The Federal Open Market Committee (FOMC), the part of the US Federal Reserve which decides on interest rates, will meet for the final time today and announce their interest rates decision tomorrow. It is widely expected that the Fed will increase interest rates by 25 basis points and a few weeks ago this meeting would have been a non-event. The situation has drastically changed as the Fed has to pick between a rock and a hard place, no matter how they decide it is likely to have a negative impact on the US Dollar.

US economic prospects are deteriorating fast and the US yield curve showed its first inversion. Equity and bond markets suggest that a recession in the US may be closer than anticipated and US President Donald Trump continues to lash out at the Powell led Fed for hiking interest rates in the current environment. The US is in the midst of a trade war it started with China and will be faced with a decrease in tax revenues as spending is set to soar. Higher interest rates means that US interest on its debt will increase and put additional pressure on the budget.

The Fed can now decide to pause its interest rate hike and surprise markets. This is likely to send the US Dollar in a sharp sell-off. It will appease President Trump and show that the US central bank is not independent. It will also raise concerns that the US economy may actually be a lot weaker than expected and that the Fed is concerned about it. This will further pressure the US Dollar to the downside. Economic data out of the US has been soft and inflation subdued. A pause may be warranted, but it would increase economic fears.

Forex traders are expected to trade the US Dollar lightly until after the announcement tomorrow afternoon. Volatility is expected to spike as the US Fed has two bad choices and boxed itself, once again, into a corner. Are you prepared to profit from the fallout of the US Fed interest rates announcement tomorrow? Open your PaxForex Trading Account today and join our growing community of profitable forex traders!

The other bad choice the Fed has is to increase interest rates as expected. This would place even more pressure on an economy which is showing signs of a severe slowdown. The US Dollar may initially advance before traders sort through the impacts of another rate hike and how it will impact the economy. This is likely to result in the US Dollar contracting as well. A growing number of analysts believe that the Fed will not hike interest rates at all in 2019 with a slowly growing number calling for a cut in interest rates by the end of 2019. The US Fed gas two bad choices tomorrow, but here are three great choices for your next forex trade!

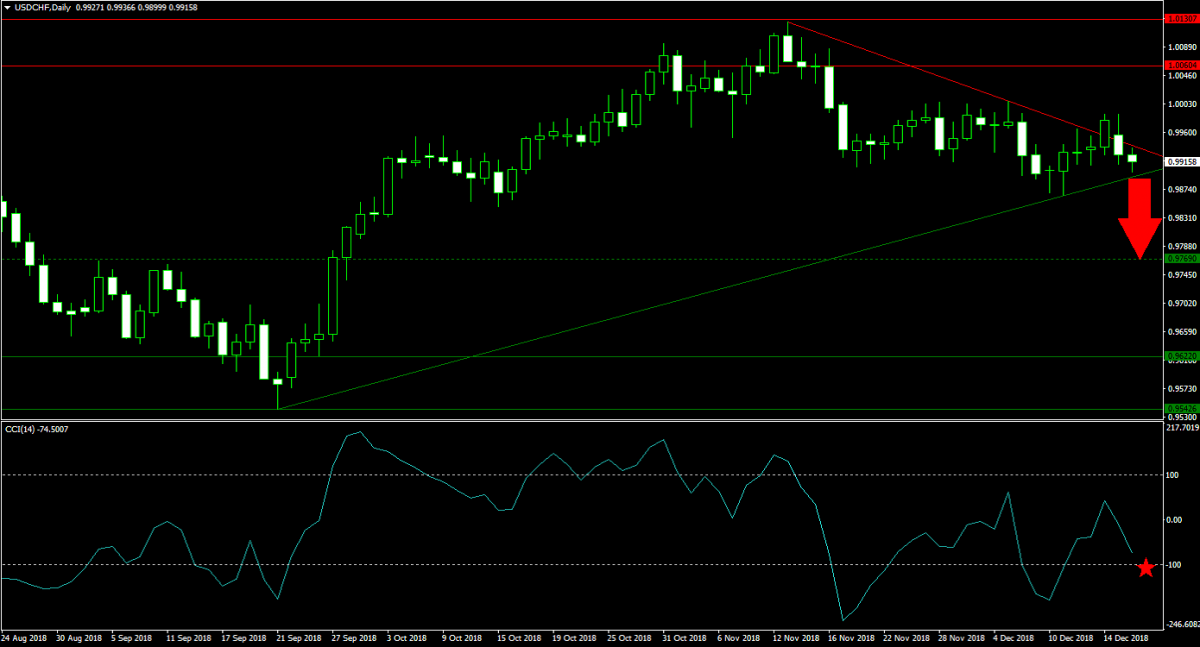

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

The Swiss National Bank (SNB) is expected to continue to sell its US equity portfolio and as traders are expected to increase their appetite for safe haven currencies, the Swiss Franc is likely to be one main benefactor. The USDCHF is currently in the middle of its corrective phase which started after a breakdown below its horizontal resistance area. Price action is now trading between its primary ascending support level and its primary descending resistance level from where a breakdown is expected. Forex traders are advised to sell the USDCHF above 0.9920.

