Fourth-quarter earnings season is under way and forex traders should take note from the developments there as we are currently in a downward spiral for the US Dollar. When companies report earnings which disappoint investors, they usually blame the results on bad weather and currency price movements. Quite a few fingers are already being pointed at the Polar Vortex which clocked in at record temperatures. It remains to be seen how much will be blamed at this weather phenomenon, but one theme which is already in play is the US Dollar as many companies who reported disappointing earnings cited it as the main culprit.

After the US Dollar reached a low in February of 2018 as measured by the ICE Dollar Index, it surged over 10% by the time November came around. The current earnings season covers the fourth-quarter and therefore is in the sweet spot of this advance. As compared to the fourth-quarter of 2017, the US Dollar was 3% higher. Many traders now call this the US Dollar Vortex. In order to place this into better perspective, the US Dollar didn’t advance because of the strength of the US economy, but rather attracted bid as a safe haven currency while many traders fled other markets.

Here are a few examples of how the US Dollar Vortex impacted US companies. IBM reported a $500 million impact on its revenues due to unfavorable exchange rates. Johnson & Johnson stated that the US dollar all but wiped out international growth and United Technologies cited it as a major headwind for operations. Leuthold Weeden Capital Management Chief Investment Strategist Jim Paulsen added that “When you increase the dollar, overnight you change the competitive status of American products.” While the strong US Dollar has a negative impact on export reliant companies, it has a favorable impact on those companies who rely heavily on imports.

How many companies will fall victim to the US Dollar Vortex? After the US Fed sounded more dovish in regards to interest rate increases as well as balance sheet reductions, will forex traders realize floating trading profits and sell the US Dollar? Volatility is expected to increase and cause price action to become more sensitive. Open your PaxForex Trading Account today and start building a market-beating forex portfolio with the help of our expert analysts!

For the third-quarter of 2018, US companies reported a loss of $11.8 billion due to the strong US Dollar which marked an increase of 12 times as compared to the second-quarter. Even companies who tried to hedge their exposure to the US Dollar price swings through forward contracts and options contract, were largely caught off-guard by the severity of the move. HSBC Securities US Head of FX Strategy, Daragh Maher, concluded that “They perhaps weren’t as fully hedged or weren’t fully prepared for it and that’s why we are getting this repeated reference to the adverse translation effects of the stronger dollar.” The US Dollar Vortexis feared by many companies, but here are three forex trades to unfreeze those pips in your trading account!

