British Prime Minister Theresa May is touring the UK in order to drum up support for Brexit which is twelve months away. Throughout 2018 her cabinet needs to outline the detail of what Brexit will actually look like and how it will be implemented. The EU as well as the UK have been negotiating with little substance as time is ticking away. May has to fight the Brexit battle on three different fronts in order to get a deal done. This will be a balancing act as she needs to make more concessions in order to get the support she needs.

The first Brexit front is in Brussels where the battle lines are drawn deep. While trade negotiations are scheduled to start next month, little progress should be expected at this point. The issue with the Irish border is likely to linger over the talks. The EU has rejected current UK proposals as they compared them to cherry picking what the UK likes and getting rid of what it dislikes. Michel Barnier, the Chief EU negotiator, and his team refuse to compromise and more expert predict a basic free trade deal which excludes services may be the most likely outcome. This is a deal the David Davis, the Chief UK negotiator, and his team rejects.

Businesses will get their transition period during which time necessary and gradual adjustments will be made. The majority of the UK public may not even notice the dramatic change the pro-EU camp is using in order to change Brexit opinion. This brings Prime Minister May to her second Brexit front within her own Conservative Party. Rebels have the numbers to side with the Labour Party led by Jeremy Corbyn. This means that more compromise is needed in order to keep the rebels at home. At the same time this will alienate the core of her party which supports a hard stance on Brexit. A delicate balancing act and precise math is required in order to have sufficient votes to support a final Brexit deal.

Forex traders should be prepared for more volatility in the forex market, especially in the British Pound as the Brexit deadline nears. Any setback in negotiations is expected to have a greater impact than previously as time is running out for a deal to be reached. Open your PaxForex Trading Account today and position your portfolio on the right side of the Brexit fallout.

The third Brexit front needs to be battled in Parliament where the Labour Party is leading a strong opposition to a hard Brexit. Jeremy Corbyn essentially would like for the UK to remain inside the EU Customs Union which is a big red line for pro-Brexit backers. One of the main reasons, outside of control over immigration, for Brexit was to gain freedom from the EU and to negotiate trade deals favorable to the UK economy. While there are calls for a new referendum, the majority believes that the same outcome is likely. UK voters are not against Brexit, but against the way it is being handled. Here are three forex trades in order to profit from the triple Brexit front.

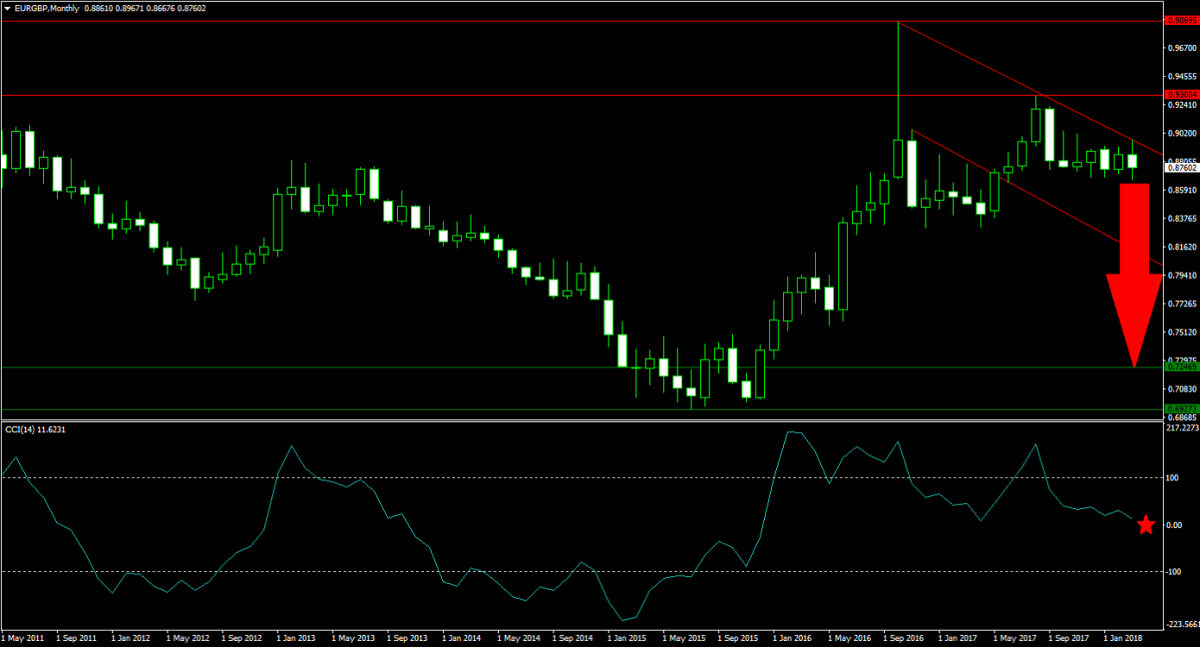

Forex Profit Set-Up #1; Sell EURGBP - MN Time-Frame

The EURGBP is under an increase in bearish momentum after moving below its horizontal resistance area. Following the initial breakdown, this currency pair attempted a second advance which was rejected by the lower band of its horizontal resistance area. Price action is now being guided lower inside a bearish price channel. Forex traders are advised to sell any rallies into the descending resistance level of its current bearish chart pattern.

