The UK labor market is very tight which explains today’s reported increase in average weekly earnings which expanded by 3.0% annualized for the three-month period ending in September. Excluding bonuses, the increase was reported at 3.2% annualized. This marked the fastest expansion since December 2008. The unemployment rate was reported at 4.1%, up from the previous month’s 43-year low of 4.0%. While wages are expanding, output per working hour is lagging and only expanded by 0.1% in the third-quarter while hours worked rose by 1.0%.

Overall this is good news for the British Pound as it will make an increase in interest rates by the Bank of England more likely and frequent. The rise in wages is creating domestic inflation while it adds to consumer confidence and spending. 23,000 more workers joined the UK labor force which now stands at a record 32.4 million for an employment rate of 75.5%. Another positive for British households is that wage increases are greater than the rise of prices which is easing pressure and may eventually result in an increase in consumer spending.

The main driver behind the tight labor market is full-time employment in a sign that it will be sustainable moving forward. Brexit saw a record number of EU nationals exit the UK labor force. In the three-month period ending September, 2.25 million EU nationals worked in the UK. This represented a contraction of 132,000 as compared to the same period last year. Countering this exodus to a smaller degree was the 34,000 increase in workers from non-EU countries. Out of the 2.25 million EU nationals working in the UK, 881,000 are from the eight East European countries which joined the EU in 2004. This was down 154,000 as compared to last year.

The British Pound rallied throughout today’s trading sessions after the labor report was published. UK Prime Minister May is under pressure to abandon her Brexit approach which may keep a top on the British currency. Are you positioned to profit from the tight UK labor market as Brexit is bleeding EU workers? Open your PaxForex Trading Account now and take the first step in the profitable direction.

While the British Pound was able to pare losses faced yesterday, Brexit will remain front and center and despite some positive news coverage where EU negotiator Barnier spun the same story again, May appears to have less support now than she had before. This month was supposed the be the one where May planned to present a Brexit deal to Parliament and many claim that this week is her last chance to unite her divided Cabinet. For now it appears as she will fall short of her ambitions. Here are three forex trades which will allow your forex portfolio to deliver profits.

