The online trading industry has options for those interested in automated systems, or managed accounts to trade on their behalf under what is known as ‘Power of Attorney’. The concept of delegating a trading activity to a third party is not new, but the forex trading arena has developed a specific range of automated/managed accounts, with specific terminology that forex traders have typically used, and continue to use today. Forex PAMM account is beneficial for followers because they can benefit from forex trading without having to do in-depth market research, trade and monitor positions themselves.

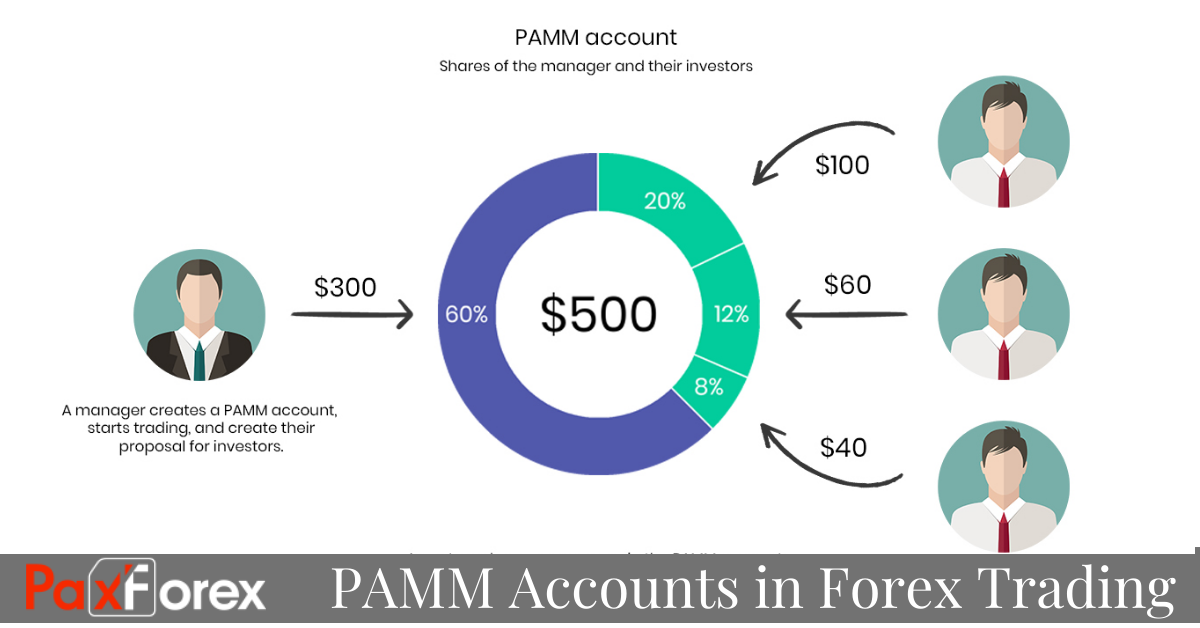

Percent allocation money management describes a software application used predominantly by forex brokers to allow their clients to attach money to a specific trader managing one or more accounts appointed on the basis of a limited power of attorney. PAMM solution allows the trader on one trading platform to manage simultaneously unlimited quantity of managed accounts. Depending on the size of the deposit each managed account has its own ratio in PAMM. Trader's activity results (trades, profit, and loss) are allocated between managed accounts according to the ratio.

Just like in the cases of one trader account, the PAMM is managed by a forex broker whose job it is to ensure the smooth execution of trades as much as is within their jurisdiction as forex PAMM brokers. All the operations that take place in a forex PAMM account are controlled by the broker, who makes sure other traders who invested in a with a money manager gets access to a maximum transparency of the trades conducted. The forex PAMM brokers ensure that the records of all currency exchange transactions carried out are shared among the investors to ensure equal right of all traders.

PAMM account is an independent account that belongs neither to the manager nor to Investors, thus the broker regulates such managed account what completely excludes risks of PAMM investors. Initially, a trader who is willing to become an account manager posts his trading statistics. According to trading results, investors decide whether to invest their funds or not. The broker does not take part in PAMM trading and has no influence on the manager and investors while providing its services as well as technical support for PAMM accounts, reception and fair funds distribution and equal rights to all the investors.

Brokerage firms offer numerous way for investors to make an informed choice, including detailed CVs, qualifications, past performances in terms of returns, amount of money managed, numbers of associated investors, positive/negative reviews, etc. about their traders/ money managers. In addition, there are outside rating systems. PAMM accounts are a simple hassle-free method for individuals to pick and choose their money managers for forex trading. With these accounts, investors benefit from profits with minimal involvement. However, PAMM accounts also carry the risks of capital loss, based on a money manager's performance.