The CCI has decelerated after a brief advance into extreme overbought conditions above 100 and is now drifting down to the 0 level. A move lower will further attract sell orders as a result of the bearish momentum change. Take advantage of the PaxForex Daily Forex Technical Analysis section where our experts highlight the most profitable technical trade set-ups.

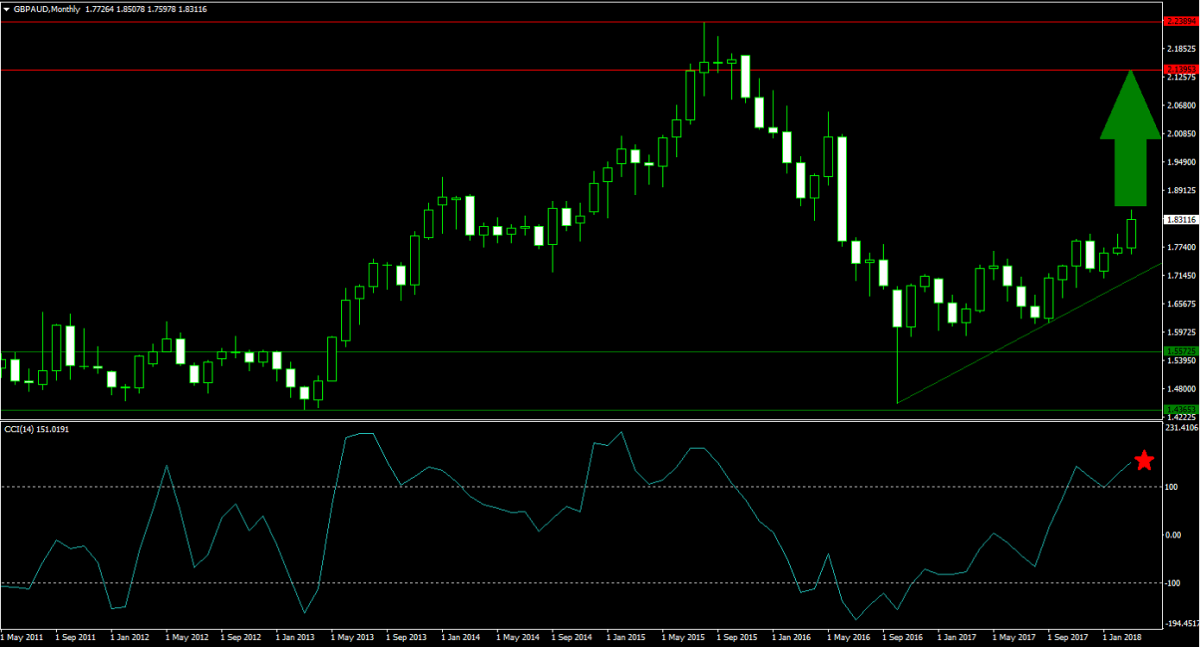

Forex Profit Set-Up #2; Buy GBPAUD - MN Time-Frame

This currency pair is in a recovery process following a plunge into its horizontal support area. Following the breakout above it, the GBPAUD has formed a rounded bottom chart formation which is a strong bullish indicator. More bullish pressures are provided by its ascending support level which originates from inside its horizontal support area. Forex traders are recommended to buy the dips into its ascending support level.

The CCI is currently trading above the 100 mark and therefore in extreme overbought conditions. Short-term contractions in the GBPAUD will take this momentum indicator back into neutral territory and create a solid buy signal. Make a deposit into your PaxForex account now and add this trade to your trading account. We accept many different deposit options, including Bitcoin and Ethereum.

Forex Profit Set-Up #3; Buy GBPZAR - MN Time-Frame

The GBPZAR advanced from its horizontal support area into its horizontal resistance area from where price action reversed. This currency pair has now reversed roughly 50% of its advance an is trading at its ascending support level from where an advance is expected. The move to the upside is likely to challenge the lower band of its horizontal resistance area. Forex traders should place their buy orders just above and below the ascending support level.

The CCI has corrected from extreme overbought conditions above 100 and additionally confirmed the ascending support level in the GBPZAR. This technical indicator is set to advance from current levels. Earn over 500 pips per month with the help of our expert analysts. Sign-up to receive our PaxForex Daily Fundamental Analysis and boost your monthly earnings.

To receive new articles instantly Subscribe to updates.