Delays, defeats and deadlines have been the norm since Prime Minister May brought back a deal from Brussels almost nobody in Parliament supports. Today’s vote was scheduled for last month, but May pulled it as it was clear that she would suffer a great defeat. Today appears to be no different, but many are now waiting to see by how many votes she will actually lose in order to determine the next steps. The EU could give more concessions if May loses by less than 60 votes. German Chancellor Merkel assured May that she will try to get more out of the EU in order to help May win over votes in case of a defeat, according to a newspaper report published without naming sources of this information.

This could be wishful thinking as May is on track for the biggest Parliamentary defeat in 95 years. She will have at least 70 members from her own party vote against the deal and her junior partner, the DUP, is expected to vote it down as well. Adding the number of expected opposition Labour MP’s and she could lose by as many as 150 votes. Even if a group of expected MP’s will abstain from today’s vote, May is still on track to lose by roughly 100 votes which would be the biggest defeat in UK politics since 1924.

May continues to believe that her deal is the best one possible and pleaded that “I will be continuing to encourage members of this House to vote for what I believe to be a good deal. We asked the people what their view was and said we would do what they decided, and we should now do it.” The size of the defeat this evening will be the most important factor to watch. A defeat is expected and so is a no confidence vote by the opposition Labour government which may be called as soon as this week.

It is smart to not take British Pound trades today as the uncertainty is great and volatility is expected to soar. Will May lose by over 150 votes and send the British Pound tumbling in a wild session or will forex traders cheer her defeat? Open your PaxForex Trading Account now and take the first step to a profitable forex trading future!

Key Brexit supporter and former UK Foreign Secretary as well as London Mayor Boris Johnson remained confident in voting against May’s deal in order to put the UK on the proper track for a bright future. He stated that “We can flunk it, we can vote for this deal, and we would thereby confirm the worst suspicions of the British public about the cynicism of the elite, or we can get it right and seize the opportunities before us. If and when this deal is voted down let us not continue to flog this dead horse.” Today the UK Parliament will vote on May’s Brexit deal which she is expected to lose in a bitter defeat, but here are three trades which will keep your profits rising.

