The World Economic Forums is on its way in Davos, Switzerland. There are plenty of topics discussed and regardless of which financial market you trade in, Davos is always a great place for breaking news and developments which may ripple through all parts of financial markets. Bank of England Governor Mark Carney commented that companies aren’t able to full prepare for a WTO type Brexit. He stated that “There are a series of logistical issues that need to be solved, and it’s quite transparent that in many cases they’re not. There is a limited amount that many businesses can do to prepare if there are going to be substantial delays on the logistical side.” The British Pound remained on a solid path higher.

French Finance Minister Bruno Le Maire announced, in Davos, the resignation of Carlos Ghosn from Renault. His resignation came from a Japanese prison cell where he has been fighting allegations against him which include tax fraud. Ghosn is credited with holding the challenging Renault-Nissan alliance, the largest manufacturer of electric cars, in place for the past two decades. He was also a well know figure in Davos. Independent Auto Industry Consultant Bernard Jullien stated “It’s the kind of thing that happens when somebody stays in power for too long.” Renault is the biggest French auto manufacturer and problems at Renault often indicate a weak French economy which is shows a contracting manufacturing sector according to this morning’s PMI data. The Euro has plenty of headwinds which increase in strength.

Turkish Treasury Minister Berat Albayrak met investors and officials from around the world, convincing them that the Turkish economy is on the right track. He stated that the current soft patch in the economy is a healthy development and in-line with his soft landing strategy. As he expects the current slowdown to extend, his outlook for 2019 remained bright. He noted that “Following the second quarter, Turkey’s going to be very much aligned with what we have planned for the 2019 growth, which was 2.3%. So it’s very much on track.” The Turkish Lira has been strengthening following a melt-up last summer, a trend which may be extended especially against the Euro.

Forex traders have plenty of news flow to monitor as the first quarter of 2019 shapes up rather interestingly. The British Pound is approaching the Brexit deadline, the Euro is dealing with recession pressures and the US Dollar is weakening against a slowing global economy. The Japanese Yen attracts bids as a safe haven currency and the Australian Dollar receives volume as a Chinese Yuan proxy trade. Are you ready to profit from a very exciting forex market in 2019? Take the first step now by opening your PaxForex Trading Account!

Saudi Arabia is on a charm offensive in Davos, juts three months after the international community tried to distance itself fro the oil rich kingdom due to the Khashoggi murder. The kingdom is owner of the largest billboard in Davos which reads “Invest Saudi: The Future-Forward Economy.” The Saudi delegation to Davos is unified in the comment of Aramco CEO Amin Nasser when asked about the Khashoggi situation: “We don’t have any problem.” It appears to be back to normal for Saudi Arabia which is key to stability in the Middle East, oil and therefore oil dependent currencies such as the Canadian Dollar. Patrick Pouyanne, CEO of Total, commented that “Let’s look more positively and move forward.” 4 Davos developments with global reach and here are three forex trades for ongoing portfolio profitability.

Forex Profit Set-Up #1; Sell GBPCHF - W1 Time-Frame

The British Pound has enjoyed a solid January, but its price action recovery may be short-lived. With plenty of uncertainty in the pipeline, forex traders may opt to take profits which would reverse the rally in the GBPCHF. Price action extended its move higher into its secondary descending resistance level, from where bearish pressures are on the rise. A breakdown below its primary descending resistance level, which currently acts as support, should take the GBPCHF into the upper band of its horizontal support area. Sell orders from current levels are favored.

The CCI recorded a higher low in extreme overbought territory from where it was able to quickly advance and push above the 0 mark for a bullish momentum shift. This technical indicator is now approaching a descending resistance level which is likely to force a new momentum change. Download your PaxForex MT4 Trading Platform now and join our community of profitable forex traders which grows daily.

