US President Donald Trump and his administration view cheap steel imports as a threat to national security and he often pointed out to China dumping cheap steel on the global market. While President Trump has in the past changed his opinion on proposals, it appears that his proposed 25% tariff on imported steel is something he wants to force through. Global as well we domestic criticism about this move are elevated as it will initiate another world war, this time not militarily but economically through a trade war which will leave many victims in its path. Forex traders need to be aware of the implications and how it can move currencies from countries involved.

Many who blame China on the demise of the US steel sector and who applaud the proposed 25% tariff fail to realize that China’s share of the imports are minimal and the tariffs won’t have any significant impact on Chinese steel exports. The US imports about 30% of its steel and Canada is it biggest supplier. China only accounts for 2.5% of US steel imports. In addition to the 25% tariff on steel imports, a 10% tariff on aluminum imports is on the table. The tariffs will do little to change the direction of the US steel market which will continue to lose jobs due to automation rather than imports from countries which can produce steel at cheaper rates than its US counterparts.

While the tariffs will have little to no positive impacts on the US steel industry, it will have a devastating impact in other areas. Trade wars are never a good idea and in this case the US consumer will have to pay the bill. Goldman Sachs noted that 'Import tariffs make the US less competitive by raising the prices of raw materials. The president has likely created a two-tier metal market. Economically, a two-tier market is ultimately damaging to US downstream industries that consume these metals, as it creates an uneven playing field for US industries that face higher metal prices.' Trading partners have sought exemption from the tariffs which seem unlikely at the moment, but what does seem very likely is retaliation against US exports.

As trade wars unfold, currencies will move which is why forex traders need to be aware of which countries are dragged into a trade war and how their currencies will be impacted. Economies which are at the forefront of this trade war are the US, the EU, Canada, Mexico, China, Australia, Japan, South Korea and Russia. An increase in volatility will accompany the global trade war which will create many trading opportunities on the short as well as long end. Open your PaxForex trading account today in order to benefit from price action in the forex market as a result of the US-EU trade war.

Today, the EU announced a proposed tariff of 25% on US goods if President Trump does enforce the planned tariff on steel and aluminum imports. The EU seeks to target €2.8 billion worth of imports of US goods to the trading bloc which will include €1.0 billion worth of apparel, consumer and luxury as well as recreational goods, €951 million worth of agricultural goods and €854 million worth of industrial goods. The proposed EU import tariffs would result in a tit-for-tat response to US tariffs on exports from the EU. Ultimately, the punishment would span a wide range of US exporters. With the US-EU trade war on the horizon, here are three forex trades to shine.

Forex Profit Set-Up #1; Buy EURUSD - MN Time-Frame

Trade wars take some time to play out and our first candidate us the EURUSD which puts both main actors in direct competition. The trend for the Euro has been to the upside with the economy firing on all cylinders which led to a breakout above its horizontal support area. This currency pair is now approaching a key descending resistance level and a sustained move above it will clear the path for the EURUSD to advance back into its horizontal resistance area. Forex traders are advised to buy the dips in this currency pair below 1.2250 as it is ready for a major advance. The trade war could provide the spark it needs to push higher.

The CCI is trading above and below the 100 level which identifies extreme overbought conditions. Any pull-back in price action will take this indicator into neutral territory, but is predicted to remain above the 0 mark, and confirm a solid buying opportunity. Download the PaxForex MT4 Trading Platform now and add this forex trade to your portfolio before a the expected breakout will materialize.