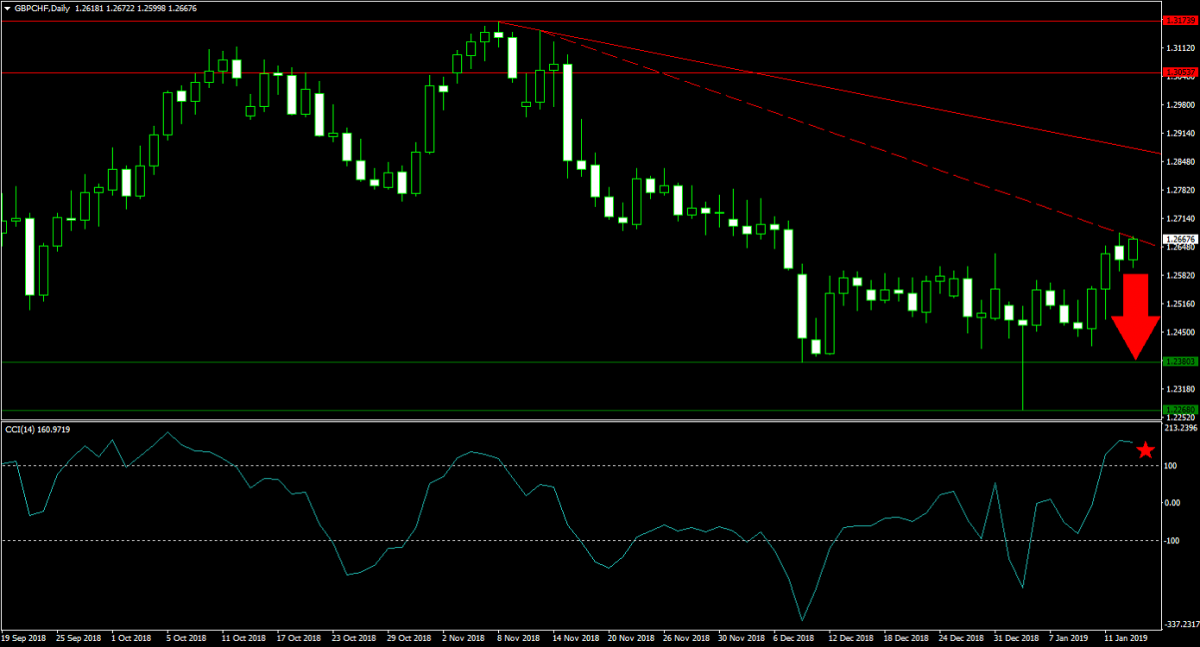

Forex Profit Set-Up #1; Sell GBPCHF - D1 Time-Frame

While forex traders should be careful with the British Pound today, or avoid it altogether, those who are seeking a bit more risk can take a look at the GBPCHF. This currency pair offers a one-two punch as the British Pound is set to plunge while the safe-haven Swiss Franc could spike temporarily. The secondary descending resistance level is additionally applying downside pressure on price action and the GBPCHF could quickly drop into the upper band of its horizontal support area. Sell orders are favored from current levels.

The CCI quickly accelerated into extreme overbought conditions, but has started to reverse from its peak. A move below 100 could initiate a profit-taking sell-off, but today’s UK Parliamentary vote on May’s Brexit deal will remain the driving force. Make a deposit into your PaxForex Trading Account today and start building a revenue generating forex portfolio with the help of our expert analysts!

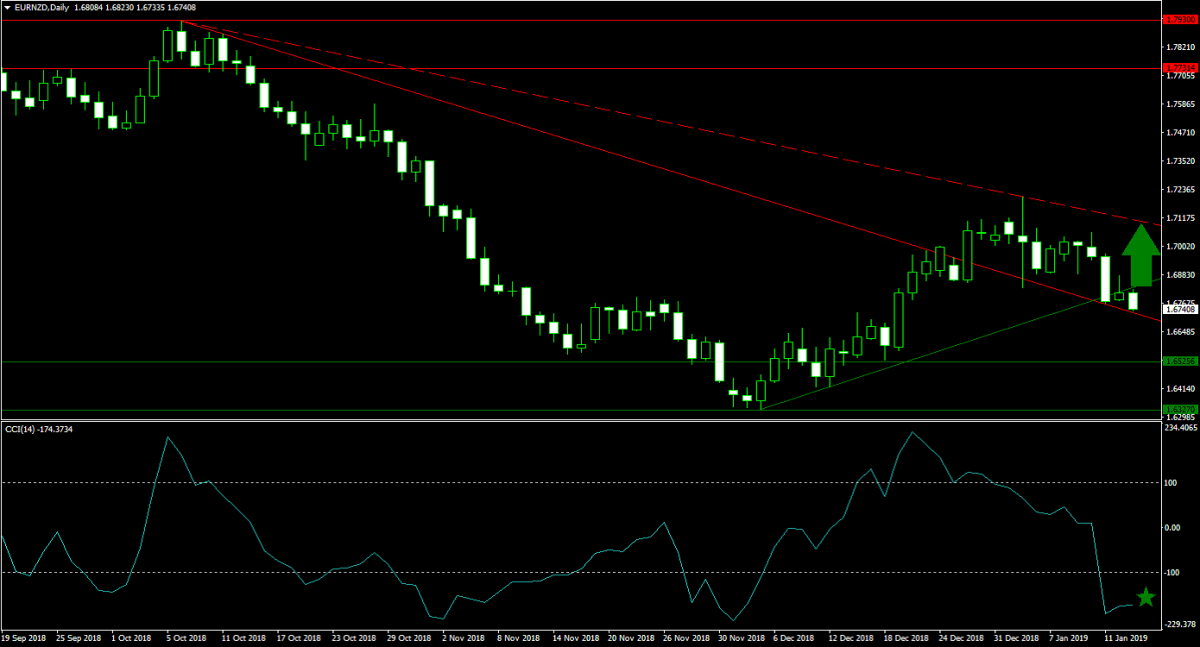

Forex Profit Set-Up #2; Buy EURNZD - D1 Time-Frame

Staying away from Brexit volatility, but still pegging two declining currencies against each other and the EURNZD offers a great trading opportunity. While the Eurozone remains in slowdown mode, so does China which pressures commodity currencies like the New Zealand Dollar. Price action is currently trading at its primary descending resistance level which acts as support and just below its primary ascending support level which acts as resistance. A push higher is anticipated which will take the EURNZD back into its secondary descending resistance level. Forex traders are advised to enter their buy orders at current levels.

