Welcome back everyone to my weekly update on the cryptocurrency market and on my Bitcoin - Forex Combo Strategy. We had a very solid start to 2019 as far as fundamental developments are concerned, but as you all know the price of many cryptocurrencies did not follow through. Not yet that is. As Bitcoin is approaching the lows its bear market, volume has spiked in many local markets. This suggests that traders are preparing their wallets for what may come next. It is entirely possible that we will slide down to the lows, but what will happen once we test support?

I think there have been enough positive developments and that there will be many more to come this year. Therefore I think we will see a sharp spike once support is confirmed. I would also expect that volume will continue to accelerate the closer we get to the $3,000 level. One sign that traders are shifting positions, depending on their believe of what will happen next, is the trading volume on Localbitcoins. Several markets reported record volume which is a positive sign. This means that the next move will be most likely confirmed by volume and therefore result in a valid move. Price action moves on the back of low volume are rather insignificant.

Singapore reported a surge in trading volume for the week which ended February 2nd 2019 as 145 Bitcoins changed hands. Those of you who like to compare this in local fiat currency, 145 BTC in Singapore Dollars resulted in SG$683,302 worth of trades which makes it the best one week total in BTCSGD history. Another exchange which reported all-time records in Bitcoin transaction was Kazakhstan with 22 Bitcoins changing hands there. In local fiat currency this clocked in as the 10th biggest on record with a total of 28.36 million Kazakh Tenge moving peer-to-peer. Poland reported a 14-month high with 23 Bitcoins moving from wallet to wallet.

Then there is Venezuela. Once it boasted Latin America’s strongest economy and some expert claim it has bigger oil reserves than Saudi Arabia. The socialist government since Hugo Chavez constantly mismanaged the economy which led to the chaos the country is in now. It is therefore no surprise that Bitcoin became the go-to-currency in Venezuela. The government has issued its own cryptocurrency which is backed by its proven oil reserves. Venezuelan P2P transactions swelled to 2,004 Bitcoins worth 17.34 billion Venezuelan Bolivars, both figures a record.

I will be watching price action very closely as we approach the 2018 lows for Bitcoin. Ethereum is struggling with the $100 level and may dive into its lows as well. In both cases I expect a strong rally. Long-term I expect the $3,000 - $4,000 level to form a very strong support area for Bitcoin. For Ethereum I think the $100 will remain a very crucial level and I am looking for a confirmed support area between $75 - $125. Ripple appears to be carving out its own support area above and below the $0.3000 level from where I see higher prices as 2019 plays out.

Currently I don’t plan to add to my cryptocurrency holdings, but should we see a temporary breakdown below $3,000 in Bitcoin or below $75 on Ethereum I may reconsider. In the meantime I will focus on generating the required income from my forex trading. I could also consider cashing out of some Gold and moving it into cryptocurrencies. For now I am happy with my 200 Bitcoins which I purchased at an average price of $4,315. I also have 4,500 Ethers which I added at an average price of $131.22 and 600,000 Ripple which I bought at an average price of $0.3250. You can see my cryptocurrency positions in the three images below.

