As this past weekend’s G-20 summit concluded in Argentina, market participants were largely focused on the dinner between US President Trump and Chinese President Xi. The sideline show stole the spotlight which meant that something would be announced in an attempt to please the markets and shows that positive progress has been made in the trade war the US started with China. As expected Trump hailed progress and his negotiating tactics while US Treasury Secretary Steven Mnuchin stated that 142 items have been discussed between both leaders.

Financial markets initially cheered the announcement yesterday, but the enthusiasm faded just as fast amid the lack of details what has been agreed on other than a 90-day truce where tariffs won’t be increased. Some call it a Christmas truce Trump can bring back to Washington while Xi can use the break to focus on domestic issues. The calm didn’t last long as traders now demand details. It appears it may have been a smoke screen as Trump’s advisers had a hard time to explain the deal Trump claimed to have reached with Xi. Confidence is eroding fast, what will this mean for the US Dollar?

One Trump Tweet stated that “China has agreed to reduce and remove tariffs on cars coming into China from the U.S. Currently the tariff is 40%.” A spokesman for the Chinese foreign ministry declined to comment on this matter. Mnuchin added that “I think there is a specific understanding that we are now going to turn the agreement the two presidents had into a real agreement in the next 90 days. I’m taking President Xi at his word, at his commitment to President Trump. But they have to deliver on this.” This all sounds the same as the US expects China to make changes in order to revert the trade war.

Neither Trump nor Xi can afford to look weak on this trade war in front of their domestic base which suggests that the pressure is more on Trump to back down than Xi. So far the biggest victim of the post-dinner developments has been the US Dollar which weakened across the board. Open your PaxForex Trading Account today and take advantage of the trading opportunities in the forex market through the help of our expert analysts!

Just as Mnuchin has been on a campaign to dial back expectations, Trump’s Top Economic Advisor Larry Kudlow joined the chorus. He responded to a question about the trade deal Trump hail by stating “I’ll call them ‘commitments’ at this point, which are, commitments are not necessarily a trade deal, but it’s stuff that they’re going to look at and presumably implement.” A second Trump tweet claimed “Farmers will be a a very BIG and FAST beneficiary of our deal with China. They intend to start purchasing agricultural product immediately. We make the finest and cleanest product in the World, and that is what China wants. Farmers, I LOVE YOU!” Trump hails trade deal as Beijing remains quiet, but here are three forex trades which scream loudly.

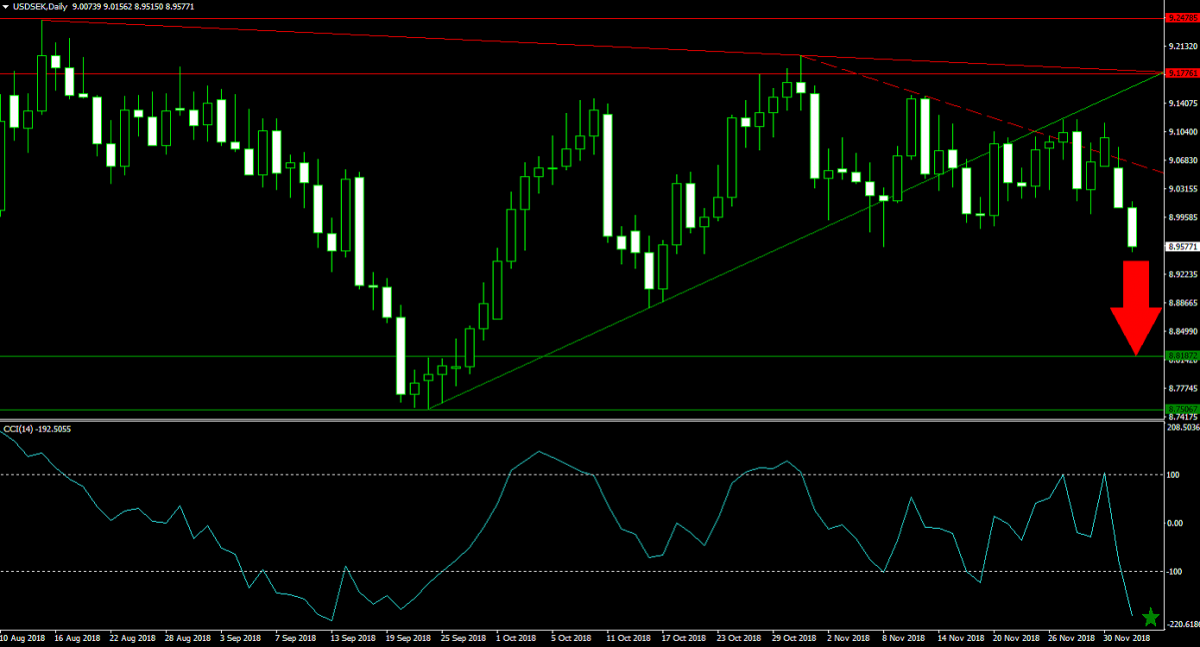

Forex Profit Set-Up #1; Sell USDSEK - D1 Time-Frame

This is an outside-the-box trade for a weaker US Dollar moving forward. Rather simple, it is more likely that Sweden will form a government than the US-China trade war from being resolved. The USDSEK was rejected by its horizontal resistance area and price action completed a breakdown below its steep, primary ascending support level. This has accelerated the move to the downside in this currency pair. The secondary descending resistance level is expected to push the USDSEK into its next horizontal support area and selling the rallies is therefore recommended.

