The EU has warmed up to more compromise in order to avoid a no-deal Brexit. Even Michel Barnier, the top EU negotiator and the EU’s version of Jeremy Corbyn, sounded more open to strike a deal over the next six to eight weeks. A conference is scheduled for mid-November where a potential Brexit deal between the EU and the UK could be signed. Then there is the issue of the Irish border which many claim is the last obstacle to a Brexit deal. The EU decided to redraft the language on the Irish border backstop deal in order to please the UK.

The EU now asks for more concessions from the UK in order to agree on the Irish border issue. The UK claimed that concessions will be offered after the Conservative Party conference which is scheduled for early October. The problem is that UK Prime Minister Theresa May could face a leadership challenge as pro-Brexit Tories gave her until the conference to drop her current Brexit approach. It is currently unclear if enough votes for a leadership challenge are present, but during a meeting last week over 50 Tories attended without any objection to such a challenge.

One thing which is clear, pro-Brexit lawmakers view May’s handling of Brexit negotiations as a betrayal to the 2016 vote and will fight hard to give the voters what they asked for: a clean break from the EU. Another fact all parties can agree on is that a hard border between Northern Ireland and the Republic of Ireland is unacceptable. The EU is looking at technical solutions for border checks so that the Irish border does not look like a border, but it also tries to prevent the UK to gain access to the EU through the Irish border without complying with EU laws and regulations.

Will the Irish border issue become a Brexit deal killer? May is facing a touch test during the Conservative Party conference and many wait for former London mayor and Foreign Secretary Boris Johnson to step in and take the reigns. He resigned over May’s so called ‘Chequers’ blueprint and enjoys a surge in support from the voter base who helped Brexit become reality. Open your PaxForex Trading Account today and find out why more successful forex traders trust PaxForex.

Germany has sounded more deal friendly and Spain announced that any issues surrounding Gibraltar will not prevent a Brexit deal. Spain has a special veto if any Brexit deal will apply to Gibraltar. On October 3rd, May is scheduled to give a speech at the Conservative Party conference and it is likely to determine if she will remain PM or if pro-Brexit Tories will move ahead with a no confidence vote which will lead to her ouster. The potential new PM, many hoping for Johnson, will ensure that the UK will get the clean Brexit voters demanded during the referendum. In the meantime, the Irish border could very well become a Brexit deal killer. Here are three forex trades to add to you forex portfolio.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

Positive news surrounding the British Pound together with its oversold nature over the past few weeks create a solid combination which is expected to push the GBPUSD further to the upside. Price action completed a breakout above its horizontal support area which has been intersected by its primary ascending support level. This currency pair is now approaching its secondary descending resistance level which just crossed below its horizontal resistance level. Forex traders are recommended to buy the dips in the GBPUSD as a move back into its primary descending resistance level is expected.

The CCI has moved into extreme overbought territory, but given the build-up in bullish momentum new highs should be anticipated. This would support an extension of the current rally in this currency pair. Download your PaxForex MT4 Trading Platform now and earn more per pip. Join our growing community of profitable forex traders and start building your forex trading account today!

