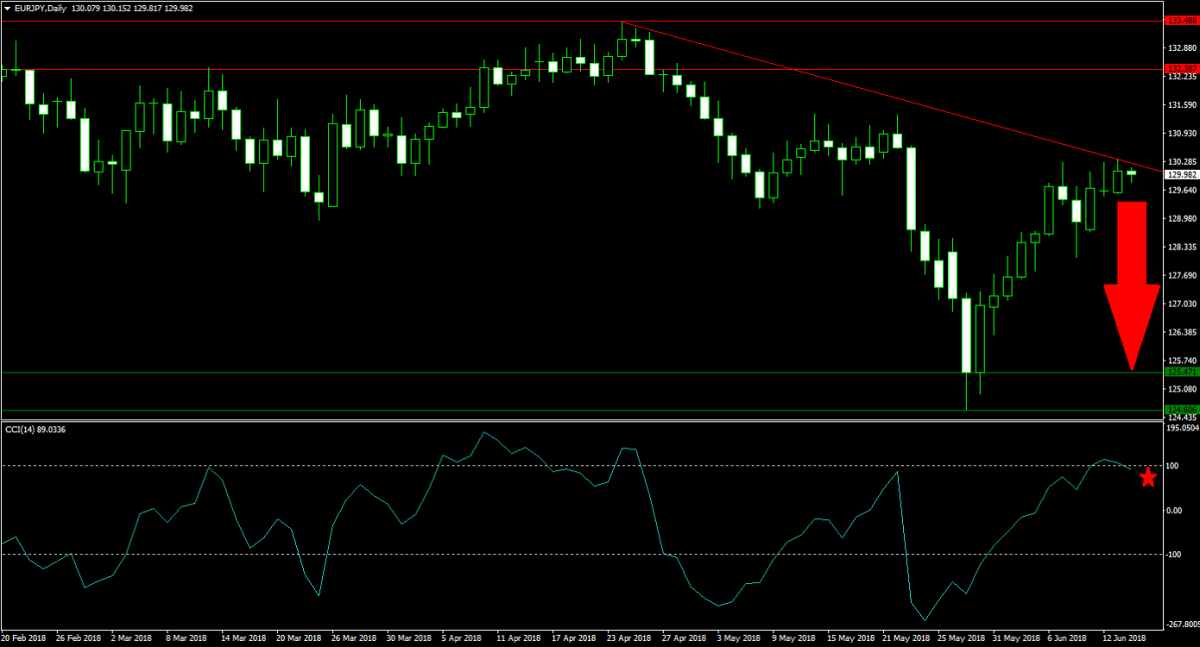

Forex Profit Set-Up #2; Sell EURJPY - D1 Time-Frame

With uncertainty about today’s ECB press conference high, a great hedge to Euro bullish bets is a short position in the EURJPY. The Japanese Yen is a safe haven currency and performs well in high-risk trading environments. Price action spiked from its horizontal support area into its descending resistance level from where bearish momentum is expanding. Forex traders are recommended to stagger their short positions along its descending resistance level.

The CCI already retreated from extreme overbought conditions above 100 which resulted in an increase of bearish momentum. More downside is anticipated from this technical indicator. Subscribe to the PaxForex Daily Forex Technical Analysis and get each trading day’s best technical trading set-ups which will help you increase your account balance.

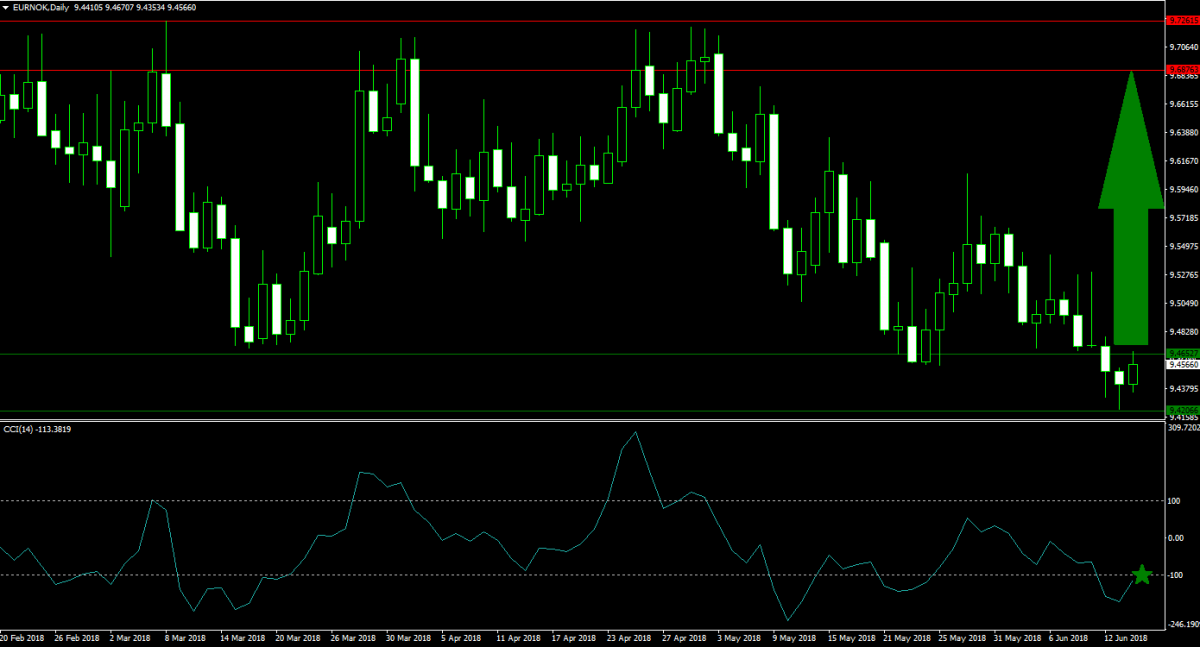

Forex Profit Set-Up #3; Buy EURNOK - D1 Time-Frame

A steady descent took the EURNOK from its horizontal resistance area into its horizontal support area. Price action has now stabilized and bullish momentum is accumulating. This currency pair is preparing for a breakout above support levels which could come on the back of a short-covering rally. Bullish sentiment is anticipated to increase and take the EURNOK back into its horizontal resistance area. Forex traders should spread their buy orders between the lower band and the upper band of its horizontal resistance area.

The CCI is trading in extreme oversold territory, but with an upside bias. This lead to the formation of a positive divergence which is a strong bullish trading signal. Make sure to follow the PaxForex Fundamental Analysis in order to remain ahead of fundamentally impacted trading set-ups. Earn over 500 pips per month with the help of our expert analysts who will provide you with daily trading recommendations.

To receive new articles instantly Subscribe to updates.