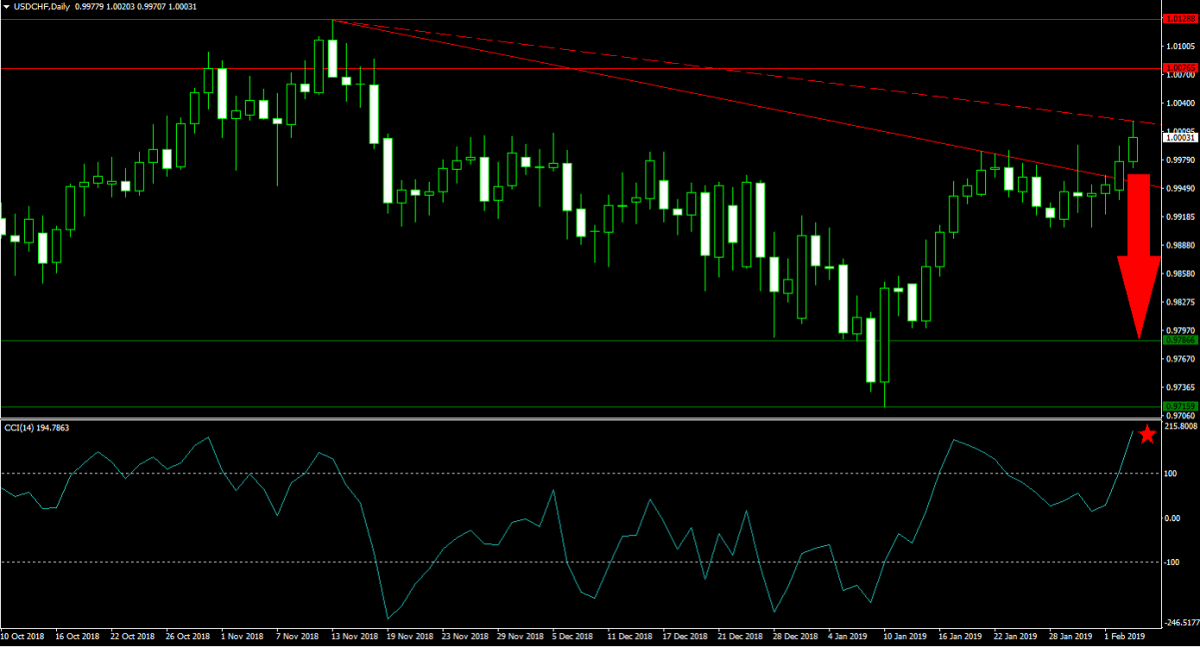

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

After a dovish Fed announcement following the last FOMC interest rate decision, the US Dollar still managed spiked against the Swiss Franc which took the USDCHF close to parity. Price action has been stalled above its primary descending resistance level which now acts as a weak support level as its secondary descending resistance level is applying bearish pressures. Parity acts as an additional psychological resistance level and forex traders are likely to book floating trading profits which will send price action lower. Selling the rallies into its secondary descending resistance level is favored.

The CCI spiked deep into extreme overbought territory and recorded a higher high, confirming the acceleration to the upside in the USDCHF. A quick reversal is anticipated which will drag this technical indicator back below the 100 mark from where new sell orders are expected. Download your PaxForex MT4 Trading Platform now and add this trade to your forex portfolio!

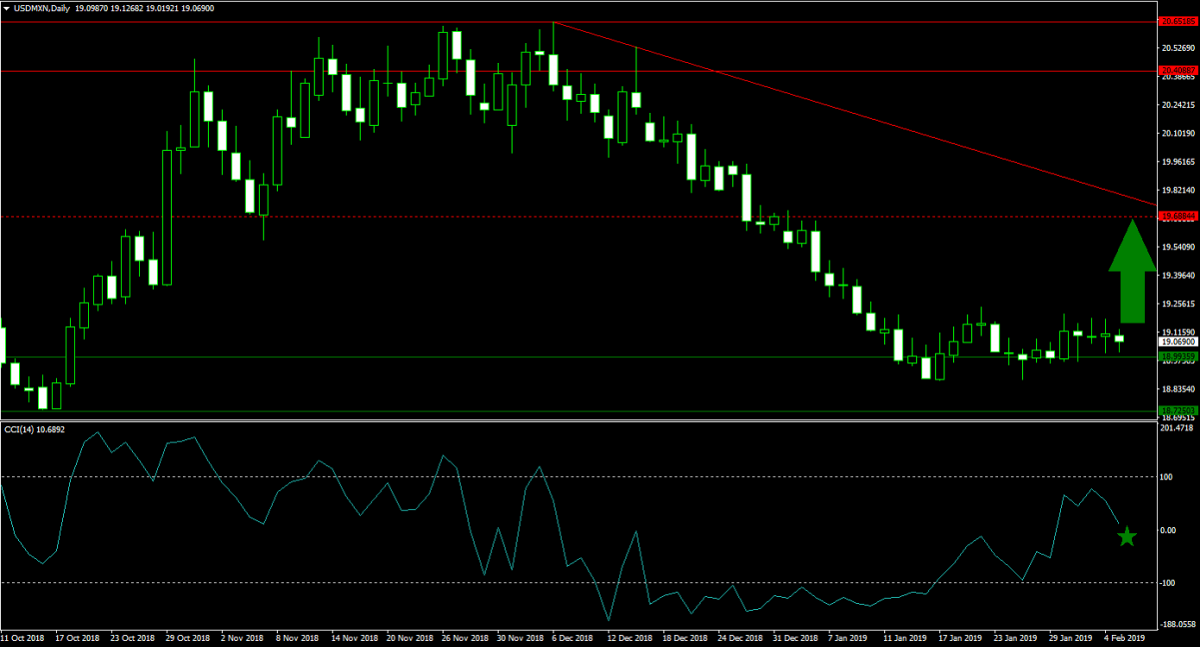

Forex Profit Set-Up #2; Buy USDMXN - D1 Time-Frame

Forex traders who are looking for a bullish US Dollar trade can find a great candidate in the USDMXN. This currency pair has ended its corrective move and started a sideways trend just above the upper band of its horizontal support area. A short-covering rally is expected to materialize which has enough room to extend into its next horizontal resistance level which is being approached by its primary descending resistance level. Forex traders are advised to buy the dips in the USDMXN down into the upper band of its horizontal support area.

