Many UK businesses are hoping for a swift Brexit transition which will last at least two years in order to implement the required changes without major disruptions to their operating models. Hardliners inside the Tory led government favor a hard Brexit if necessary as the British public voted to leave the European Union with good reason according to Brexit supporters. Prime Minister Theresa May voted to remain in the EU at the time of the referendum which has many pro-Brexit lawmakers questioning her commitment to deliver to the British public what they voted for.

Those in hope for a quick announcement by both sides, the UK and the EU, about a smooth transition period received a set-back as Theresa May announced such a deal would only be sealed as part of a much wider divorce deal between both sides. Such a deal is currently not expected to be announced until shortly before Brexit takes effect in March of 2019 which would give businesses little to no time to prepare. More and more market watchers think that there won’t be any deal reached before the March 2019 deadline and the the UK economy should be prepared for a hard Brexit.

PM May told the House of Commons during yesterday’s session that “The point of the implementation period is to put in place the practical changes necessary to move to the future partnership, and in order to have that, you need to know what that future partnership is going to be.” Until a trade deal can be reached, the transition period won’t be clear. As this gives UK businesses essentially no time to plan properly, many may opt to approach Brexit with no deal in mind and act accordingly. The British Pound is expected to remain volatile and news as well as data dependent. This will create plenty of excellent trading opportunities.

The PM’s cabinet remains divided on what type of deal it wants which makes the transition question even more challenging. The announced transition has been compared to a bridge, but without the type of deal agreed on it became a bridge to nowhere for the time being. Forex traders should monitor, but instead of being fearful of the expected knee-jerk reactions as well as volatility ahead they should look forward to profit from plenty of opportunities ahead. Just as the crisis in Catalonia has created and is creating profitable trading opportunities, the Brexit scenario is doing the same.

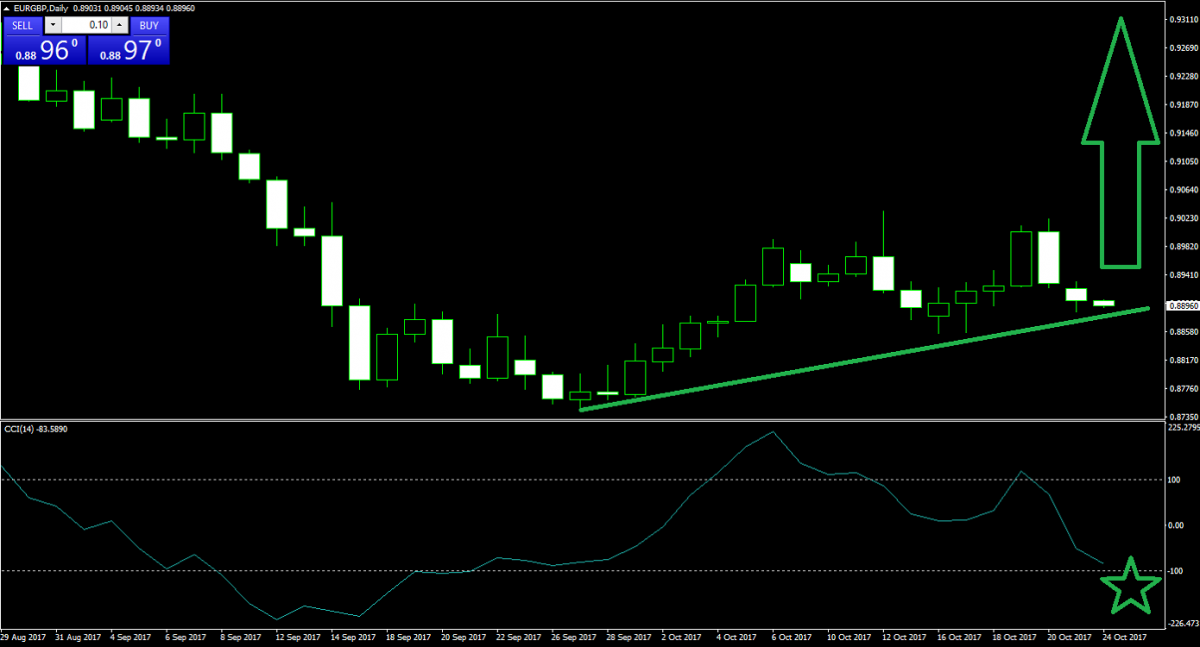

Forex Profit Set-Up #1; Buy EURGBP - D1 Time-Frame

Jump right into the action with the EURGBP which puts the EU against the UK, the discussions are likely to heat-up as the deadline approaches. Right now it appears as the Euro is ready to bounce off of an ascending trendline, confirmed by the CCI approaching the -100 level which indicates an oversold condition. The EURGBP has the right ingredients to rally into the 0.9300 territory where a double top would from and a correction should be accounted for. This is in-line with the back-and-forth expected over the next 15 months between Brussels and London.