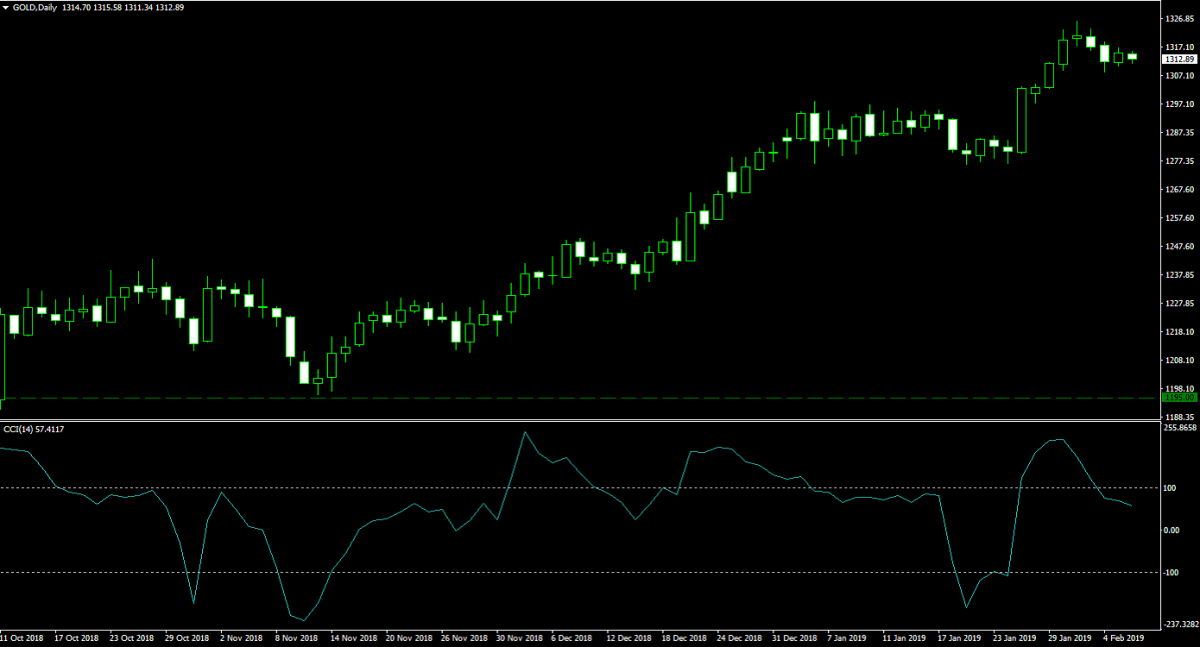

Gold retreated from its highs, but remains above the psychologically important $1,300.00 level. My current Gold portfolio stands at 100 lots which were purchased at $1,195. The margin requirement is $123,179 with a pip value of $100. I do expect this precious metal to continue its advance in 2019, but as mentioned earlier if there is an attractive opportunity to add to my cryptocurrency positions I may rotate some cash out of Gold. The image below shows my current position and the path it has take so far.