The CCI is currently trading below the 0 level and maintains its bearish momentum. A further contraction into extreme oversold territory is expected to lead price action lower. Download your PaxForex MT4 Trading Platform now and fund it through many different options which include Bitcoin and Ethererum!

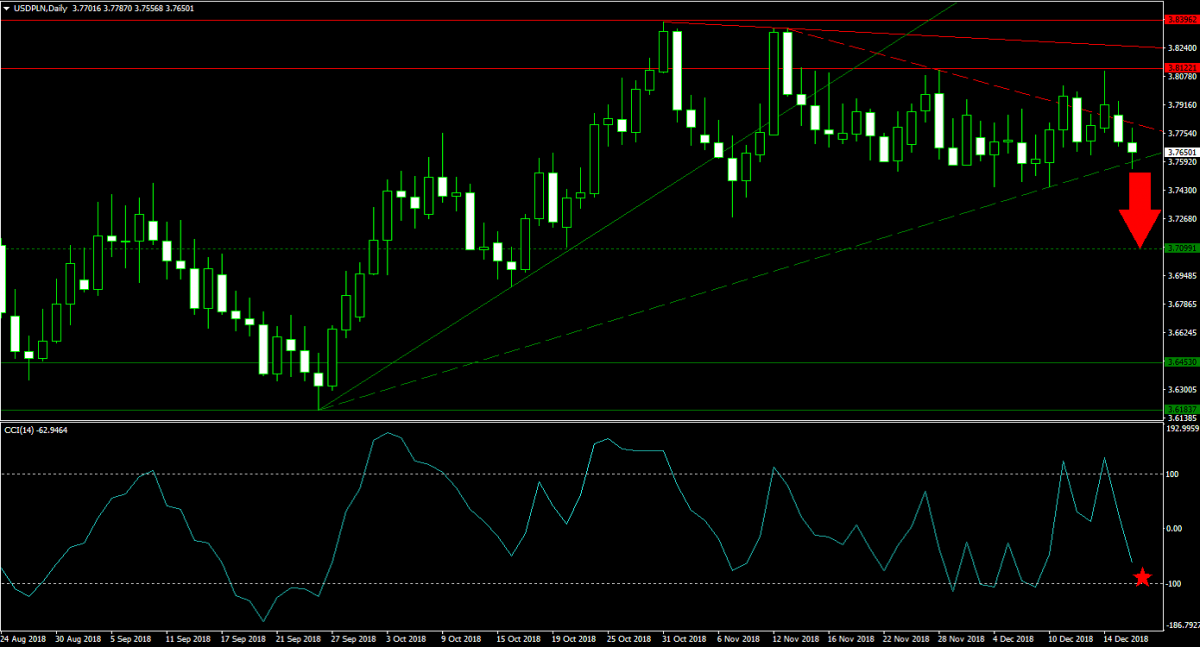

Forex Profit Set-Up #2; Sell USDPLN - D1 Time-Frame

Similar to the USDCHF, this currency pair has completed a breakdown below its horizontal resistance level. A sideways trend followed the breakdown which allowed the secondary ascending support level and the secondary descending resistance level to converge on the USDPLN. Another breakdown is expected to take this currency pair back down into its next horizontal support level and forex traders are recommended to sell the USDPLN above its secondary ascending support level.

The CCI dropped from extreme overbought conditions and plunged though the 0 level for a bearish momentum crossover. An extension of this move is expected. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide your forex portfolio through the markets; earn over 500 pips per month!

Forex Profit Set-Up #3; Buy BTCUSD - D1 Time-Frame

As the US Dollar is forming a top and is faced with an increase of bearish pressures, Bitcoin is on the other side of the spectrum. Fundamentals have improved and are expected to continue this trend and this cryptocurrency has formed a bottom. Price action in the BTCUSD is currently trading inside of its new horizontal support area with momentum building for a breakout. This would clear the path for a rally into its primary descending resistance level. Buy positions for the BTCUSD inside its current support area are favored.

The CCI has already moved out of extreme oversold territory as a positive divergence formed and supplied the required bullish momentum. A push above the 0 mark is expected to attract another wave of buyers. Subscribe to the PaxForex Daily Forex Technical Analysis and just copy the recommended trades posted by our expert analysts into your own portfolio!

To receive new articles instantly Subscribe to updates.