Earn more money per trade inside your GBP account with PaxForex and take advantage of tight spreads which will put more cash into your forex account.

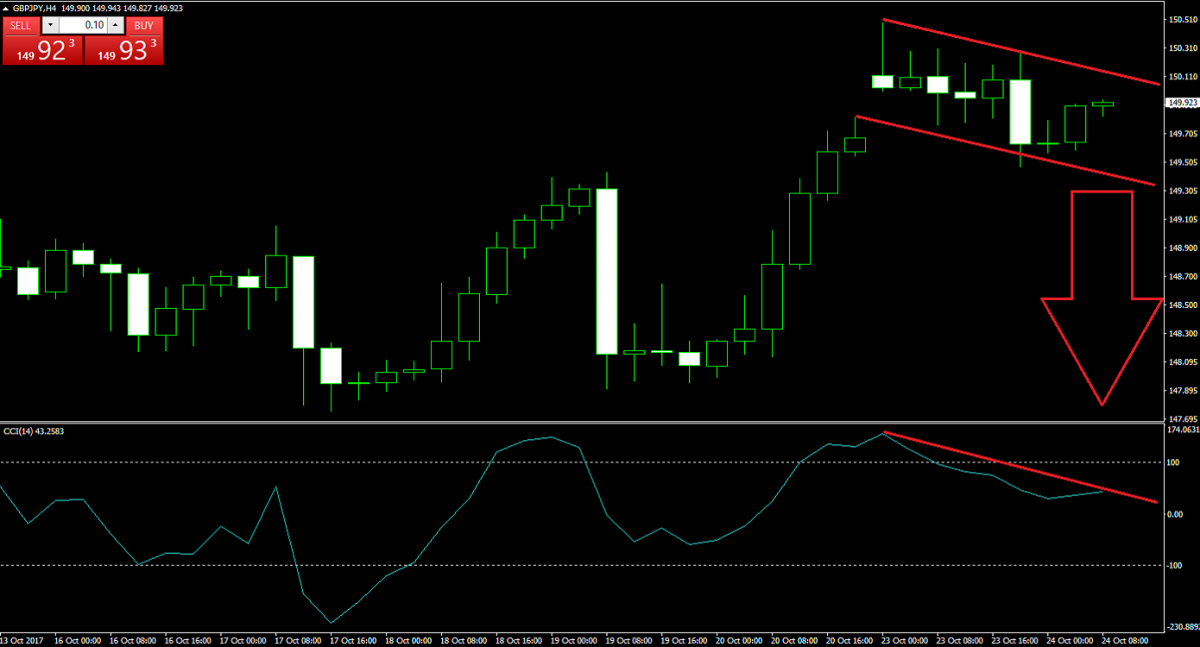

Forex Profit Set-Up #2; Sell GBPJPY- H4 Time-Frame

Do you want to mix it up a little bit and trade the GBP with a a layer of safe haven? The GBPJPY will give traders a nice mix of the two. The GBPJPY started to drift lower, a move likely to be accelerated over the next few trading sessions as the CCI already broke down below the 100 mark and price action inside a bearish price channel. Stagger your orders above the 150.000 mark where this currency pair will meet the descending resistance level of its bearish chart pattern.

A drop down to the 147.750 - 147.900 level is expected and there is no better way to profit than to enter this trade and have it filled fast with PaxForex speedy execution times. In a volatile market, each pip counts!

Forex Profit Set-Up #3; Buy GBPCAD- W1 Time-Frame

This trade is for the long-term traders who build positions in currency pairs. The GBPCAD has been trading inside a support area with bullish pressures building up, creating the potential for a breakout. The CCI is trading near the 100 level and forex traders should take advantage of any pull-back down to the lower end of the current trading area near the 1.6315 mark. The Canadian economy has enough struggles which are likely to outweigh Brexit tensions for the GBP.

Trade the GBPCAD currency pair and many more assets in a highly professional trading environment at PaxForex today and grow your account where many traders, from the retail space to the professional world, enjoy a growing account balance in their portfolios. Don’t miss our twice weekly analysis of current events and how you can make the most pips out of the trading opportunities which will develop as a result.

To receive new articles instantly Subscribe to updates.