The CCI has dropped deep into extreme oversold territory, but did record a higher low with bearish momentum fading. This technical indicator is is anticipated to complete a breakout above the -100 mark which will initiate a short-covering rally. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide to over 500 pips in monthly profits.

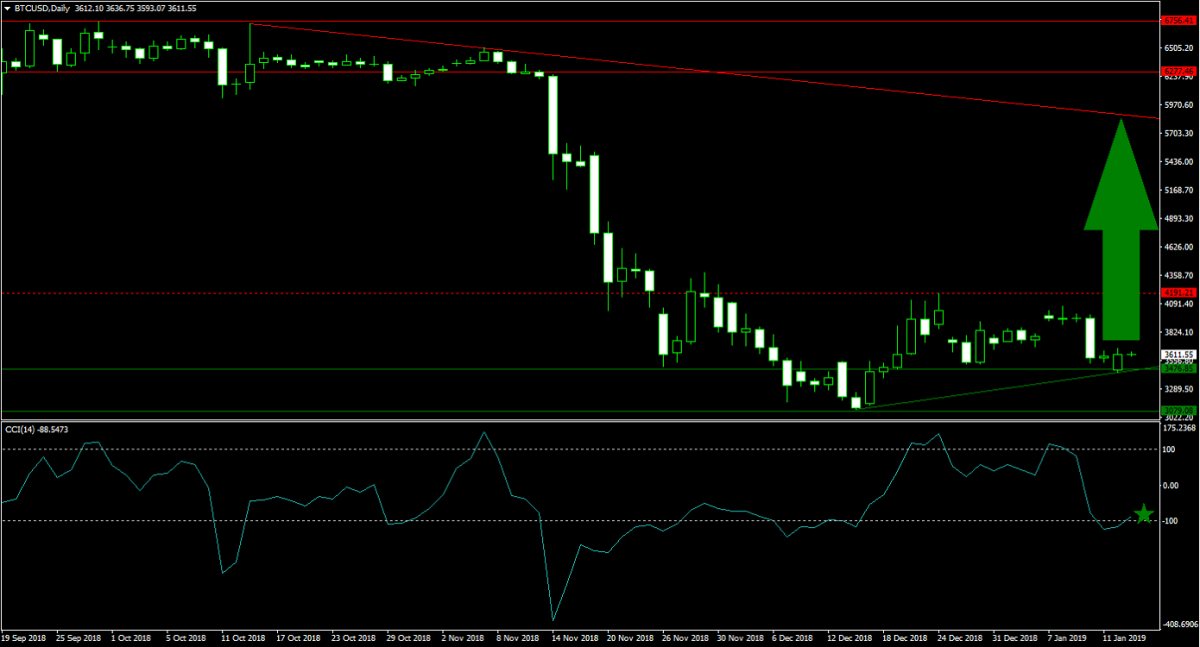

Forex Profit Set-Up #3; Buy BTCUSD - D1 Time-Frame

As forex volatility spikes, cryptocurrencies often attract bids which sets up BTCUSD for a potentially powerful rally following this evenings expected defeat of May’s Brexit deal in Parliament. After stabilizing at the upper band of its horizontal support area, bullish momentum is building and with limited resistance in its way around the $4,000 level, BTCUSD can extend a breakout above it into its primary descending resistance level. Forex traders are recommended to buy the dips.

The CCI briefly descended into extreme oversold conditions, but reversed above the -100 level as bullish momentum is accumulating with price action at strong support levels. A move by this momentum indicator above the 0 mark is expected to further fuel a strong advance. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades of our expert analysts into your own forex trading account.

To receive new articles instantly Subscribe to updates.