As the US-China trade war is set to intensify, forex traders should take a closer look at commodity currencies. US President Trump announced that tariffs on the remaining Chinese imports into the country may be announced if no progress is achieved on the sidelines of the G-20 meeting in Buenos Aires, Argentina between November 30th and December 1st. This would levy tariffs on all Chinese exports to the US, valued over $500 billion per year. This is expected to have a much bigger negative impact on the global economy than many are prepared for.

In an attempt to front-run what could be a very challenging 2019 for China after its Lunar New Year, the time new US sanctions could take effect, the Chinese leadership has announced that more stimulus may be released. Local and provincial governments are anticipated to see a lot more support in order to keep the economy expanding. This will put President Xi Jinping’s debt deleveraging on pause. Dongguan Securities Analyst Fei Xiaoping stated that “With the strong policy support, the market is likely to stabilize and to regain some ground in November.”

Goldman Sachs argues that the Chinese Yuan will reach the key 7.0000 level against the US Dollar with one of their economists, MK Tang, noting that “We see good economic reasons arguing for a weaker yuan, especially in the coming months. It’s only a matter of time for the yuan to hit 7.” A cheaper Yuan makes exports more attractive and US President Trump has accused China of currency manipulation in order to maintain the upper hand and an unfair advantage over the US.

The PBOC issued bills in Hong Kong for the first time ever yesterday, but what type of impact should forex traders expect in the Australian Dollar, the New Zealand Dollar, the Canadian Dollar and the Swiss Franc? How will these commodity currencies perform as they have to deal with a global slowdown on top of domestic issues? Open your PaxForex Trading Account now and navigate the commodity currency storm with a profitable outcome.

The Australian Dollar has been under pressure and may face more obstacles as the RBA has turned more dovish as housing data as well as consumer confidence are crumbling. Some expect an interest rate cut by the RBA at the time other central banks are hiking rates. The New Zealand Dollar depends heavily on exports, but is a much smaller economy than Australia. Canada is a bit more diversified, but the Canadian Dollar remains dependent on the the price of oil more than anything else. The Swiss Franc is a favorite amongst commodity traders as China remains the big unknown in the trade. The US-China trade war warrants a closer look at commodity currencies and so do the following three forex trades.

Forex Profit Set-Up #1; Buy AUDNZD - D1 Time-Frame

The Australian Dollar as well as the New Zealand Dollar are set to struggle if the Chinese economy will slow further from current levels. Australia is more dependent on China, but New Zealand is a much smaller economy. The AUDNZD is therefore expected to attract more bids after price action stabilized at its horizontal support area. A move to the upside is likely to result in a breakout above its secondary descending resistance level as well as above its horizontal support level. Buying the dips in the AUDNZD is recommended as this currency pair is anticipated to move back into its horizontal resistance area.

The CCI already completed a breakout fro extreme oversold territory and bullish momentum sufficed to carry this indicator above the 0 mark. More upside is expected which would support price action to advance. Download your PaxForex MT4 Trading Platform today and create a market beating forex portfolio for tomorrow!

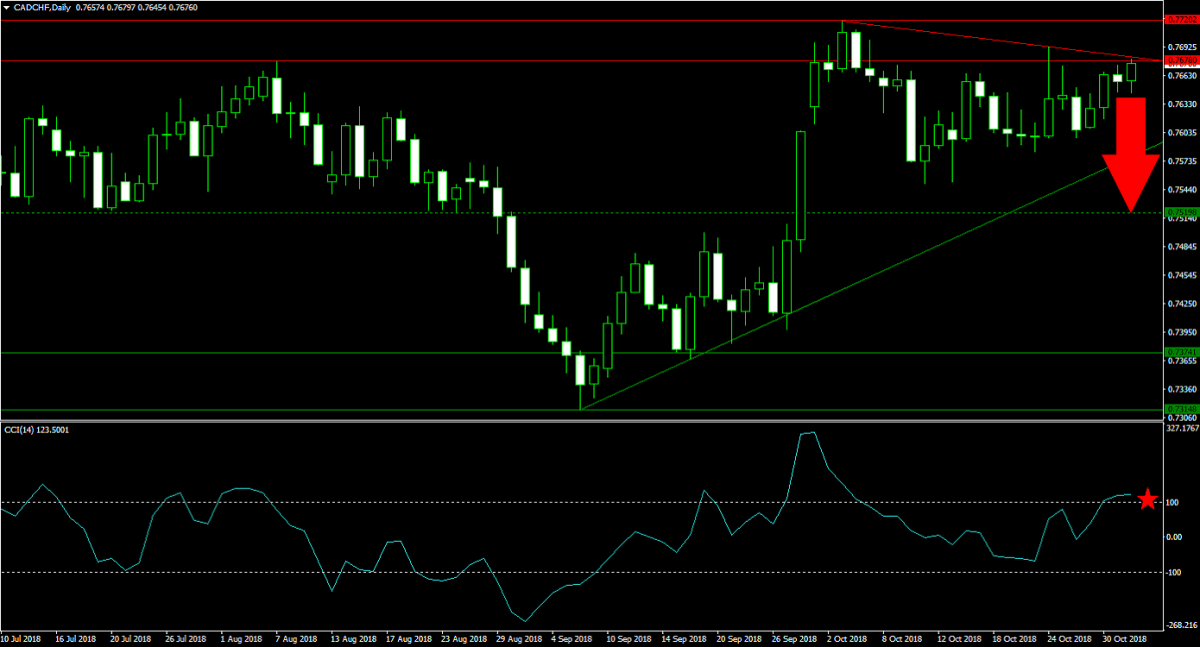

Forex Profit Set-Up #2; Sell CADCHF - D1 Time-Frame

A breakdown below its horizontal resistance area resulted in a bearish momentum shift in the CADCHF with price action being pressured to the downside by its primary descending resistance level. Oil prices are expected to contract if the global economy stalls or falls into a recession which will pressure the Canadian Dollar. The CADCHF is expected to complete a push below its primary ascending support level which will lead this currency pair into its next horizontal support level. Forex traders are recommended to sell the rallies from current levels.

The CCI is trading in extreme overbought conditions, but recorded a lower high than during its previous advance which resulted in a bearish trading signal. More downside in this currency pair is therefore anticipated. Subscribe to the PaxForex Daily Forex Technical Analysis and grow your account balance with the recommended trades of our expert analysts!

Forex Profit Set-Up #3; Sell USDSGD - D1 Time-Frame

The Singapore Dollar has started to retreat amid profit taking. This resulted in a double breakdown, below its horizontal resistance area as well as below its primary ascending support level. A bearish sentiment change is expected to drive the USDSGD further to the downside. A breakdown below its horizontal resistance level is anticipated to follow which will take the USDSGD down into its secondary ascending support level. Forex traders are advised to sell the rallies in this currency pair.

The CCI dropped from extreme overbought territory and bearish momentum is expected to push this technical indicator below the 0 level which is likely to attract more sell orders and fuel the contraction. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide your portfolio through the forex market with ease; earn over 500 pips per month!

To receive new articles instantly Subscribe to updates.