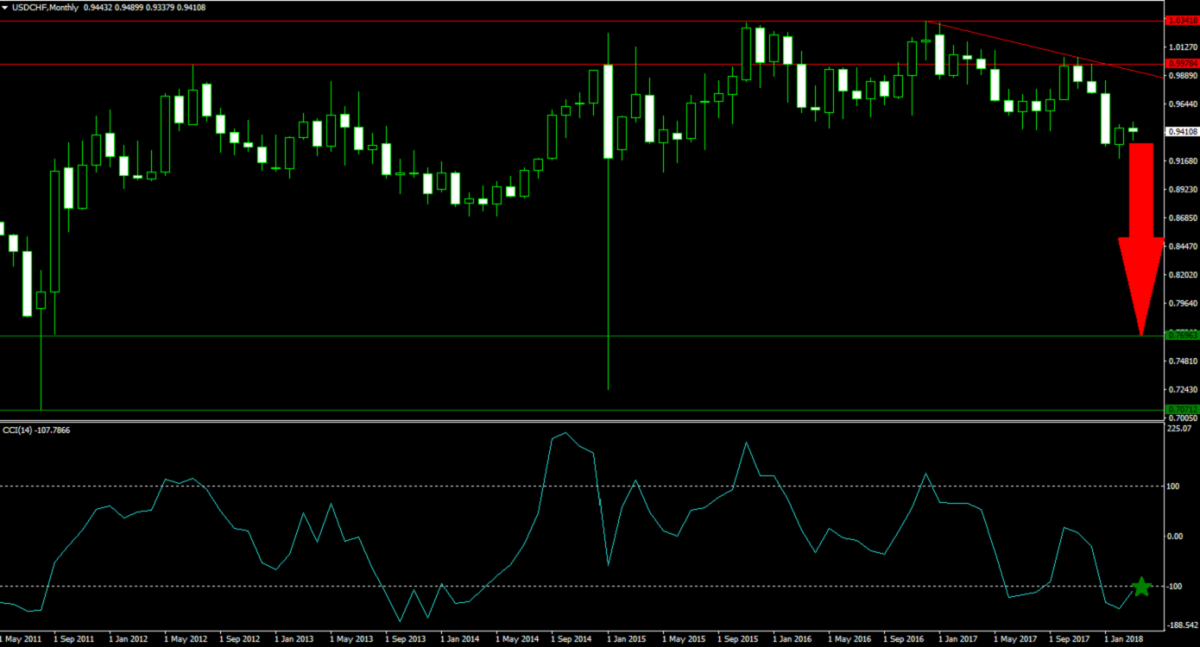

Forex Profit Set-Up #2; Sell USDCHF - MN Time-Frame

A good counter-part to the above mentioned trade is a short position in the USDCHF. Switzerland is home to plenty of commodity traders and the currency will be moved when a trade war threatens to disrupt price action. Unless the US administration will have a change of heart, this currency pair is set to resume its down-trend. After the completion of a breakdown below its horizontal resistance area, a momentum change to bearish occurred. In addition price action is being pressured to the downside by its descending resistance level which is set to guide the USDCHF lower. Forex traders are recommended to sell any potential rallies above 0.9450.

The CCI collapsed below -100 which took price action into extreme oversold conditions, but this indicator has started to drift higher. An advance in the USDCHF will take it above the -100 mark and could push it closer to the 0 level which would coincide with a good short entry into this trade. Follow the PaxForex Daily Forex Technical Analysis and get our experts’ most profitable technical forex trades every trading day.

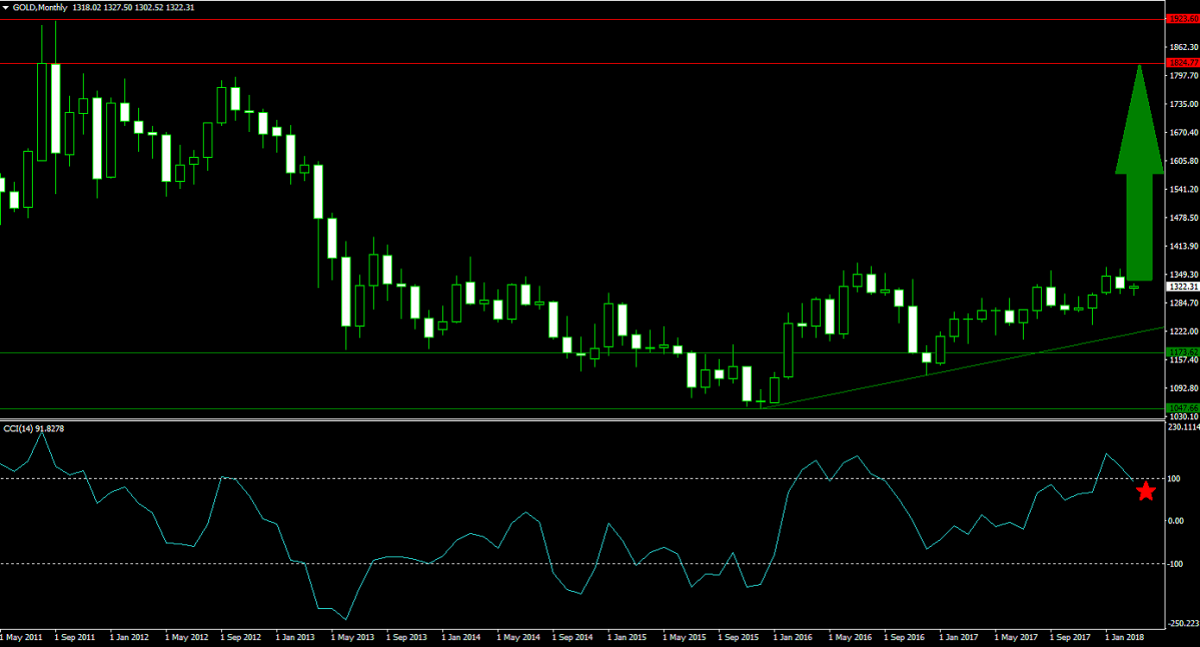

Forex Profit Set-Up #3; Buy Gold - MN Time-Frame

Gold remains the go-to asset when uncertainty and fear increase. A trade war between the US and the EU is likely to continue to apply upward pressure on Gold which could extend its advance to highs last seen in 2012. After this commodity broke out above its horizontal support area, a brief pull-back followed which led to the formation of an ascending support level. This level now apples upside pressure on price action. Forex traders are advised to hedge their forex portfolio with long positions in Gold, best added during brief sell-off below 1,300.

The CCI, a momentum indicator, briefly spike above 100 but has since then retreated below it. The predicted minor pull-back will further push the CCI lower and into good buying conditions closer to the 0 mark. Subscribe to the PaxForex Daily Fundamental Analysis and get the most important forex trades delivered every day. Learn how add over 500 pips per month, let our experts do the work and find the trades for you!

To receive new articles instantly Subscribe to updates.