The CCI has plunged deep into extreme oversold conditions, but new lows are expected. Small rallies may yank this momentum indicator it above the -100 mark which would create attractive short entry opportunities. Download your PaxForex MT4 Trading Terminal now and start building a profitable forex portfolio for tomorrow!

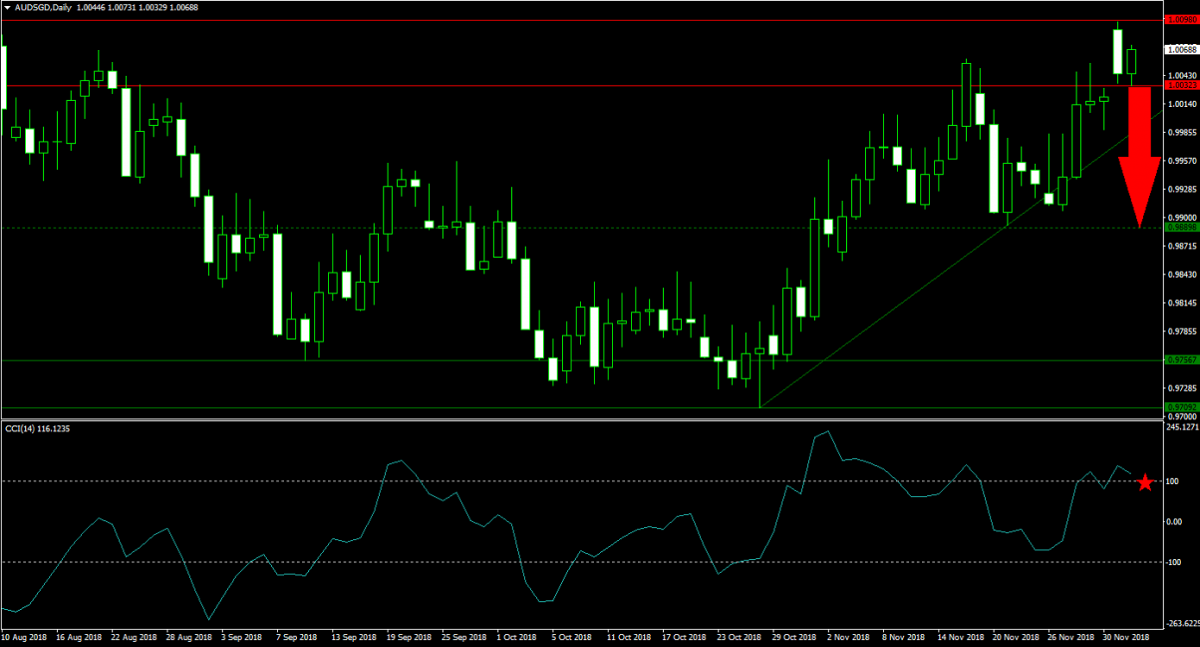

Forex Profit Set-Up #2; Sell AUDSGD - D1 Time-Frame

The Australian Dollar advanced based on hopes of a quick resolve in the trade war, but as Trump hails a deal and Beijing remains quiet, forex traders are likely to lock in profits in the AUDSGD as uncertainty is one the rise. Price action is currently trading inside of its horizontal resistance area from where a double breakdown is predicted. The first one below current resistance and the second one below its primary ascending support level which will take the AUDSGD down into its next horizontal support level. Forex traders are advised to spread their short positions inside the horizontal resistance area.

The CCI is trading in extreme overbought territory where a negative divergence has formed. This offered a very bearish trading signal and price action is anticipated to accelerate to the downside. Subscribe to the PaxForex Daily Fundamental Analysis where our expert analysts guide you through the forex market every day, yielding profits of over 500 pips per month!

Forex Profit Set-Up #3; Sell USDJPY - D1 Time-Frame

As uncertainty increases, forex traders will seek out safe haven trades such as the Japanese Yen and the USDJPY offers a great trading opportunity for the more risk averse traders. The primary descending resistance level rejected price action inside its horizontal resistance area which led to a breakdown below its primary ascending support level. Bearish momentum is expected to result in a double breakdown, below its secondary ascending support level and its horizontal support level, which will clear the path for the USDJPY to descend into its next horizontal support area. Selling the rallies from current levels is favored.

The CCI spiked from extreme oversold conditions above the 0 mark, but quickly reversed and is now back below it and confirmed bearish momentum remains intact. Follow the PaxForex Daily Forex Technical Analysis and boost your pips just by following the recommended trading set-ups as outlined by our expert analysts, copy the trades and profit!

To receive new articles instantly Subscribe to updates.