Investors have not had a chance to fully digest what the announced tariff truce between the US and China means, but US President Trump has already moved towards his next target. While the trade dispute between the US and the EU started before Trump took office, it is expected that ties between both sides will deteriorate. At the center of the dispute are US based Boeing and EU based Airbus. The US has accused the EU of heavy subsidies for Airbus which give the aerospace and defence giant an unfair advantage. Trump has added to the dispute by attacking the Euro, the ECB and the trade deficit the US runs with the EU.

Just as financial markets received the news that the US and China agreed to not implement a fresh round on tariffs which would have further strained the global supply chain, the US Trade Representative’s (USTR) published a list of $4 billion worth of goods from the EU for retaliatory tariffs due to Airbus subsidies. This comes on top of the previous list which totals $21 billion worth of goods. The additional goods which were listed cover products from agriculture through whiskey to industrial goods. A public hearing in the proposed tariffs is scheduled for August 5th 2019.

According to the USTR, the Airbus subsidies cost the US economy $11 billion per year. The World Trade Organization (WTO) agrees with the US case and will announce their decision this summer in regards to how much the US can retaliate. EU subsidies violate international trade rules, but the EU has brought their own case against the US. The EU expected tariffs to be imposed after the WTO ruling, but pointed out that ties will be further strained. The USTR stated “The final list will take into account the report of the WTO Arbitrator on the appropriate level of countermeasures to be authorized by the WTO.”

How will this impact the Euro which is under pressure from a slowing economy and a dovish central bank? How will the US Dollar react which is struggling due to the negative impact of the trade war with China and a central bank poised to reverse monetary policy? Does your forex trade analysis consider the implications to the upside as well as to the downside? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

The EU has readied a list worth $12 billions of US goods sourced from states which form the core of Trump’s base, in retaliation to US subsidies provided to Boeing. US industry groups moved fast to voice their opposition to tariffs. The Distilled Spirits Council noted to the USTR that “US companies from farmers, to suppliers to retailers are already being negatively impacted by the imposition of retaliatory tariffs by key trading partners on certain US distilled spirits resulting from other trade disputes.” This showcases the ripple effects and negative impacts on the US economy, countering the claims of the Trump administration. Trump’s EU tariffs are being prepared and here are three forex trades to prepare your account for profits!

Forex Profit Set-Up #1; Buy EURUSD - W1 Time-Frame

With the Euro and the US Dollar facing heavy headwinds over the summer months, the Euro started to stabilize after a strong sell-off. Forex traders already know the ECB is dovish, but the US Fed just started to lean towards interest rate cuts. This will pressure the US Dollar to the downside and provide a boost to the EURUSD. Price action just pushed above its horizontal support area from where more upside is favored. A breakout above its primary descending resistance level will clear the path for a rally into its next horizontal resistance level. Forex traders are advised to buy and dips in the EURUSD down to the lower band of its horizontal support area.

The CCI spiked into extreme overbought conditions before retreating below the 100 level. A new push to the upside is anticipated as price action is set for an extension of the rally. Download your PaxForex MT4 Trading Platform and find out how forex traders earn more pips per trade by trading with one of the prime MetaTrader4 brokers!