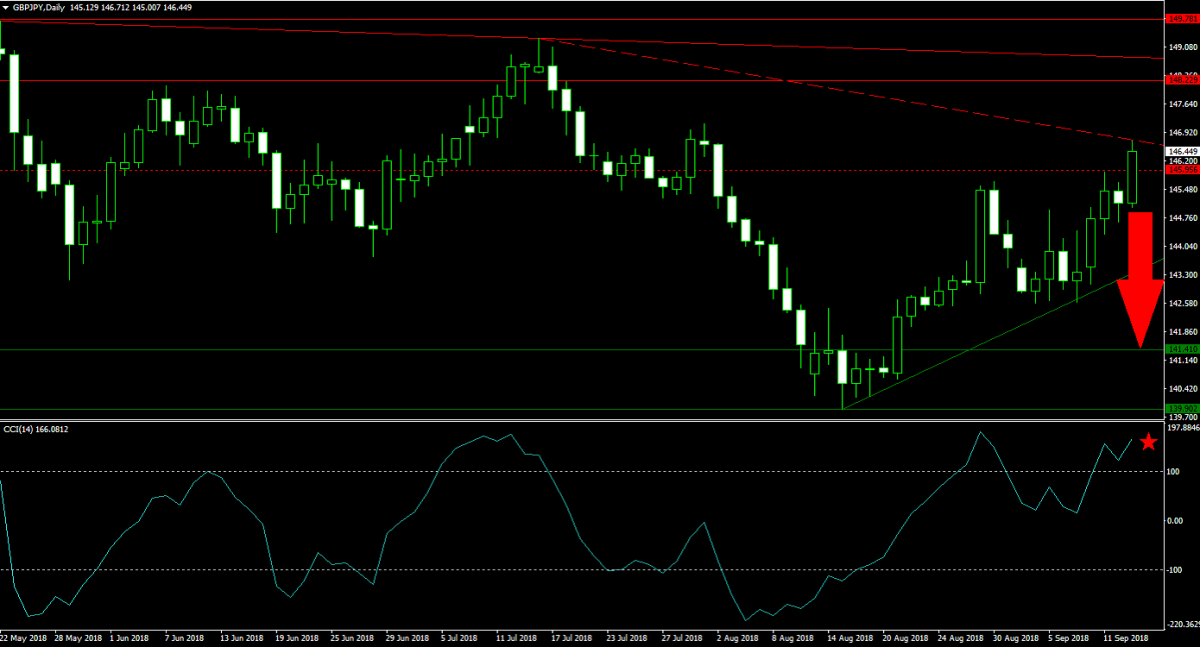

Forex Profit Set-Up #2; Sell GBPJPY - D1 Time-Frame

While plenty of uncertainty remains, forex traders can hedge their British Pound long positions with short positions in the GBPJPY. The Japanese Yen is anticipated to attract more bids due to its safe haven status. Price action ran into its horizontal resistance level which is enforced by its secondary descending resistance level. As this trade is extended to the upside, a reversal back into the upper band of its horizontal support area is likely to materialize. Forex traders are advised to sell the rallies in the GBPJPY.

The CCI has advanced into extreme overbought conditions, but a move below the 100 mark is expected to trigger a wave of sell orders. Together with profit taking in this currency pair it is expected to create enough bearish momentum for a breakdown. Subscribe to the PaxForex Daily Forex Technical Analysis and simply enter our trading recommendations into your own trading account and watch your profits grow!

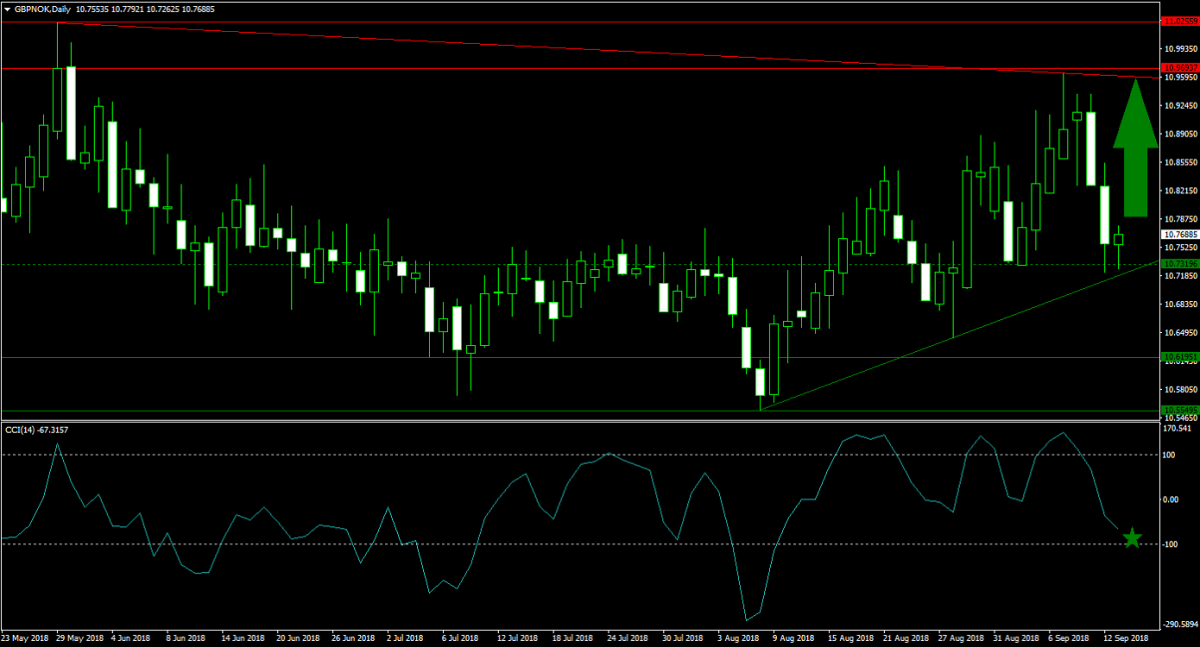

Forex Profit Set-Up #3; Buy GBPNOK - D1 Time-Frame

The GBPNOK is at a more advanced stage of the bullish British Pound trend. This currency pair already completed one breakdown into its horizontal support level which is being intersected by its primary ascending support level. Price action stabilized and forex traders should now seek long entry opportunities just above its horizontal support level. The GBPNOK is expected to attempt another breakout above its primary descending resistance level which is located just beneath its horizontal resistance area.

The CCI dropped from extreme overbought territory and plunged into negative territory, but remained well above its previous low. This technical indicator is expected to stabilize along with price action over the next few trading sessions. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide your forex portfolio to over 500 pips in profits per month.

To receive new articles instantly Subscribe to updates.