According to the US as well as China, there has been plenty of progress made in the trade talks aimed at ending the trade war initiated by the US. Several reports suggested that both leaders may meet this month in order to officially end the trade war, but at least three officials with knowledge of talks have now come forward and stated that there won’t be any such meeting in March. President Trump and Xi may meet at Trump’s Mar-a-Lago golf resort, if they meet at all. The Chinese side is worried about Trump’s willingness to walk out of discussions he dislikes as he did with the Democrats at the White House and with North Korean Leader Kim Jong-un in Vietnam.

China insists on a formal state visit in order to sign the potential trade deal and is not interested in a low key meeting just to sign it. This will take more time for preparations on the US side which could explain the delay. Sources claim that a visit at the end of April is possible. The US has hoped that President Xi will fly to the US later this month as he wraps up his trip to Europe, this was denied by staff members of President Xi’s delegation. There has been no official response from the White House in Washington, DC or the State Council in Beijing.

Some analysts believe the reason for the delay in the potential meeting is more serious than media reports suggest. It could hint that both sides are too far away from striking a meaningful deal which both leaders are comfortable taking back to their respective countries. According to US Trade Representative Robert Lighthizer, who is leading the US side in negotiations, plenty of unresolved issues remain which will prevent a trade deal from being signed. One of the biggest issue remains the transfer and treatment of intellectual property rights. While smaller concessions were granted from both sides, Lighthizer noted that none of the big issues which led to the trade war have been addressed.

Are the US and China close to reaching a trade deal or are both sides too far apart? The US Dollar has seen a rise in volatility which has been echoed in the price of Gold. The global economy is slowing down and while the trade war between the US and China has had an impact, some analysts questions if a trade deal will unravel the damage done. Open your PaxForex Trading Account now and start building a portfolio which will grown steadily over time with the help of our expert analysts.

Even President Trump has scaled back the urgency of signing a deal before the month is over. He has further acknowledged the fact that China has concerns over him walking out. This has resulted in Trump pushing back the date for a meeting with President Xi. Trump noted that “We could do it either way. We can have the deal completed and come and sign or we can get the deal almost completed and negotiate some of the final points. I would prefer that. But it doesn’t matter that much.” For the time being, the Trump-Xi meeting has been postponed, but here are three forex trades which will deliver pips on time!

Forex Profit Set-Up #1; Buy USDMXN - D1 Time-Frame

Ever since President Trump won the Republican nomination for President, the USDMXN has been in the cross hairs. Trump vowed to build a wall along the Mexican border, paid for by Mexico. While this has been far from reality, trade disputed and the scrapping of NAFTA as well as the global slowdown have left their marks. This currency pair has now stabilized a double breakout, one out of its horizontal support area and one above its primary descending resistance level, has boosted bullish momentum. Price action is furthermore supported by it primary as well as secondary ascending support levels. An move into its next horizontal resistance level is expected and forex traders are advised to buy the dips down into its secondary ascending support level.

The CCI has dropped out of extreme overbought territory and descended close to the 0 mark where an ascending support level allowed for a reversal in this momentum indicator which remained in bullish conditions. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market, yielding over 500 pips in profits!