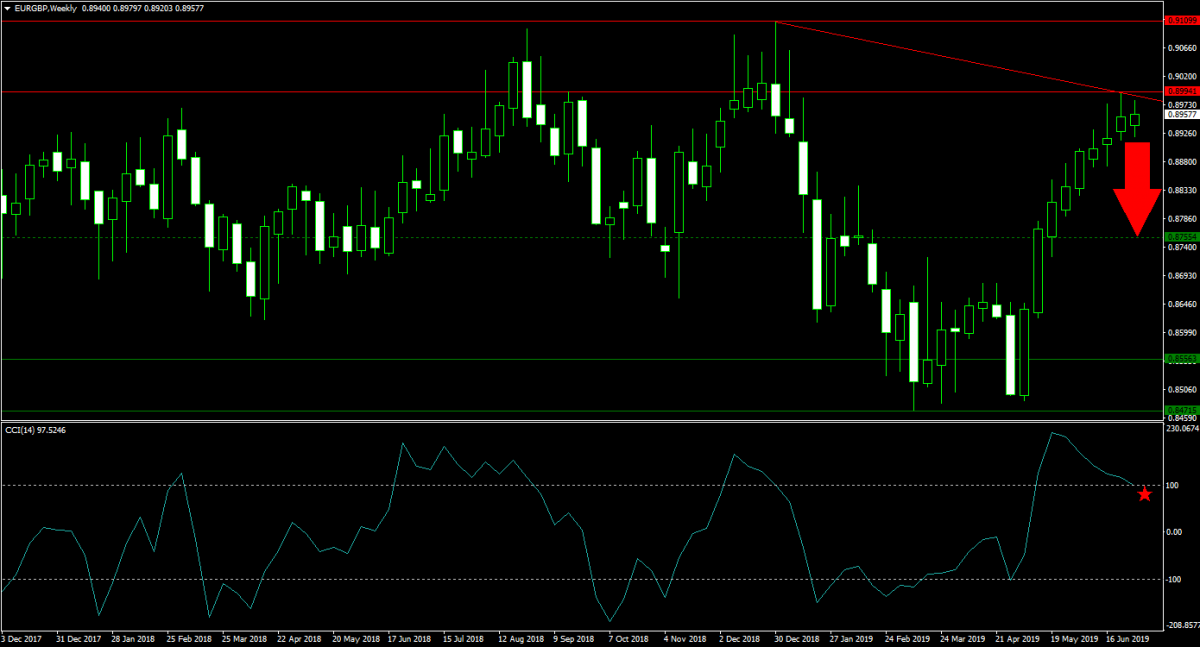

Forex Profit Set-Up #2; Sell EURGBP - W1 Time-Frame

While there is plenty of upside in the EURUSD, the EURGBP is ripe for a bigger sell-off especially with Boris Johnson staying in the lead to become the next British PM. Price action ran into the lower band of its horizontal resistance area from where it was rejected and a primary descending resistance level added to bearish pressures in this currency pair. The failed breakout has cleared the path for a price action reversal on the back of profit taking which can take the EURGBP back down into its next horizontal support level. Forex traders are recommended to sell any rallies in this currency pair up into the upper band of its horizontal resistance area.

The CCI is retreating from a new high in extreme overbought territory and just moved below 100. This resulted in a build-up in bearish momentum and this technical indicator is set to contract further. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide to over 500 pips in monthly profits!

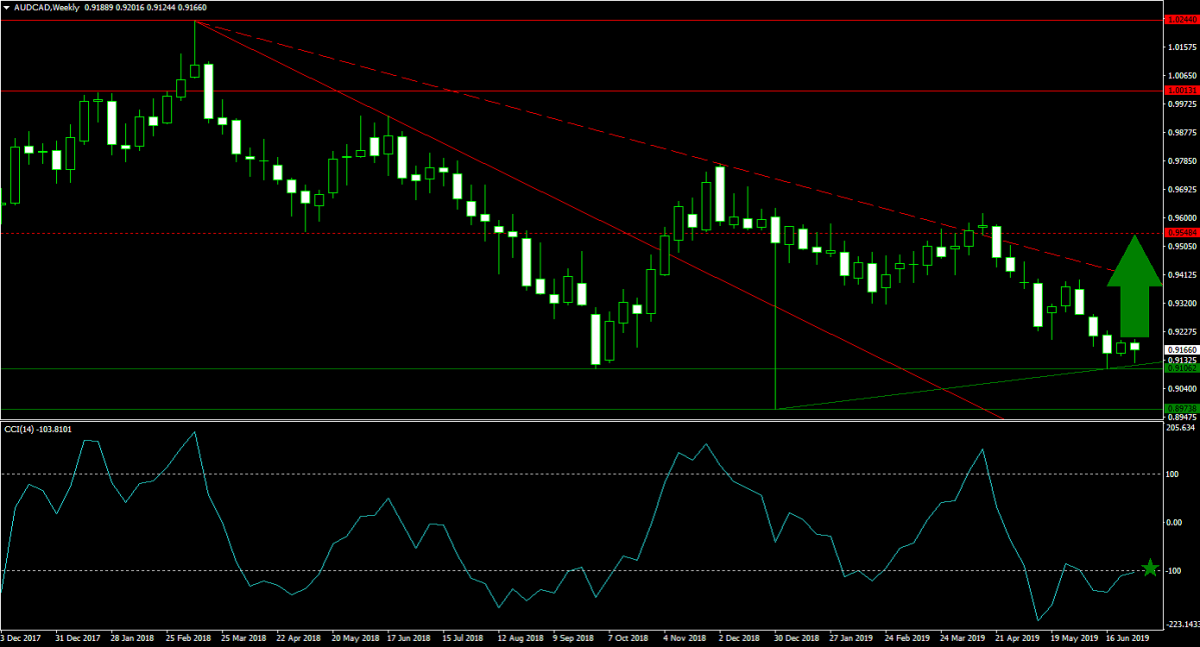

Forex Profit Set-Up #3; Buy AUDCAD - W1 Time-Frame

Commodity exporters are facing a negative impact from the disruptions the global supply chain as a result of trade wars and tariffs, but the spike in oil and gold prices have limited the impact. Australian and Canada are two major exporters of commodities with Canada more exposed to oil and Australian more exposed to Gold. The AUDCAD halted its correction after its reached the upper band of its horizontal support area from where its primary ascending support level added further bullish momentum. Price action is now expected to push above its secondary descending resistance level and back into its next horizontal resistance level. Buying any dips in the AUDCAD down to the lower band of its horizontal support area remains the favored trading approach.

The CCI remains in extreme oversold conditions, but has recovered from its lows. This momentum indicator is now anticipated to eclipse the -100 mark and extend to the upside. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.