The CCI accelerated out of extreme oversold conditions and bullish momentum carried this indicator above the 0 level for a bullish momentum crossover. It is likely that the 0 mark will be challenged before it will take the next leg higher. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the forex market, yielding over 500 pips in profits per month.

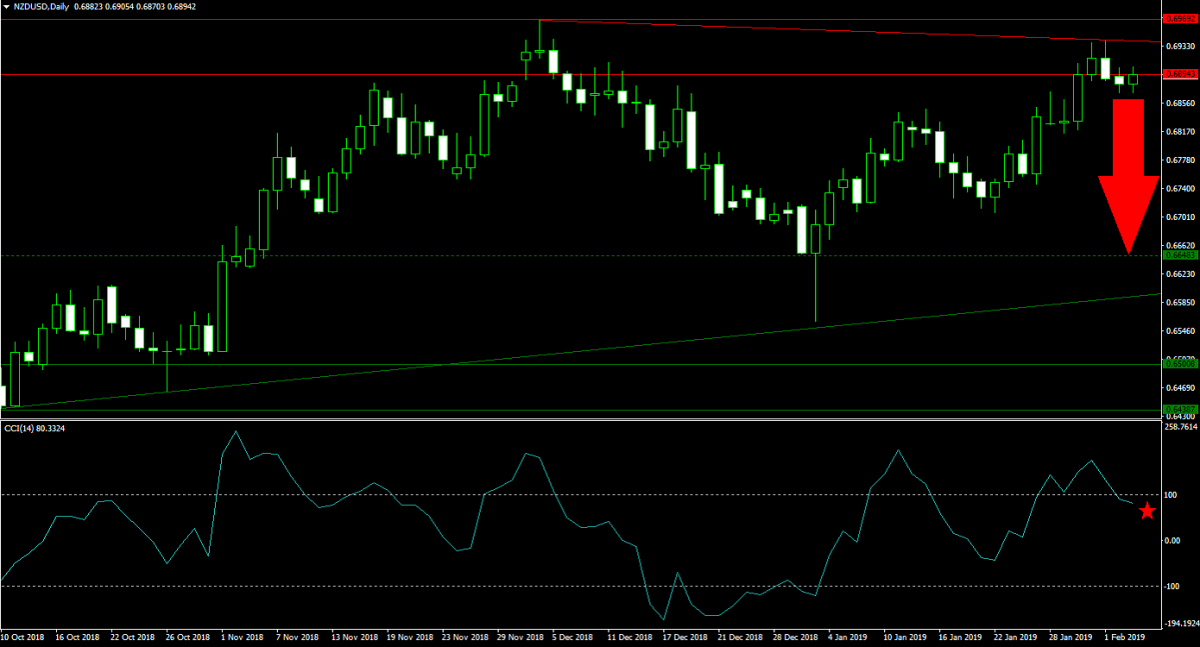

Forex Profit Set-Up #3; Sell NZDUSD - D1 Time-Frame

The NZDUSD recovered strongly after briefly correcting into its primary ascending support level. The move to the upside took price action back into its horizontal resistance area, but formed a lower high. The primary descending resistance level which formed as a result forced a breakdown below its horizontal resistance are. This currency pair is now vulnerable for a sell-off on the back of profit taking which can take the NZDUSD down into its next horizontal support level which is being approach by its primary ascending support level. Forex traders are recommended to sell the rallies up into the lower band of its horizontal resistance area.

The CCI already move out of extreme overbought territory after a negative divergence resulted in a spike in bearish momentum. This accumulation is anticipated to accelerate and result in a bearish momentum crossover which will further fuel a move to the downside. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account.

To receive new articles instantly Subscribe to updates.