The International Monetary Fund (IMF) will hold is bi-annual meeting in Washington this week. Today finance ministers as well as central bankers from the G20 will convene which will be followed by Saturday’s meeting which will include all member nations of the IMF. The US as well as China are on a path to gather allies for their trade war, especially within the G20 members. This is a sign that both sides are preparing for a longer stand-off and a potentially deeper trade war than markets are currently prepared for. This is likely to result in an increase in volatility across asset classes from equity markets through forex markets to bond markets.

The business community as well as investors will take this as a sign to be more cautious in the medium term which will have an impact on the global economy. The trade war officially started after the Trump administration imposed tariffs on steel and aluminum on Chinese imports citing national security concerns. Some of the other countries are negotiating exemptions from the tariffs. China retaliated by imposing tariffs on US imports. The US has threatened more sanctions against China, this time on the grounds of intellectual property infringement and China vowed to respond in kind if those sanctions will be applied.

As the trade war is set to widen in scope, the US Dollar and the Chinese Yuan are set for wild price swings. Traders will react to each development and reallocate assets if the news create a fundamental change in their perspective on the currencies. Stephen Orlins, the President of the US National Committee on US-China Relations noted in regards to the relations that ‘I’m deeply concerned.Over the next 12, 18, 24 months it may be deeply, deeply disrupted.’ China held high-level talks with Japan and India who face tariffs from the US as well.

As the US and China gather allies and the trade war is set to intensify, it will create many profitable trading opportunities in the forex market. Open your PaxForex Trading Account now and take full advantage of the upcoming forex trading moves. Our expert analysts will guide you through the price action swings and cover currency pairs from a fundamental as well as technical perspective.

The former IMF China Division Chief, Eswar Prasad, stated that ‘China’s rising economic might, coupled with the perception of the U.S. as an unreliable and untrustworthy partner, is driving countries around the world closer into China’s economic embrace.’ Since the US is pushing tariffs against many of its trading partners it will find itself isolated in this trade war. The US Dollar is likely to feel the brunt of the impact on the forex market. How deep the dislike with the US tariff policy will run remains yet to be seen as countries try to negotiate with the US individually. The US-China trade war is set to intensify and here are three forex trades to pip your portfolio.

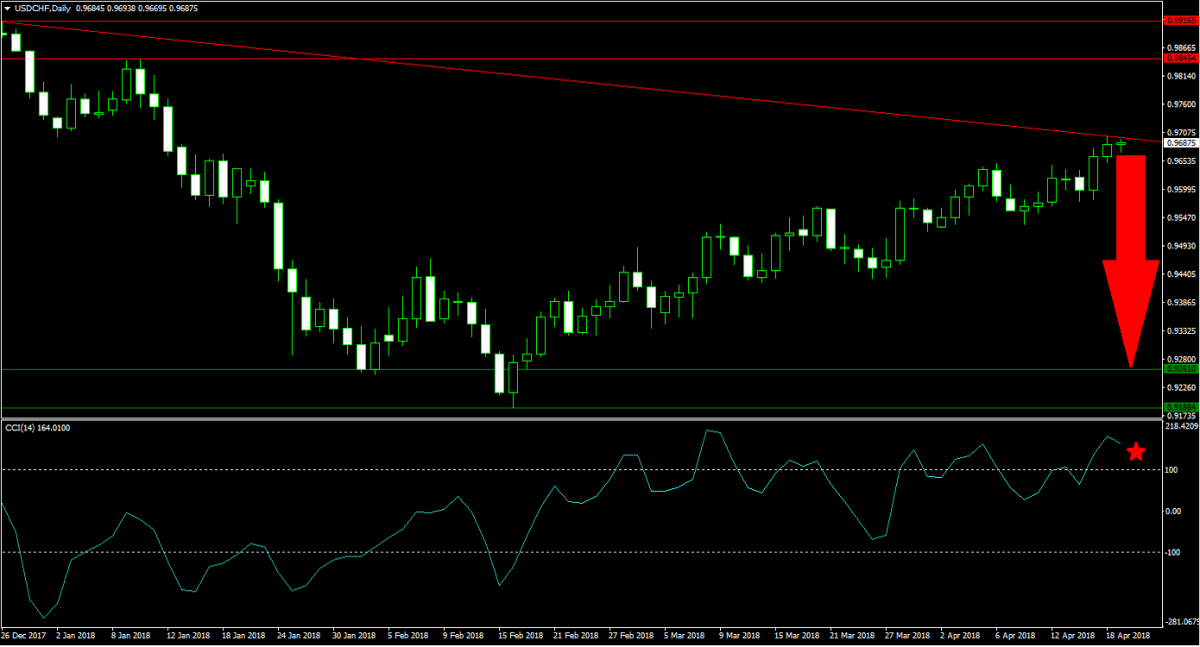

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

The US Dollar could end up with the biggest defeat as a result of a more intense trade war between the US and China. The USDCHF has steadily advanced after pushing above its horizontal support area, but is now trading at its descending resistance level which can trace its origin to the upper band of its current horizontal resistance area. Profit taking at current levels could result in a price action reversal and forex traders are advised to sell the rallies.