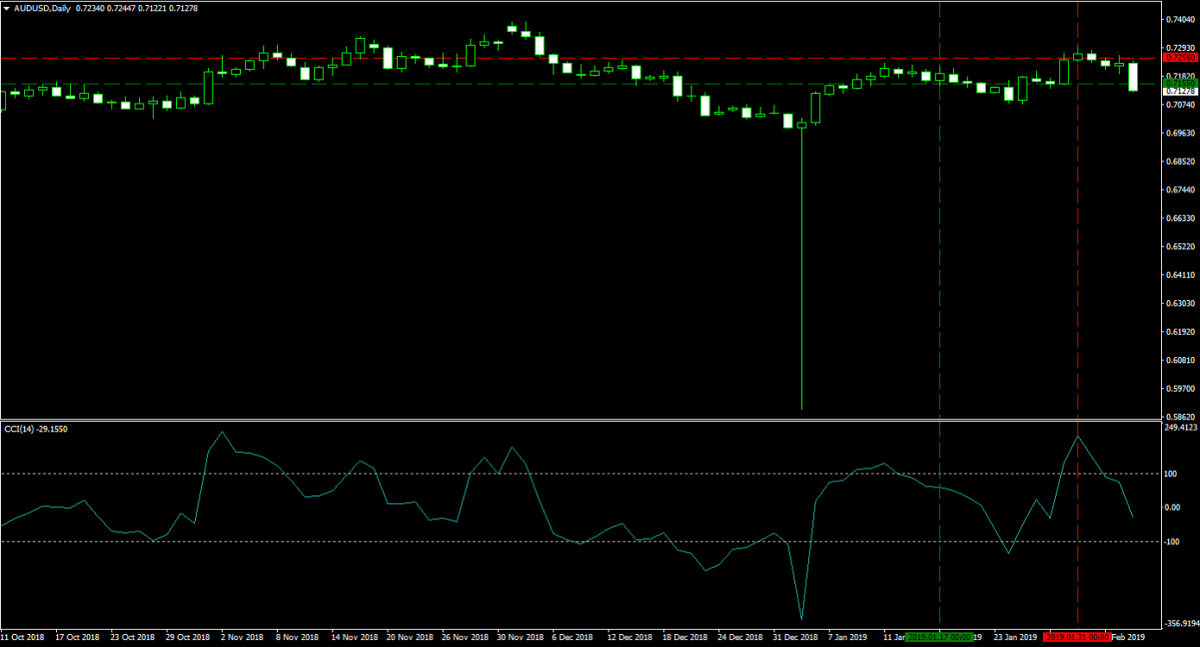

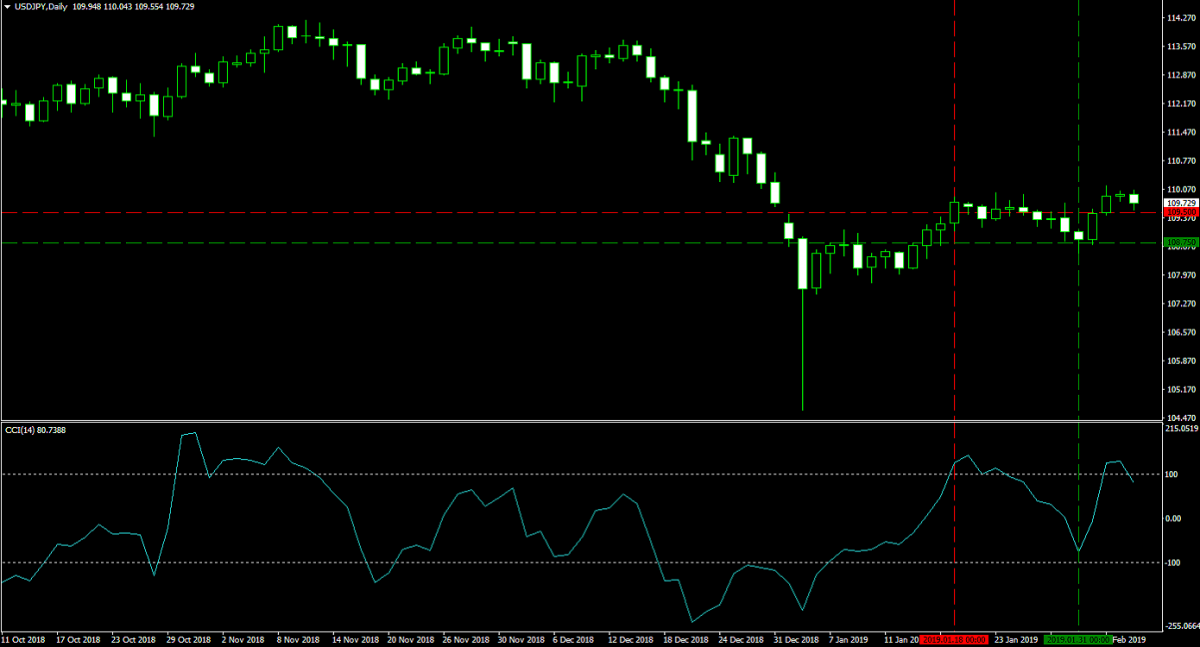

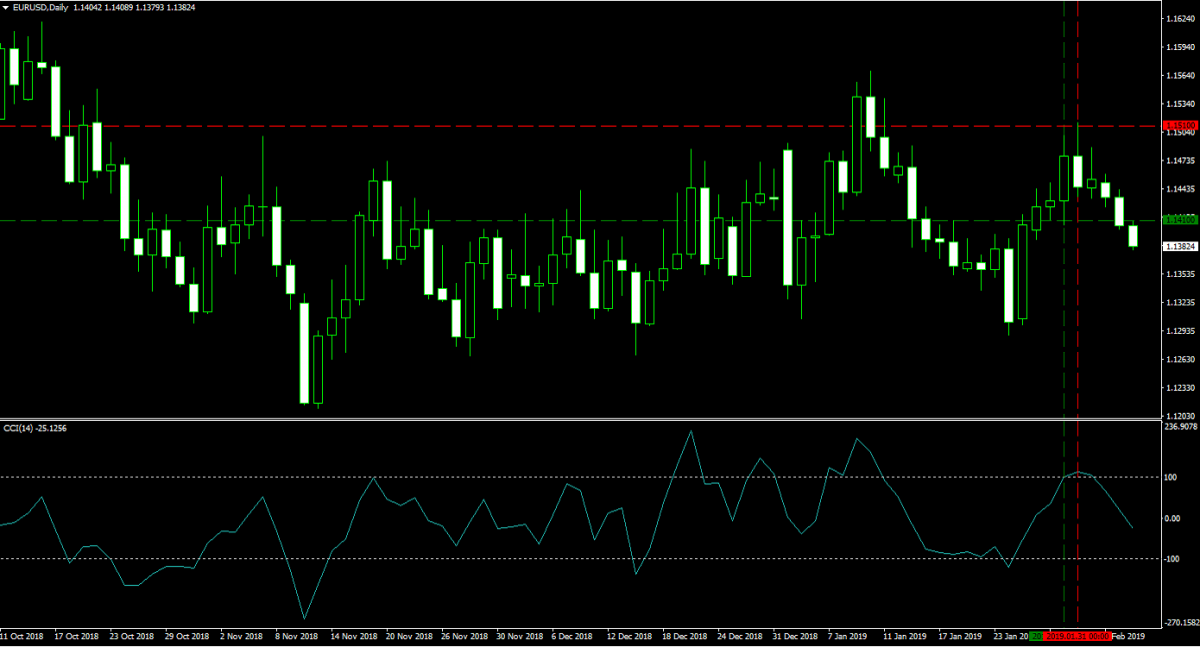

I had five open forex positions as we closed last week’s update and all of them were closed on January 31st 2019. The US Fed changed its tone towards a more dovish one and I exited three trades for a profit and two trades for loss. Let’s take a look at my three profitable exits. My 25 lots long position was closed at 0.7255 for a profit of 100 pips or $25,000. My 25 lots short position in the USDJPY was closed at 108.75 for a profit of 75 pips or $17,080. My 25 lots EURUSD long position was closed at 1.1510 for a profit of $25,000. As you can see in the images below, it was a good exit as price action reversed course.