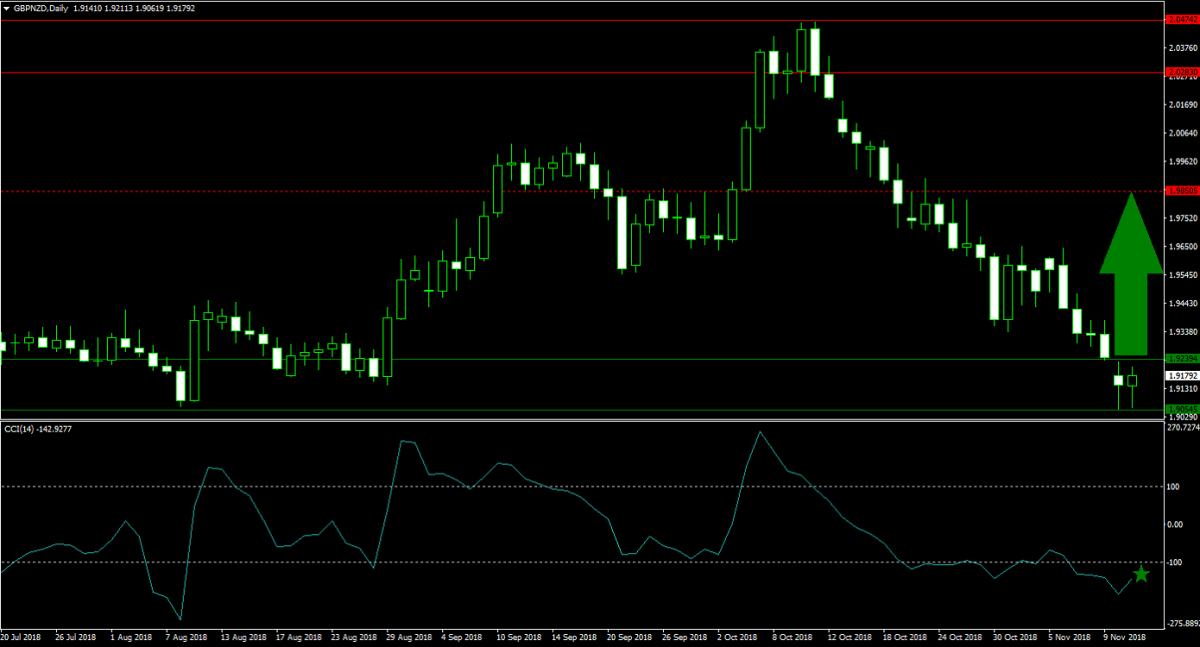

Forex Profit Set-Up #1; Buy GBPNZD - D1 Time-Frame

This currency pair contracted into its horizontal support area from where bearish sentiment is fading. While Brexit will cloud the British Pound, forex traders are growing wary of the New Zealand Dollar as it will be used for a Chinese Yuan proxy. The last two daily candlestick patterns created a bullish trading signal. The GBPNZD is expected to complete a breakout and advance into its next horizontal resistance level. Forex traders are advised to spread their buy orders inside the horizontal support area.

The CCI plunged into extreme oversold conditions, but remains off of its previous low. It has also started to ascend and a push above the 100 level is likely to ignite a short-covering rally in the GBPNZD. Subscribe to the PaxForex Daily Forex Technical Analysis and simply enter the trading recommendations posted by our expert analysts.

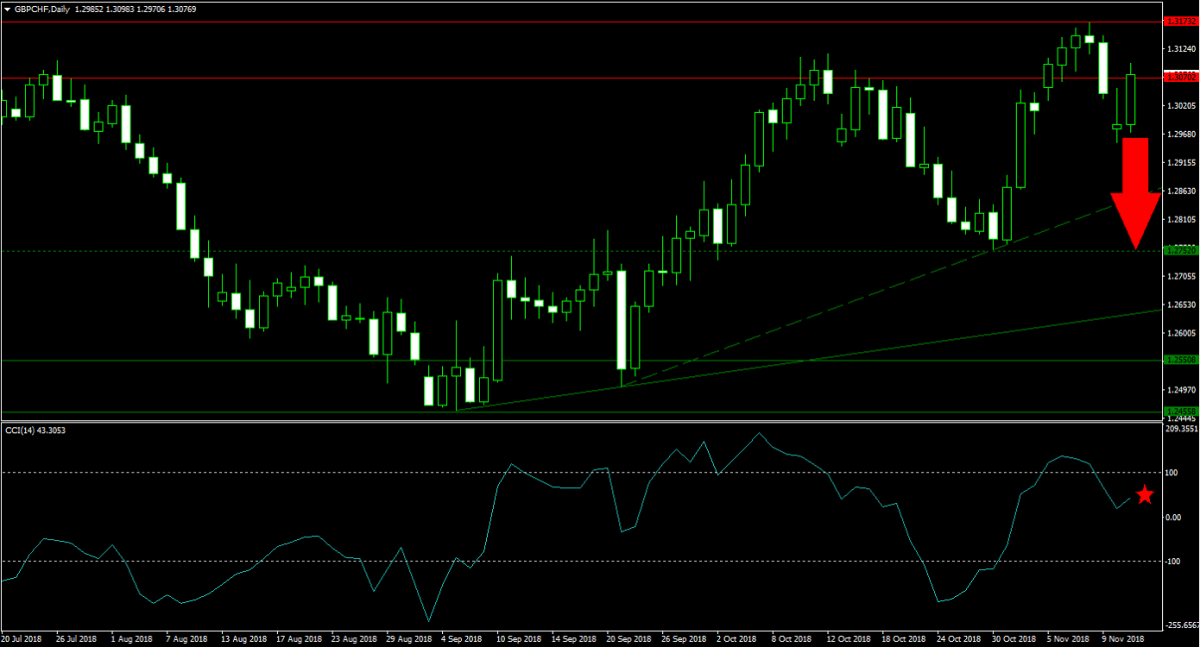

Forex Profit Set-Up #2; Sell GBPCHF - D1 Time-Frame

A horizontal resistance area is pressuring the GBPCHF and has so far rejected an extension of its advance. Given the Brexit uncertainty it is unlikely that this currency pair will advance past the upper band of its resistance area. As bullish momentum is expected to fade, price action is called down into its secondary ascending support level from where a breakdown will extend the contraction into its next horizontal support level. Forex traders are recommended to sell the rallies in the GBPCHF from current levels.

