After winning the leadership race with a 2-1 majority, Boris Johnson became the new Prime Minister of the UK and which now has its first Brexit cabinet after the referendum. The extended Brexit data stands at October 31st 2019, but the EU stated it is willing to extend again. This is something Prime Minister Johnson has ruled out as he promised to deliver on Brexit and move the country forward. He has less than 100 days to deliver. With less than 24 hours in his new job, he wasted no time to reshuffle the cabinet and install pro-Brexit ministers during his purge.

As PM Johnson left Buckingham Palace and arrived at 10 Downing Street, he told supporters and opponents of Brexit who gathered outside that “The doubters, the doomsters, the gloomsters, they are going to get it wrong again. We are going to fulfill the repeated promises of Parliament to the people and come out of the EU on Oct. 31, no ifs or buts, and we will do a new deal, a better deal.” Out of the 29 cabinet ministers who started their jobs Wednesday morning, eighteen were without their positions before the day ended. While PM Johnson has now a pro-Brexit cabinet, he has also created at least eighteen enemies who may hold a grudge and seek to derail the fragile Tory government.

Dominic Raab became First Secretary of State as well as Secretary of State for Foreign and Commonwealth Affairs, Priti Patel became Secretary of State for the Home Department and Sajid Javid Chancellor of the Exchequer. Jacob Rees-Mogg was appointed as Leader of the House of Commons and Lord President of the Council while Ben Wallace was named new Secretary of State for Defence. Liz Truss became the new Secretary of State for International Trade and President of the Board of Trade and Andrea Leadsom was appointed Secretary of State for Business, Energy and Industrial Strategy.

With a pro-Brexit cabinet in charge of Brexit and after the Boris Johnson Purge, is it now the right time to buy the British Pound? How will PM Johnson solve the issues surrounding Brexit in less than 100 days? Open your PaxForex Trading Account today and join our fast growing community of profitable forex traders; find out why PaxForex is one of the prime brokers for new traders and seasoned professionals alike.

The few cabinet ministers who remained include Brexit Secretary Steve Barclay, Health Secretary Matt Hancock, Work and Pensions Secretary Amber Rudd, Leader of the House of Lords Natalie Evans, Wales Secretary Alun Cairns and Attorney General Geoffrey Cox. Michael Gove, Brandon Lewis and Julian Smith were moved to different posts. I regards to a no-deal Brexit, PM Johnson added “The ports will be ready, the banks will be ready, the factories will be ready, business will be ready. The British people have had enough of waiting.” He also pledged that “I take personal responsibility for the change I want to see.” The Boris Johnson Purge is complete with a cabinet ready to deliver Brexit and here are three forex trades ready to deliver profits along the way!

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

As the US Fed is poised to cut interest rates, as early as this month or as late as December, and with the global economy moving closer to a recession with each released data point, the GBPUSD is poised to capture a double dose of bullish momentum. Price action is currently stabilizing inside of its horizontal support area, which is being pressured by its secondary descending resistance level,from where a double breakout is favored to materialize. This will clear the path for the GBPUSD to accelerate into its next horizontal resistance level and forex traders are recommended to spread their buy orders inside of the horizontal support area.

The CCI already pushed out of extreme oversold territory and the rise in bullish momentum is now favored to extend the advance above 0 which is expected to attract more buy orders. Download your PaxForex MT4 Trading Platform now and earn grow your account balance trade-by-trade!

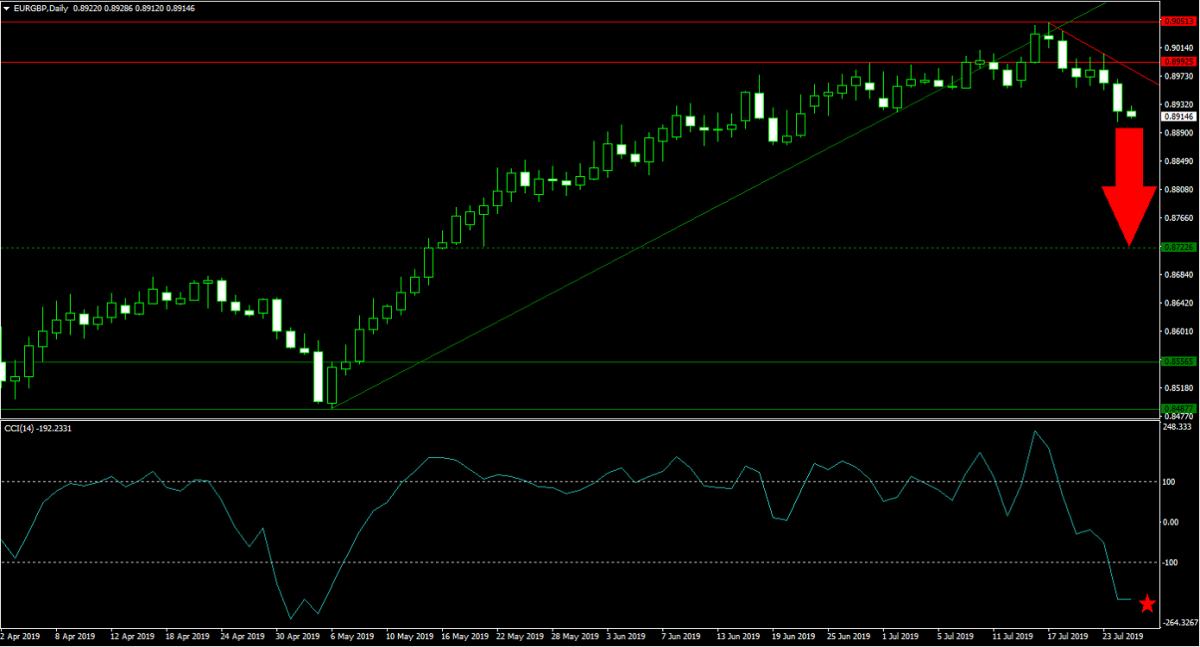

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

The ECB is poised to cut interest rates and increase QE which is anticipated to pressure the Euro to the downside as the economy is slowing down. The EURGBP already started its corrective phase after completing a breakdown below its horizontal resistance area as well as below its primary ascending support level. The primary descending resistance level is adding bearish pressures and this currency pair is on track to extend its correction until it can reach its next horizontal support level. Selling any potential rallies in the EURGBP into the upper band of its horizontal resistance area remains the favored trading approach.

The CCI moved deep into extreme oversold conditions, but remains well off of its previous low with plenty of room to the downside. A minor bounce above -100 cannot be ruled out from where the next push lower is likely to materialize. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analysts!

Forex Profit Set-Up #3; Buy GBPCAD - D1 Time-Frame

After a strong performance by the Canadian Dollar so far this year, forex traders decided to start taking profits. This has pushed the GBPCAD above its horizontal support area as well as above its primary and secondary descending resistance levels from where bullish momentum is on the rise. Price action now has a clear path to extend the breakout into a strong rally until it can challenge its next horizontal resistance level. Forex traders area advised to buy and sell-offs in the GBPCAD down to the lower band of its horizontal support area.

The CCI accelerated out of extreme oversold territory and above the 0 mark for a bullish momentum crossover. More upside in this technical indicator is favored to lead price action to the upside. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.