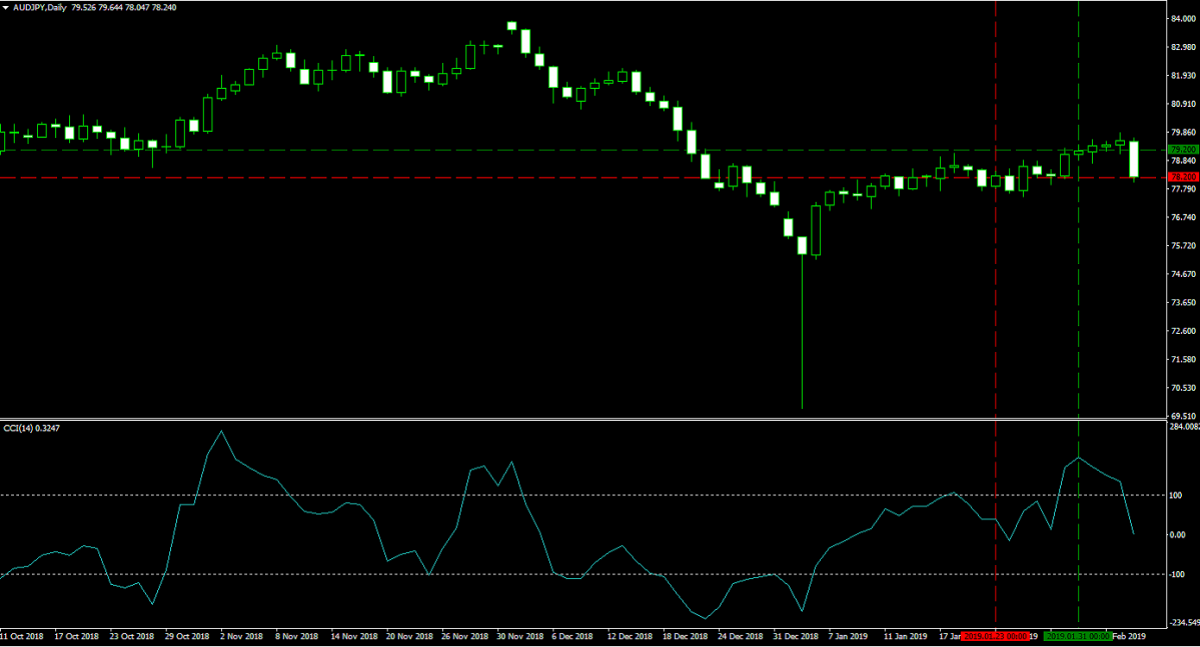

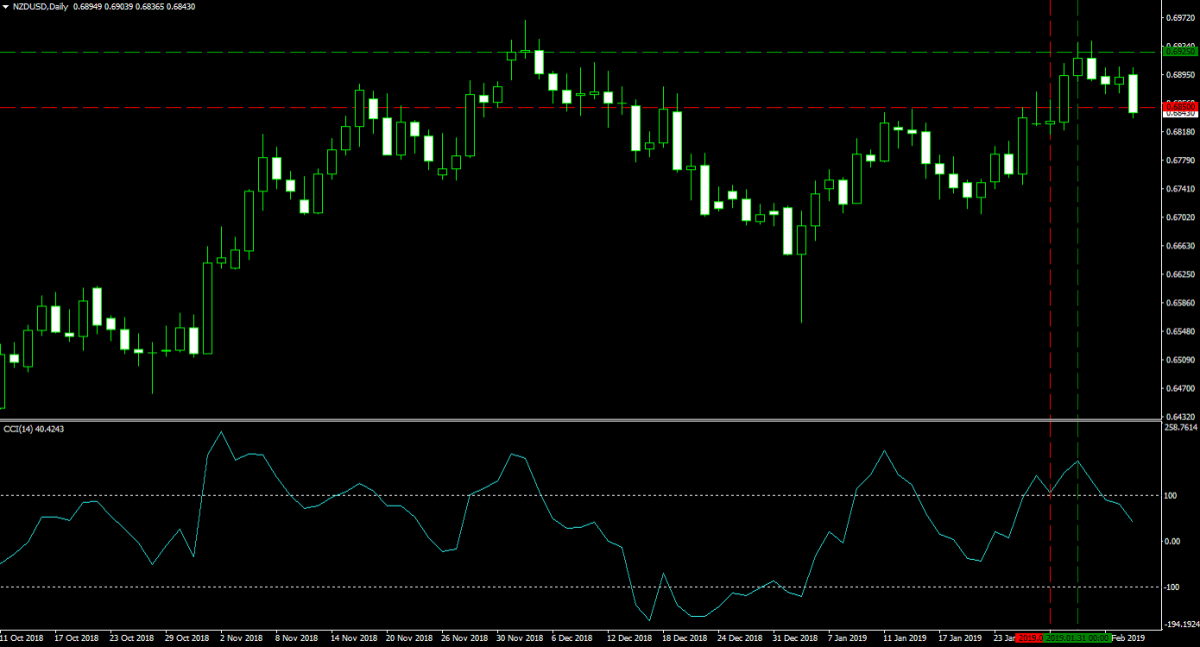

The two losses were my 25 lots AUDJPY short position which was closed at 79.200 for a loss of 100 pips or $19,209 and my 2 lots short position in the NZDUSD which was closed at 0.6925 for a loss of 75 pips or $15,333. Price action did recover in my favor if I would have held on to those trades, but the dovish tone of the US Fed and the NFP report the following day gave me a good reason to reset my forex portfolio. The five closed trades resulted in a net profit of $32,538 which was good enough for me to close out January. The two images below show my closed trades for a loss.