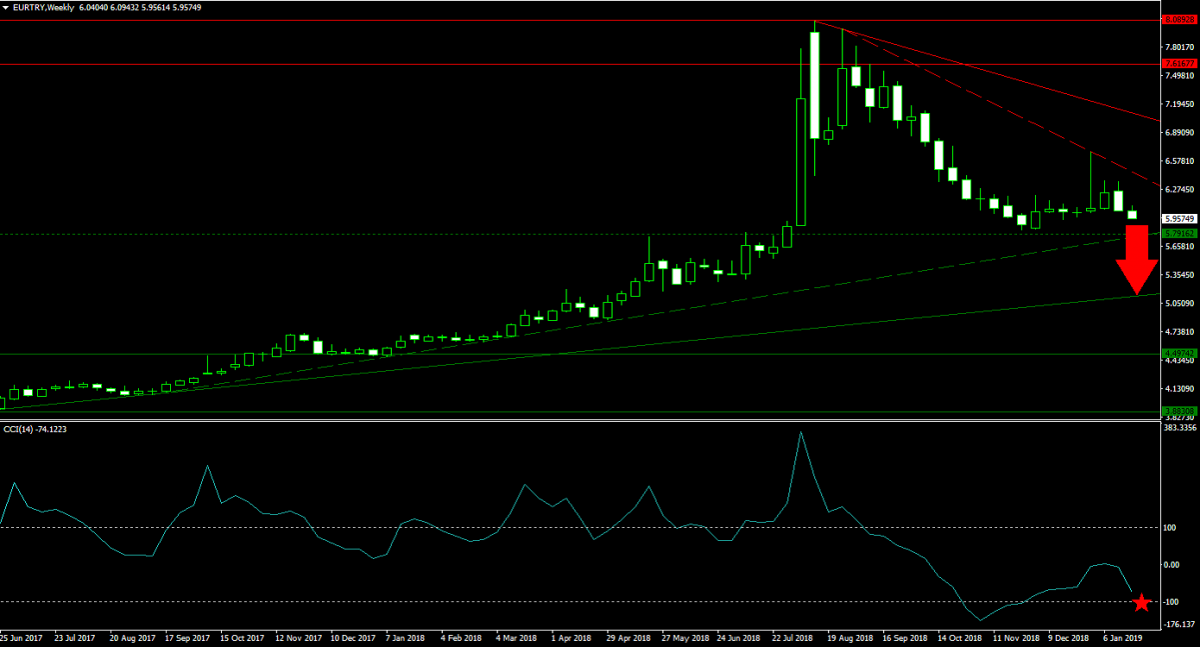

Forex Profit Set-Up #2; Sell EURTRY - W1 Time-Frame

As Turkey appears to be on the right track and the Eurozone is headed down a much bleaker economic cycle, there is room for the EURTRY to extend its recovery. Many traders have written of the Turkish Lira last summer, but following the elections and political changes a rebound started. Price action is now expected to complete a double breakdown, below its horizontal support level and its secondary ascending support level, which will take the EURTRY into its primary ascending support level. Forex traders are advised to sell the rallies into its secondary descending resistance level.

The CCI initially recovered from extreme oversold conditions, but this momentum indicator failed to sustain a move above the 0 level. With bearish momentum remaining dominant, a lower low inside extreme oversold territory is anticipated. Follow the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the guidance of our expert analysts.

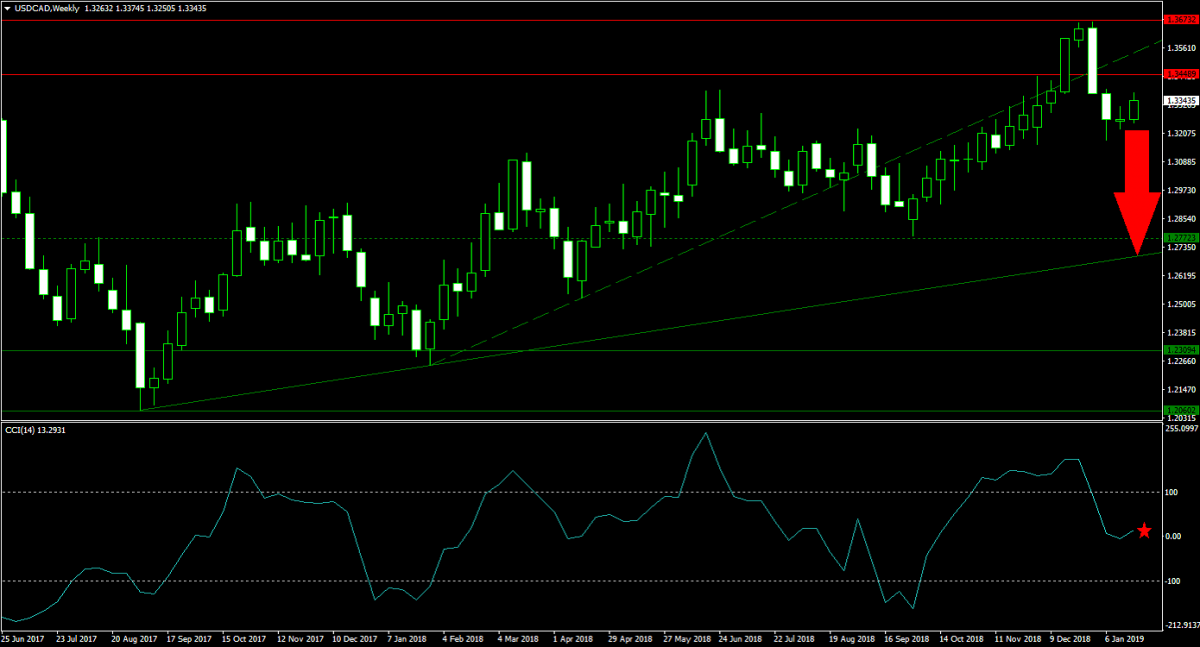

Forex Profit Set-Up #3; Sell USDCAD - W1 Time-Frame

Oil prices are expected to remain volatile in 2019 as the global economy is set to slow down, but oil supply disruptions may and output cuts may cushion the fall. The USDCAD may benefit from oil prices gyrating higher on the back of a volatility spike as the US economy cools. Price action completed a breakdown below its horizontal resistance area as well as below its secondary ascending support level which turned into resistance. An extension of this breakdown is expected to take the USDCAD into its primary ascending support level which is located just beneath its horizontal support level. Forex traders are recommended to sell the rallies into the lower band of its horizontal resistance area.

The CCI plunged from extreme overbought levels, but paused around the 0 mark. A push into negative territory is expected to lead a bearish momentum change to the downside which will attract more sell orders. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account.

To receive new articles instantly Subscribe to updates.