All currencies are traded in pairs – and as such they share relationships with their counterparts. In other words, currency pairs are correlated with each other. Each of the currency pairs is influenced by different political events, news releases and also goods/material/financial trading between different global market centers. Studying the way each currency pair moves and fluctuates will help you to become a better trader. Understanding how to effectively utilize forex correlations can add another dimension to your technical analysis.

Forex traders, trade international currencies from different countries from all around the world. Currencies are issued by central banks and are used for international trade, investing and to control economies. The value of a currency has a direct impact on an economy, the outlook for a country, commodities, stock markets and the spending behavior of people. At the same time, currencies are influenced by many different factors such as inflation, interest rates, employment and many more. Currency correlation serves as the absolute foundation of the forex market.

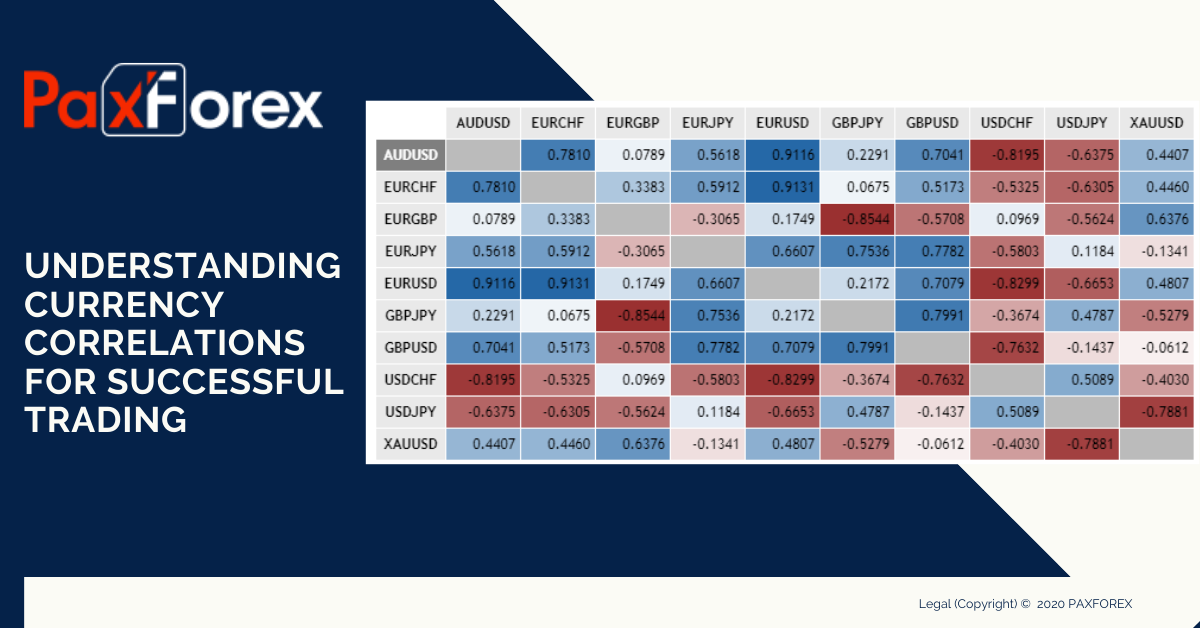

Correlated pairs are forex pairs comprised of two currencies which generally trade hand in hand and their correlation is very high. How correlated two currencies are can be checked by looking at each currency’s separate chart against the US Dollar. So, for example, the Australian and the New Zealand Dollars are two highly correlated currencies and this can be confirmed by looking at the AUDUSD and NZDUSD charts. Most of the time AUDUSD and NZDUSD move in the same direction.

When two or more pairs are highly correlated the correlation can be used as a confirmation for the moves which are occurring. For instance, if the GBPUSD makes a big move higher but the GBPAUD doesn’t, it could warn that the move higher in the GBPUSD will soon fail. Keep in mind though the GBPUSD pair will have its own trend that affects, and is affected by, the GBPAUD, and vice versa. Divergences from correlations are potential trading opportunities as well as possible warning signs that something significant is going on in one of the currencies. Pairs that diverge from long-term correlations may revert back and provide a trading opportunity, or it may signify a breakdown of the correlation.

Essentially, being aware of currency correlations can only make you a better trader, irrespective of whether you are a fundamental analyst or technical analyst. Understanding how the various currency pairs relate to each other and why some pairs move in tandem while others diverge significantly allows for a deeper understanding of the forex trader’s market exposure. Using currency pair correlation can also give forex traders further insight into established portfolio management techniques, such as diversifying, hedging, reducing risk and doubling up on profitable trades.