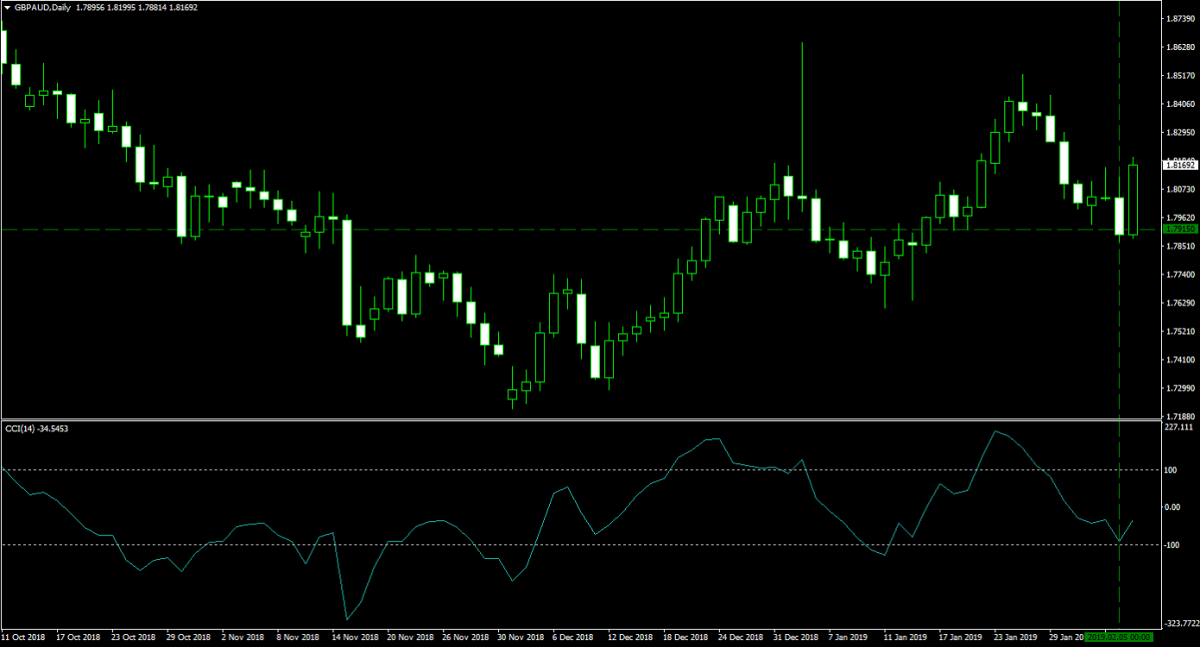

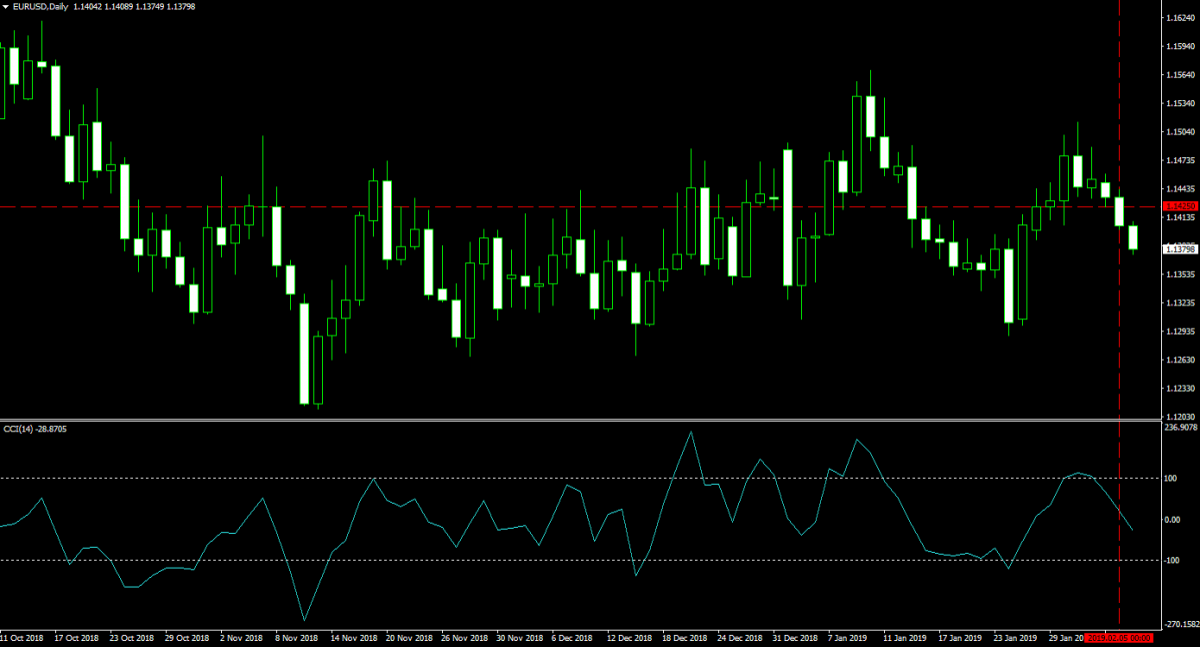

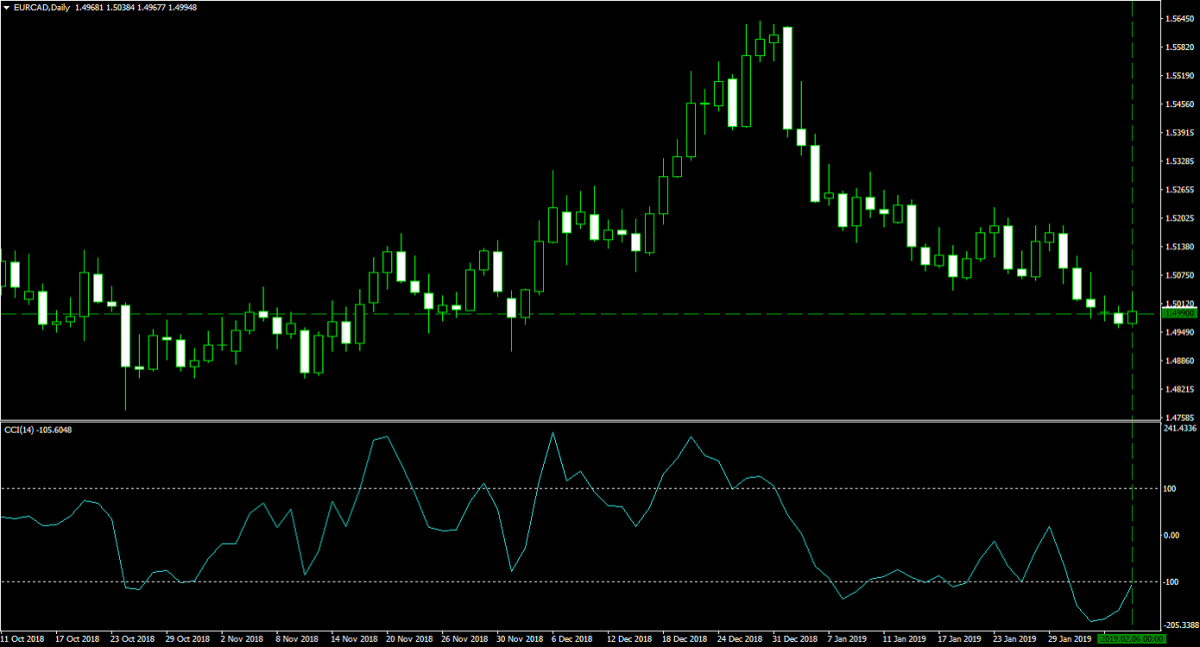

Yesterday on February 5th 2019 I bought 40 lots in the GBPAUD at 1.7915 according to this trading recommendation “GBPAUD Fundamental Analysis – February 5th 2019”. The margin requirement was $10,372 with a pip vale of $285.41. I moved my stop loss today to 181.1500 for a guaranteed profit of 200 pips or $57,082. On the same day I also took a 40 lots short position in the EURUSD at 1.1425 for a margin requirement of $9,102 and with a pip value of $400. I moved my stop loss to 1.1400 for a guaranteed profit of 25 pips or $10,000. You can read the original trading recommendation at “EURUSD Fundamental Analysis – February 5th 2019”. Earlier today I added a 40 lots long position in the EURCAD at 1.4990. The margin requirement was $9,102 and each pip is worth $303.55. I took this trade according to the following trading recommendation “EURCAD Fundamental Analysis – February 6th 2019”. The three images below show all open trades I currently have in my forex portfolio.

Here is my portfolio update. 200 Bitcoins worth $664,370, 4,500 Ethers worth $447,075, 600,000 Ripple worth $168,000 and 100 lots of Gold worth $1,290,679. Three open forex trades, all 40 lots; GBPAUD long position worth $84,579, EURUSD short position worth $28,302 and a EURCAD long position worth $12,137. I also have a cash balance worth $135,031. My total portfolio is worth $2,830,173, up $86,122 as compared to last week and getting closer to my all-time high of $2,986,212. Take your first step to a better future with a PaxForex Trading Account and my Bitcoin-Forex Combo Strategy!

To receive new articles instantly Subscribe to updates.