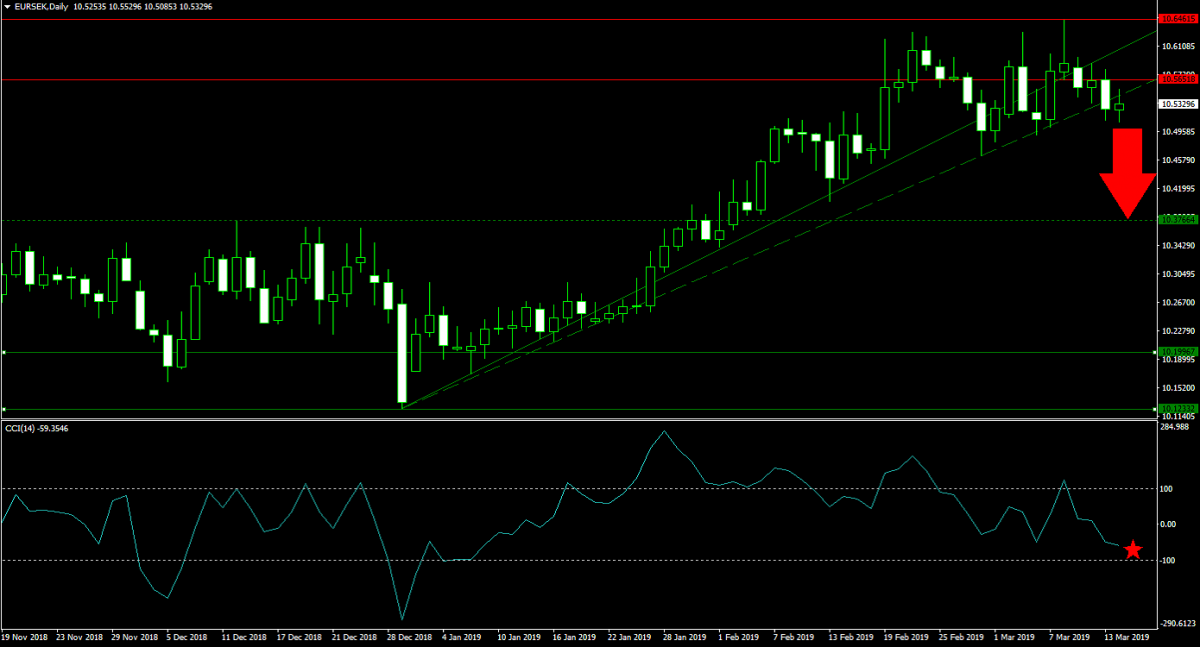

Forex Profit Set-Up #2; Sell EURSEK - D1 Time-Frame

As Sweden remains without government, many forex traders overlook the dependence of the Swedish economy on their high-tech exports. Those combined factors have helped EURSEK bulls to extend a rally into its horizontal resistance area. Price action was rejected and this currency pair completed a triple breakdown: below its horizontal resistance area which boosted bearish momentum and below its primary as well as secondary ascending support levels which ended the bullish trend. The EURSEK is now expected to accelerate to the downside until it will reach its next horizontal support level. Selling the rallies into the lower band of its horizontal resistance area is favored.

Prior to the first breakdown, the CCI formed a negative divergence which led the contraction in price action. The move extended below the 0 level which resulted in a bearish momentum crossover. Fund your PaxForex Trading Account today and join our growing community of profitable forex traders; find out why more and more successful traders prefer to call PaxForex their home!

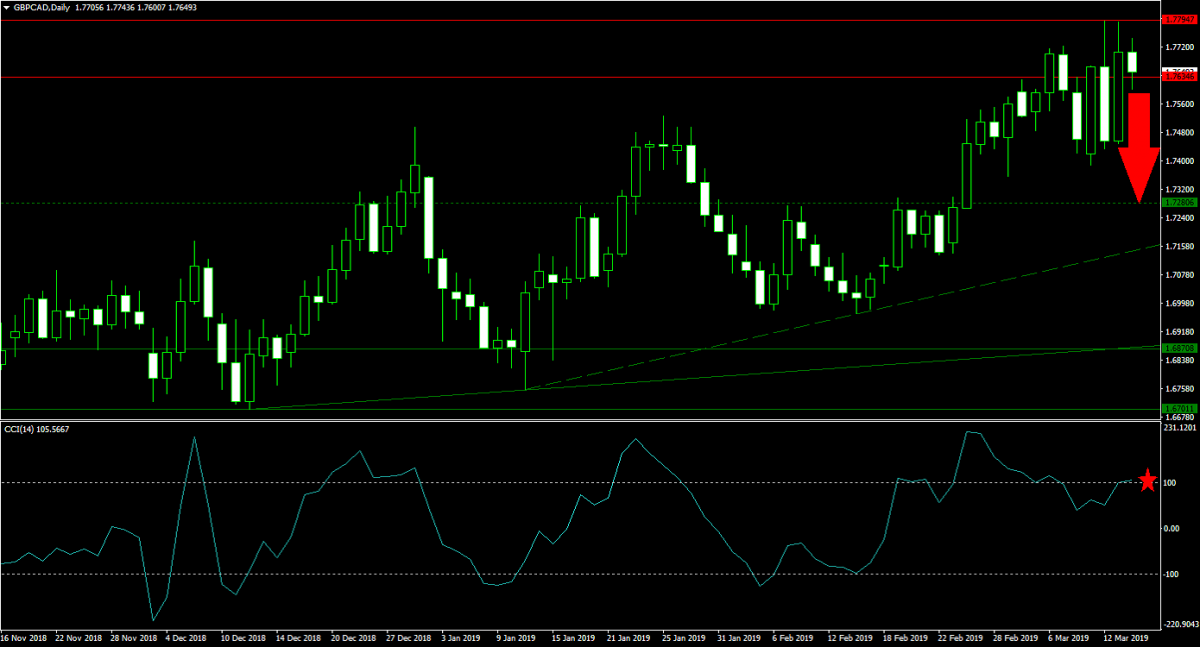

Forex Profit Set-Up #3; Sell GBPCAD - D1 Time-Frame

As the Brexit chaos is front and center and with time running out, the GBPCAD is ripe for a short-term corrective phase. Price action spiked into its horizontal resistance area from where a rise in volatility accompanied the last seven trading sessions. Forex traders are now likely to lock in profits and rotate out of their British Pound long exposure. This currency pair has traded above and below the lower band of its horizontal resistance area from where a sustained sell-off is likely to materialize on the back of profit taking. The GBPCAD is expected to descend into its next horizontal support level which is being approached by its secondary ascending support level. Forex traders are recommended to spread their sell orders inside of the horizontal resistance area.

The CCI is trading in extreme overbought conditions, but a negative divergence has formed which is anticipated to force this technical indicator to the downside. Price action is expected to follow suit. Follow the PaxForex Daily Forex Technical Analysis and follow the trading recommendations posted by or expert analysts; they do the hard work so you can reap the easy profits!

To receive new articles instantly Subscribe to updates.