Summer is approaching and as most traders know this usually comes with a severe slowdown in trading activity also known as the ‘summer doldrums’. The reason being that most active players in the financial sector are operating with a skeleton crew as the majority of staff are around the globe enjoying summer. This doesn’t mean that trading will become boring or that there won’t be any opportunities. On the contrary, each development will have a magnified impact on price action due to the lack of volume. This often adds to volatility which in return can create great trading opportunities.

It is worth to point out that those opportunities are often short-term which makes summer great for counter-trend price reversals. The summer months could also signal changes in longer term trends, especially in trades which have extended too far in either direction. Let’s take a look at the Top 3 themes for the summer trading months. US 10-Year Treasuries are flirting with the 3.00% level and this theme will carry on through the summer. Traders may want to watch for tomorrow’s refunding announcement of the US Treasury where larger auction sizes are likely to be announced. At the same time demand is set to fall for US bonds across maturities which makes this an interesting development to watch.

This brings the US Dollar into play which has been battered over the past five quarters. This is a great example of an extended move ready for a short-term counter-trend reversal. CFTC data shows the dominance in short positions in the greenback and the bearish trend may very well continue after the summer, but forex traders should expect some attempts by the bulls to push price action higher. This would actually be healthy for the longer term bear market in the US Dollar. This summer is expected to deliver answers to questions about the USD trend.

Don’t miss out on trading opportunities during the summer trading months. All you need to do is profit from the hard work of our expert analysts who will deliver the best trading ideas directly into your inbox. Follow the PaxForex Daily Fundamental Analysis and the PaxForex Daily Forex Technical Analysis while you enjoy your summer. Nothing better than plenty of sun while it rains pips in your forex trading account!

Finally a scenario where the consensus may be a bit too bullish is the slowly developing trade war, not just between the US and China but also with other trading partners of the US. While the Trump administration has granted temporary relief from new import tariffs on steel and aluminum to a few countries in order to renegotiate deals, there is plenty than can go wrong. This would could result in a full-blown global trade war which many may blame the US on starting. As you see, the summer doldrums will be far from boring and filled with great trading opportunities. Here are our Top 3 themes for the summer trading months.

Forex Profit Set-Up #1; Buy USDMXN - D1 Time-Frame

This currency pair spiked from the lower band of its horizontal support area into the lower band of its horizontal resistance area within a period of seven trading days. Price action has now retreated slightly which created enough bullish pressures for the USDMXN to attempt another challenge of its horizontal resistance area. Forex traders are advised to buy the dips in the USDMXN in order to take advantage of the next advance.

The CCI moved from extreme overbought conditions above 100 into neutral territory with a continued bullish bias. Open your PaxForex Trading Account now and enter this trade to your portfolio in order to profit from the expected spike in price action. Earn more pips per trade at PaxForex.

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

The USDCHF offers an excellent hedge to the above long recommendation. This currency pair has exhausted its advance and is currently challenging a newly formed horizontal resistance area. In addition, price action is approaching parity with a few dozen pips away from the key psychological level of 1.0000. Forex traders should be prepared for a counter-trend contraction on the back of profit-taking and are recommended to spread their sell orders inside of the horizontal resistance area.

The CCI has formed a negative divergence in extreme overbought territory which is a strong bearish trading signal. A push below 100 could trigger a bigger corrective phase in the USDCHF. Download your PaxForex MT4 Trading Platform today and access the forex market through our professional trading environment.

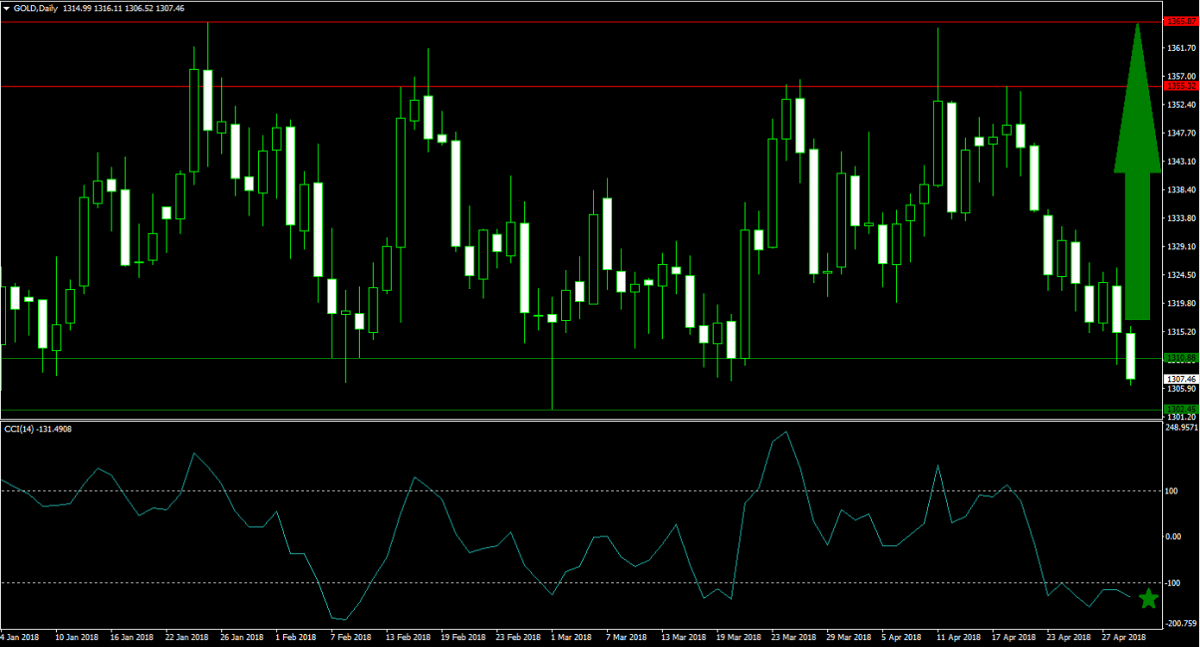

Forex Profit Set-Up #3; Buy Gold - D1 Time-Frame

Gold has corrected after failing to push above its horizontal resistance area and is now trading inside of its horizontal support area. This precious metal tends to outperform in times of uncertainty and increased volatility. Forex traders should add Gold to their forex portfolios in order to shield their account from unexpected events over the summer doldrums. Buy orders should be spread across the horizontal support area in order to decrease the overall risk profile.

The CCI, a momentum indicator, is trading in extreme oversold conditions below -100. Forex traders should monitor a move above this key level as it may trigger a short-covering rally in this precious metal. Make a deposit into your PaxForex Trading Account now and enter this trade before it will explode to the upside.

To receive new articles instantly Subscribe to updates.