The CCI is trading in extreme overbought conditions and a correction in the USDCHF is set to push this indicator below 100. This will attract more sell orders as upside momentum will start to reverse. Download your PaxForex MT4 Trading Platform now and add this trade to your forex portfolio before its next move to the downside will unfold.

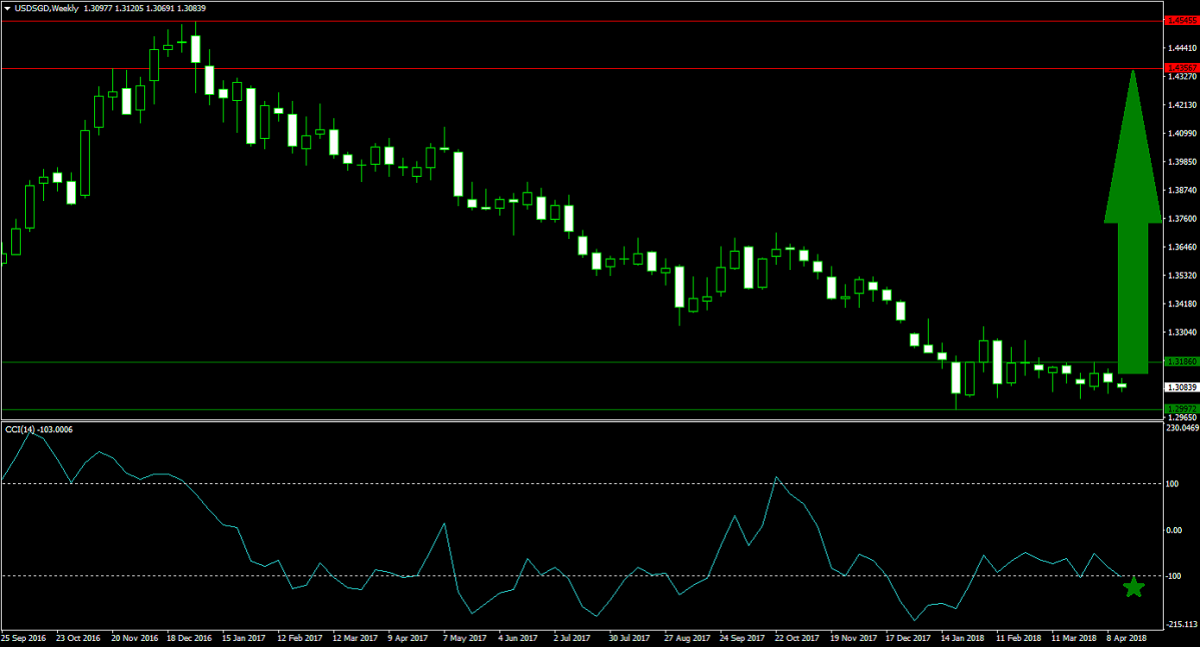

Forex Profit Set-Up #2; Buy USDSGD - W1 Time-Frame

A good hedge to the above USD short trade is a long position in the USDSGD. While Singapore is not directly involved in the trade war, the Singapore Dollar is ripe for some profit taking as volatility in the forex market is set to accelerate. The USDSGD is currently trading inside of its horizontal support area and bearish momentum is receding. A push above the upper band of its horizontal support area is set to ignite a short-covering rally. Forex traders are recommended to spread their buy orders between 1.3000 and 1.3185.

The CCI has dipped into extreme oversold conditions below -100, but is well off of its previous lows which gives this trade its final bullish trading signal. Subscribe to the PaxForex Daily Forex Technical Analysis in order to receive the most profitable technical trading set-ups every day delivered straight from our analysts desk’s.

Forex Profit Set-Up #3; Buy AUDUSD - MN Time-Frame

The AUDUSD has completed a breakout above its horizontal support area which resulted in a momentum shift from bearish to bullish. This currency pair is set to resume its advance which is additionally supported by its ascending support level. With little resistance in its way, price action is set for a sharp increase. Forex traders should buy the dips into the ascending support level of the AUDUSD as this trade carries limited downside risk with great upside potential.

The CCI, a momentum indicator, has pushed above the 0 mark which confirms the bullish momentum shift which will continue to attract buy orders for this trade. Follow the PaxForex Daily Fundamental Analysis and earn over 500 pips per month as out expert analysts outline each trading day’s most important fundamental trading set-ups.

To receive new articles instantly Subscribe to updates.