The CCI already completed a breakdown from extreme overbought levels and bearish momentum is expected to suffice to push this technical indicator below the 0 mark. This would result in a bearish momentum change. Follow the PaxForex Daily Fundamental Analysis where our expert analysts guide your trading account to over 500 pips in monthly profits.

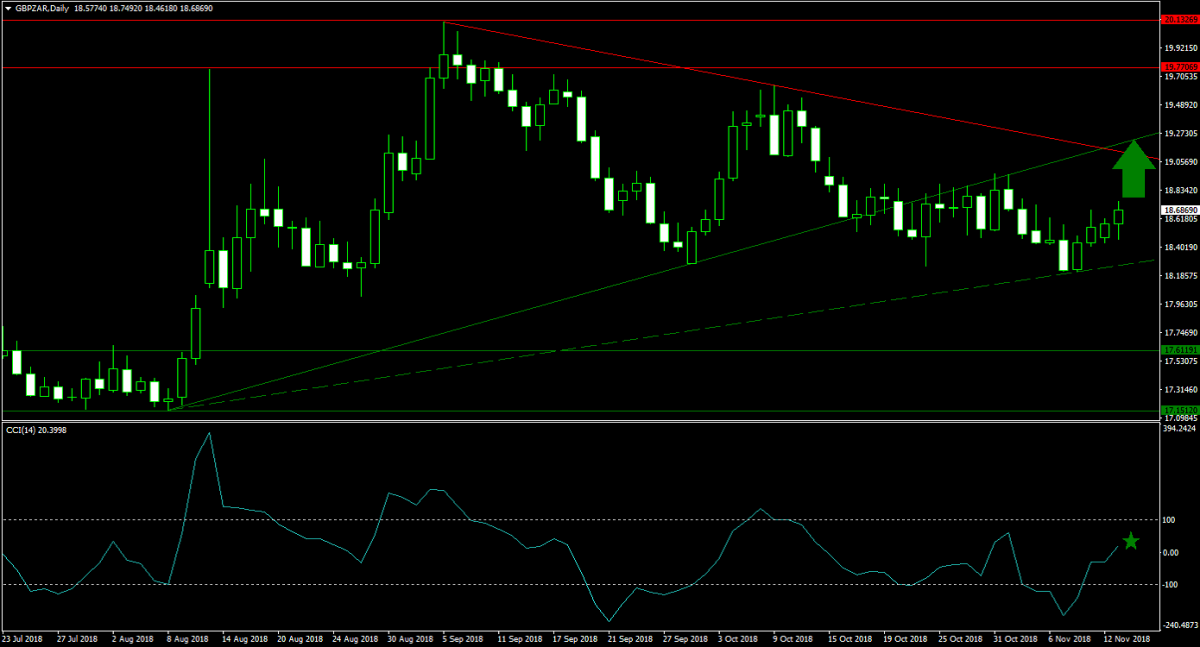

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

While the British Pound is under Brexit influence, the South African Rand faces struggles of its own which are greater than that of the British Pound. This makes the GBPZAR an excellent candidate to extend its current advance which started after price action met its secondary ascending support level. Bullish momentum is anticipated to carry this currency pair past its primary descending resistance level and into its primary ascending support level. Buying the dips in the GBPZAR is the favored approach moving forward.

The CCI already recovered from extreme oversold levels and this momentum indicator also eclipsed the 0 mark fro a bullish momentum change. This is expected to guide this currency pair further to the upside. Download your PaxForex MT4 Trading Platform today and plant the seeds for a profitable forex portfolio!

To receive new articles instantly Subscribe to updates.